-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get Form 1040-SR and What to Do with It

.png)

Dmytro Serhiiev

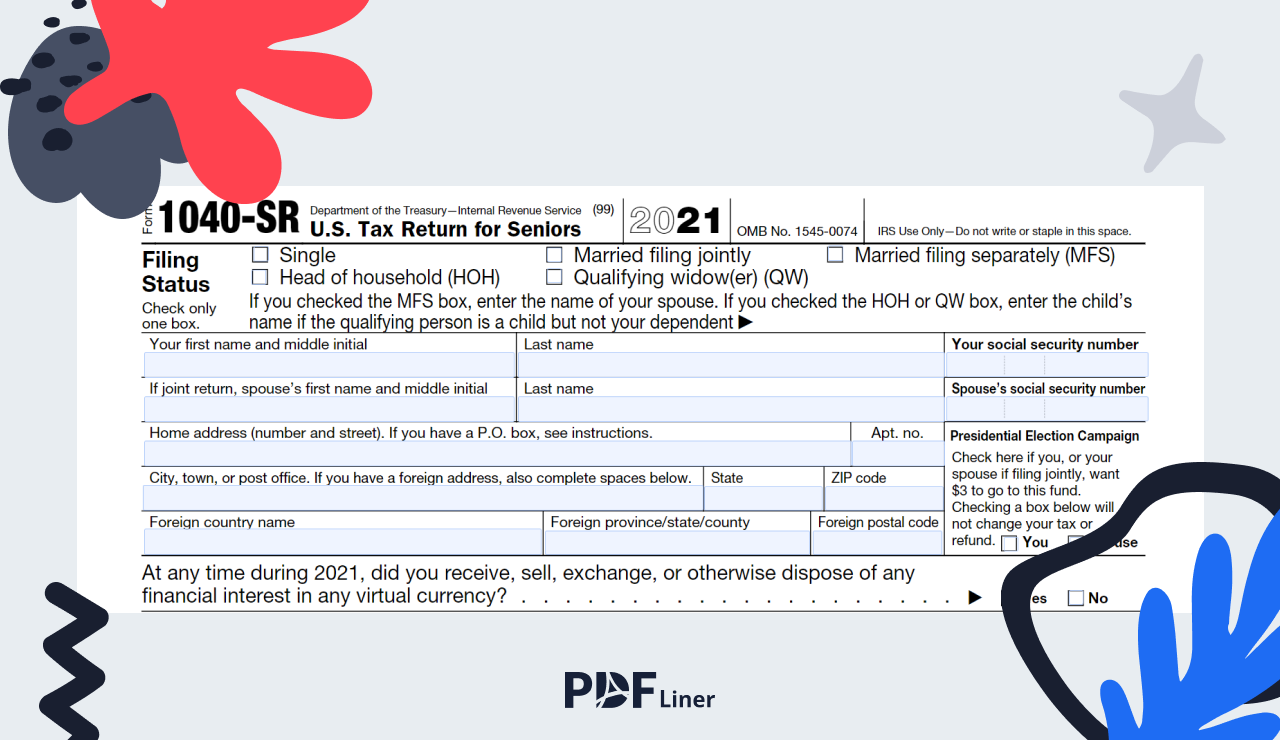

Form 1040-SR is a special version of the IRS Form 1040 meant for the individual income tax return. It was issued by the IRS in 2020 for senior citizens. The SR-version is designed to make a tax return for seniors easier, with its readability improved.

How to Get Form 1040-SR

There are two basic ways of how to get Form 1040-SR.

