-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Sign a 1040-X Form Easily

.png)

Dmytro Serhiiev

Last Update: Jan 30, 2024

Form 1040-X is meant for taxpayers to amend taxes they have erroneously returned. After filling the return, you don’t have (and, generally speaking, you can’t) just refile taxes. But mistakes and errors do happen, so there is a special form 1040-X you need to fill, sign, and file.

If you were wise enough to keep a copy of your return, you could review it later when you discovered a mistake or found a reason to claim tax credit or deduction. It can be filed after you have filed your main forms.

Sign a 1040-X Form 65cb6b37911ce9829a00d11a

Key Takeaways

- Form 1040-X is used to amend previously filed tax returns to correct errors or claim additional tax credits or deductions.

- After downloading the form from the IRS, it can be filled, signed, and filed electronically using tools like PDFLiner.

- PDFLiner provides editing tools and instructions, facilitating the process of signing and filing the 1040-X form and other documents.

How to Sign a 1040-X Form

The first idea is to download the form from the IRS site, fill and sign it locally, and file it afterward. Of course, you always have the official IRS Form 1040-X instructions, but we offer an easier and faster way to get your 1040-X filled, signed, and filed.

In the electronic form, there is a special place where to sign the amended tax return form. If you provided the real data when registering on PDFLiner, your e-signature here would be linked to your identity and thus personality. Here is how to sign a 1040-X using PDFLiner.

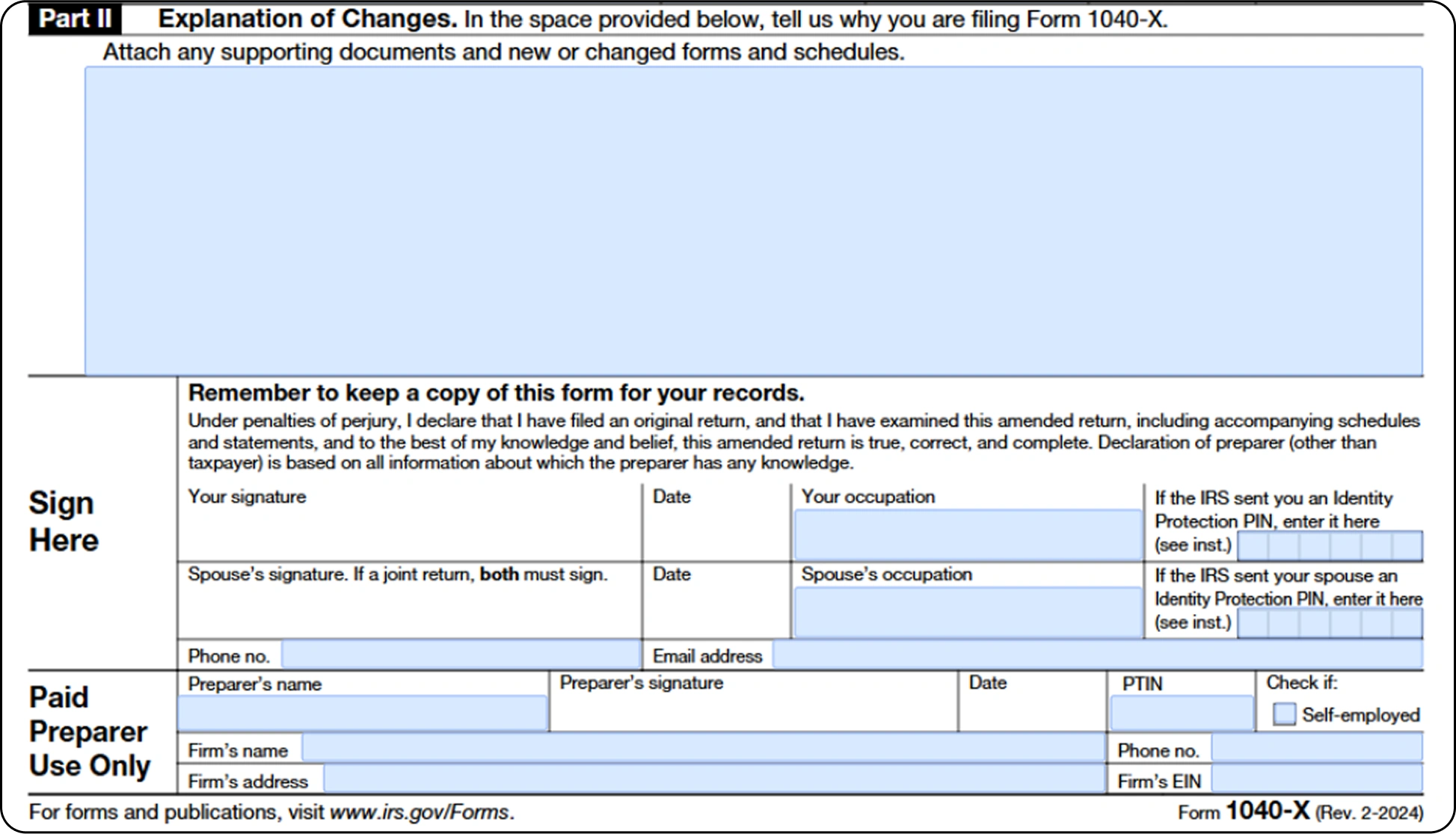

The place for signatures is at the bottom of Page 2 of Form 1040-X. To e-sign 1040-X, you should:

Step 1: Scroll the form down to the bottom of Page 2.

Step 2: Click or tap on the “Sign Field”.

Step 3: If you already have one or more signatures on PDFLiner, you can choose among them.

Step 4: If you have not created a signature yet, you can generate it by clicking the “Add a New Signature” button.

Step 5: Choose a signing method and create your signature.

If you didn’t work with Form 1040-X, you might want to look at it to see whether it’s that easy. Here, you can easily understand how to get Form 1040-X on PDFLiner, along with all the editing tools you might need and all the instructions. This versatile service can be used for signing any document you need.

Sign 1040-X Form 65cb6b37911ce9829a00d11a

FAQ

If you still have some questions left, here are the most common ones taxpayers usually ask about signing a 1040-X Form. Read them thoroughly to understand the specifics.

What is an amended tax return?

It’s the amendment to your tax returns you have already filed but want to amend. The reasons may vary: you might have found a mistake in your returns or remembered some income you had not mentioned, or learned a reason to file for tax credits or deductions.

Who can sign an amended tax return?

Spouses can sign for each other under certain circumstances (if the return is joint, though, both spouses must sign it). Parents can sign for their minors in case their signatures are necessary, too. In general, the returns can be signed by third parties that have the power of attorney, and a form confirming the power needs to be included.

Can I e-sign Form 1040-X?

Yes, and the guide above contains an explanation of how to do it.

Can someone else amend my tax return?

Tax amendment forms are meant to be sent by the taxpayers whose returns are amended. But someone else empowered to do so (like paid preparers) can help this person to do the work.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

.webp)