-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Top Recommendations on How to Renew an ITIN Number

.png)

Dmytro Serhiiev

Do you want to know how to renew an ITIN number? This article will help you to find out what to do if your ITIN number is expired and you need a new one. The problem with ITIN is that you have to continue to use it year after year in your tax return forms. If you don’t use it for 3 years, it expires. It can also expire as a result of the PATH Act.

Fillable Form W-7 5e591bab920a7d66fc49b7a1

How long does an ITIN number last?

You have to file for an ITIN number in case you are a non-citizen of the US but receive payment from US companies or individuals. In this case, you need to complete the W-7 form. Follow detailed instructions on how to apply for an ITIN number below. ITIN number contains your personal information and proves that you are a non-citizen who does not own Social Security Number. Once the application form is sent, and 10 weeks after the IRS provides you with ITIN, it can last forever, until you use it every year. It takes up to 11 weeks for the IRS to renew it. If you don’t use the number for 3 years, it expires.

Printable Form W-7 5e591bab920a7d66fc49b7a1

How to Renew an ITIN Number?

After you’ve learned how to get an ITIN number, you need to understand how to renew it. The procedure is similar to receiving an ITIN number. If you already have experience completing the W-7 form, you can quickly provide all the documents you need.

To renew your ITIN, you need to file Form W-7 and request an ITIN number without tax return filing. You also need to attach identification documents to prove your foreign status, including the passport or US driver’s license, national identification document, foreign driver’s license, birth certificate, US state ID, military ID, visa from the US Department of State, photo ID from US Citizenship and Immigration Services, School records, or medical records for dependents under 18.

After you prove your status as a foreign citizen, you may apply for free, avoiding the standard ITIN application fee. File the Federal tax return at the involved H&R Block location. If your family has multiple ITINs, you can renew all of them at once, if one person's ITIN is getting expired. You can renew all ITINs together in one pack. You have to renew ITIN before you file a tax return with an expired number.

How to Fill Out a W-7 Form?