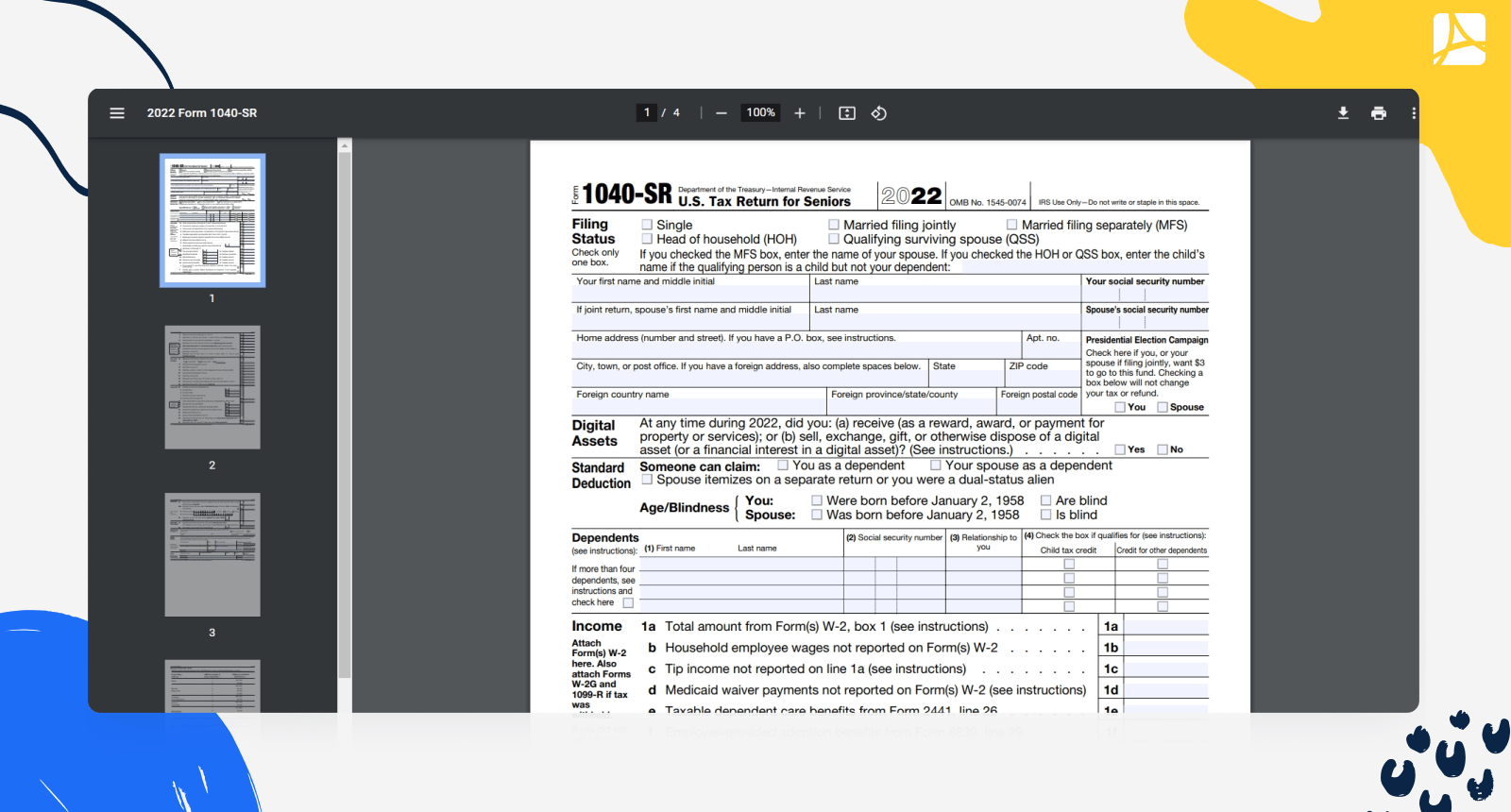

Download it from the official IRS site

The first way has the only advantage: you can be sure you download the latest version. But it provides little in addition. What you have to do is download the PDF document, open it on your local desktop or laptop with whichever software you use for that, and fill it yourself. Of course, there is an official instruction for both forms 1040 and 1040-SR, but it’s too overloaded to be comprehensive unless you’re a tax pro or a lawyer.

