-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get Form 1095-A for Accurate Tax Reporting

.png)

Dmytro Serhiiev

Form 1095-A must be used as part of tax reporting if at least one person who’s part of your household had a Marketplace health insurance plan in 2020. It belongs to proof of insurance forms that are necessary for filing your taxes with the IRS. This article answers a popular question, “Where do I get Form 1095-A?”, or “Is it possible to view 1095-A online?”, which is especially relevant for Marketplace users who haven’t received the essential document.

How to Get Form 1095-A

There are multiple answers to “How do I get my 1095-A?” depending on which approach is more convenient to you. Generally, it’s health insurance exchanges such as HealthCare.gov and others (this may depend on the state) that are to mail a copy of 1095-A both to the IRS and the policyholder. If you enrolled in a Marketplace program in 2022, you should have received the form by February 2023.

Otherwise, however, the most appropriate answer to the question “Where do I find my 1095-A” is that you should look for it at HealthCare.gov, request 1095-A from the IRS, or fill out and download a PDF version from PDFLiner. Please remember that you need to be a registered user to download 1095-A from your account at HealthCare.gov. When logged in, select 2022 under Your Existing Applications, then select Tax Forms on the left, and go to Your Forms 1095-A for Tax Filing. You’ll be able to open and save the form as the next step.

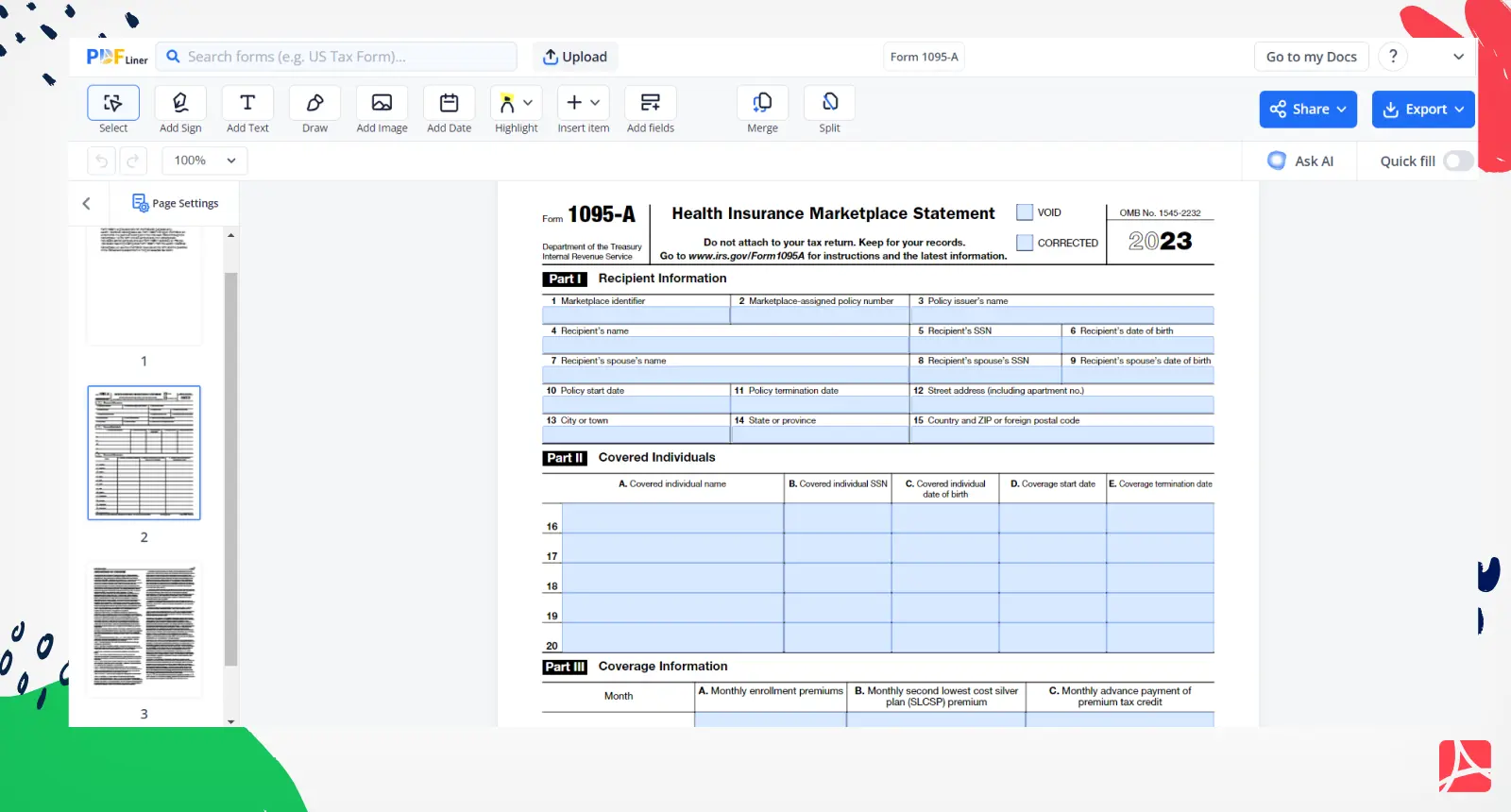

One easy way in which you can get 1095-A online is by accessing its PDF version on PDFLiner. PDFLiner is an online platform that offers an extensive PDF signing and editing toolkit along with a wealth of helpful electronic forms which you can use to file your taxes on the web. Now that you know how to obtain Form 1095-A, your next move might be to see a complete guide on how to fill out Form 1095-A, also offered by the platform.

1095-A Online 65269f86c62046236c062b1d

FAQ

Who sends 1095-A?

The form is sent out by health insurance exchanges.

What should I do if I did not receive 1095-A?

You need to get the form using one of the three methods described above before filing your taxes.

Does Medicaid send a 1095-A?

No, it doesn’t. Only Marketplace organizations do.

What if the information is incorrect or missing from my 1095-A?

You have to contact the federal Marketplace or the local one that you purchased your plan from. If the form proves to be inaccurate, you’ll most likely be sent a corrected version.

Fill Out Forms At No Time with PDFLiner

Start filing your documents electronically and save loads of time!