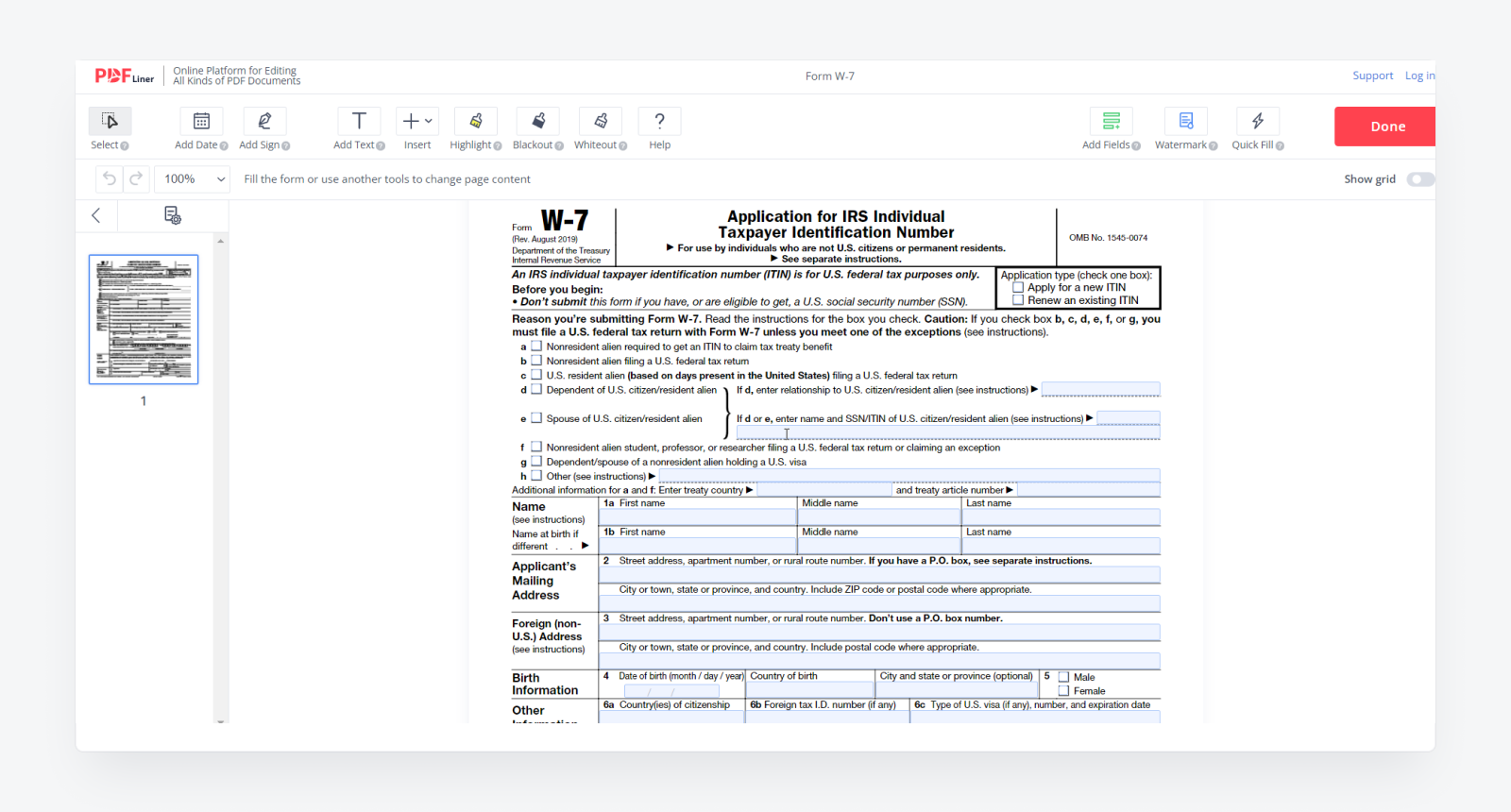

The W-7 form was created for everyone who wants to learn how to find an ITIN number. You have to submit to one of the Certified Acceptance Agents. In case you need to renew the document, you still go back to the W-7 form. It is only one page long, and it is not complicated.

Before you start filling out the form, make sure you don’t have a Social Security Number. In the right upper corner, put a tick in the right box to indicate whether you want to apply for a new ITIN or renew the old one. Follow the next instructions on how to fill out a W-7 form:

- Put a tick in the proper box naming the reason for your submission. Read the instructions near “d” and “e” boxes made for Dependent of US citizen and Spouse of US Citizen. If there is another reason, name it in the “h” line. The “a” and “f” sections require additional information, including the treaty country and treaty article number.

- Write down your personal details, including your first name, middle name, and last name. If you have a different name at birth, provide information in the 1b section.

- Fill in the section with your address details. Name the street, apartment number, or house number. If you have a P.O. box, you need to follow specific instructions from the IRS.

- Share your foreign address, naming the street, number, city/town, province, and country. You can’t use the P.O. box, so don’t write it here.

- Provide your birth data, including the date of birth, country, state, and city. Put a tick in the box to identify your gender.

- There is a section for other information you can provide. You may write down your citizenship country, tax ID number from the foreign country, visa type, number of your foreign passport, and driver’s license. If you want to renew ITIN, you have to mention it in the “6e” line and state the number of the former one in the “6f” line.

- Put your signature and date in the proper section.

Blank Form W-7 5e591bab920a7d66fc49b7a1

FAQ

Read the most popular questions about the W-7 form and its renewal.

What is an ITIN number good for?

You need this document to attach to the tax return you send to the IRS. The expired ITIN is not considered by the IRS.

How to sign a W-7 form?

You can sign the form after you print it. You can also sign it online using an electronic signature. PDFLiner offers such a feature.

Where can I get a fillable version of Form W-7?

You can receive the form from the IRS official website. You may also download or enter it online using this page on PDFLiner. Our service provides you with all the necessary tools to complete the form.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Blank Form W-7 5e591bab920a7d66fc49b7a1