Get Form 1040-SR 6596d4d03f949ca16a0e25ca

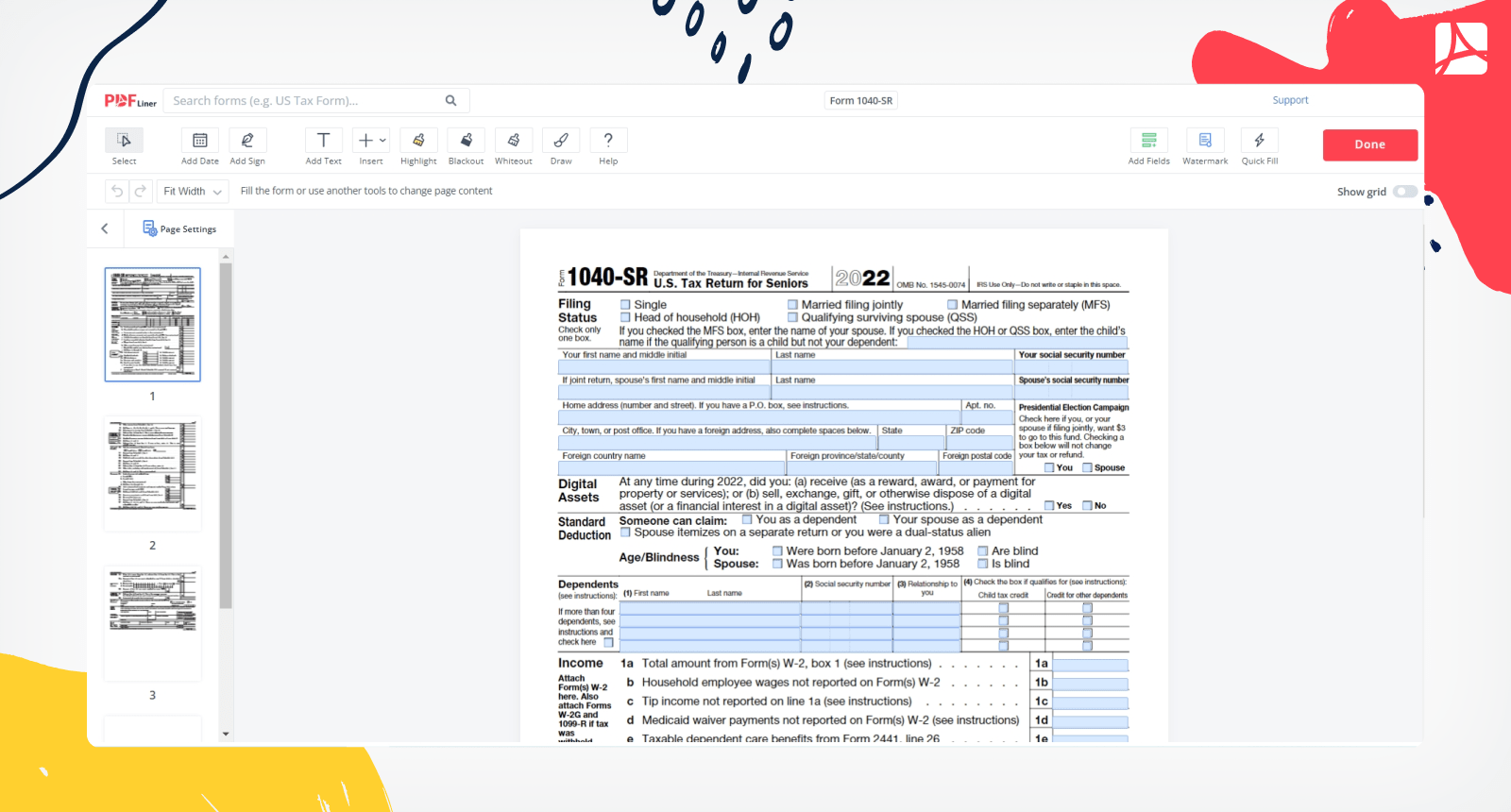

Get fillable form online on PDFLiner

As for the PDFLiner version, it’s way easier. You don’t have to download it at all, and it takes just seconds to open the fillable PDF. The online editor offers all the tools you need to fill and sign it. While filling it, sometimes, you have to switch between the pages to copy the data correctly, and it’s easier with the navigation panel where all the pages are just a click away. And it takes a single click to file it to the IRS when you are done.

Fillable 1040-SR 6596d4d03f949ca16a0e25ca

Frequently Asked Questions

Here are some questions regarding Form 1040-SR and answers you might be interested in.

What is form 1040-SR used for?

Its purpose is the same as that of the general Form 1040 – that is, for individual income tax returns.

What is the difference between Form 1040 and Form 1040-SR?

As it’s used for senior citizens, the last option features larger print and blanks. In terms of content, there is no difference between 1040 and 1040-SR at all.

Who can use IRS Form 1040-SR?

It is designed for seniors aged 65 and older. Nevertheless, if you are younger but your spouse is older (or vice versa), you both can use this form for filing a joint return.

Do pensions count as earned income?

No, pensions are among the exemptions, as well as social security benefits, unemployment compensation, and other payments you are entitled to receive without work.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

1040-SR Form 6596d4d03f949ca16a0e25ca