-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get Form 1065 and Fill It Quickly

.png)

Dmytro Serhiiev

Form 1065 is a tax return form used by partnerships to report the financial status for a year. The form is used by a majority of the US internal partnerships, religious non-profit organizations, and foreign partnerships that have income inside the US. For more detailed information about who should use tax form 1065 and form 1065 instructions, you can check the official IRS statement.

1065 Form 65c511176117143fcc0f728b

How to Get Form 1065

If you’re eligible to use IRS form 1065 for the tax return, there are two ways of getting it online. The printable form is available on the IRS website on your account. However, to fill it correctly, you have to download the form and use special software to complete it.

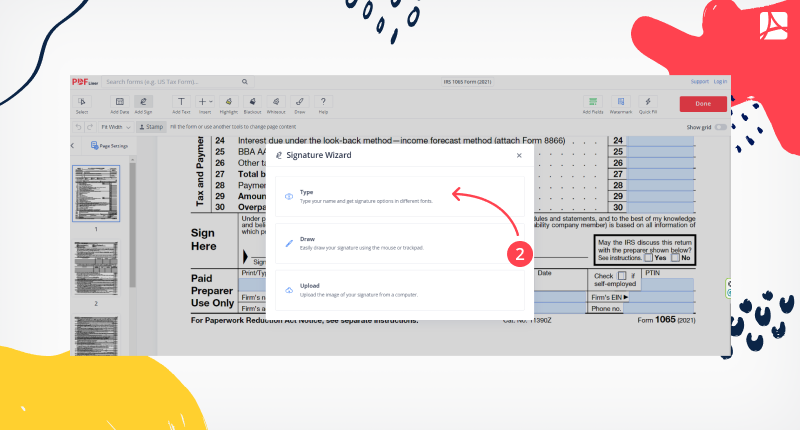

Another way is to fill the form using a convenient online PDF editor, where you can complete the form and sign it without downloading and using any additional editing programs. The PDFLiner service provides you with all the needed tools and the form 1065 instructions to fill it quickly and properly. It saves your time, providing you with an opportunity to edit and correct any mistake without reprinting the form.

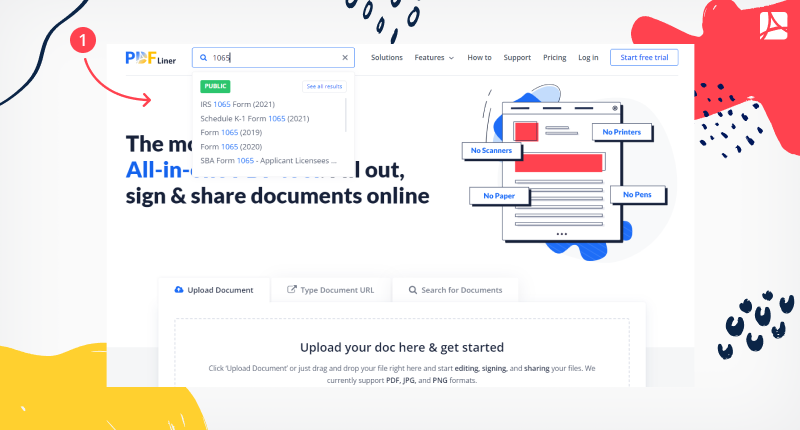

The PDFLiner has a 5-days trial for your convenience. You can check all of its handy features or just use it to complete your tax forms if needed. The wide library of official IRS forms extends and renews every day. To get the tax form 1065 on PDFLiner, you have to:

- Log in or register your profile;

- Enter “1065” in the search field;

- Click on the form you would like to fill out;

- Proceed to fill and sign it using the powerful editor equipped with useful features.

Or you can just simply click here and fillable Form 1065 will open right away.

Also, if you’re still in doubt about how to fill out form 1065 and whether you need to do it, the PDFLiner service provides a detailed and helpful guide for you.

1065 Form 65c511176117143fcc0f728b

FAQ

Are you sure you know everything about the 1065 form? See these questions to find out if you are ready to get the form and fill it properly.

What is Form 1065?

Tax form 1065 is a form that declares profits and deductions of partnerships.

When is 1065 due?

Basically, the deadline for the IRS form 1065 is by the 15th day of the third month after the date when your tax year ends.

Can I file Form 1065 online?

Yes, you can do it easily using one of the methods described above.

Do I need to file Form 1065 if I have no income?

According to the IRS, US partnerships that earn less than $20 000 or have less than 1% of their income in the USA may not apply.

What is a K-1 form 1065 addition?

K-1 Schedule is the form that should be filled by both partners of the company and sent with the 1065 form as a confirmation of their legal activity and financial movement.

Go Paperless with PDFLiner

Fill out, edit, sign and share any document online and save the planet

1065 Form 65c511176117143fcc0f728b