-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

What Is a W-7 Form and How to Fill It Out

.png)

Dmytro Serhiiev

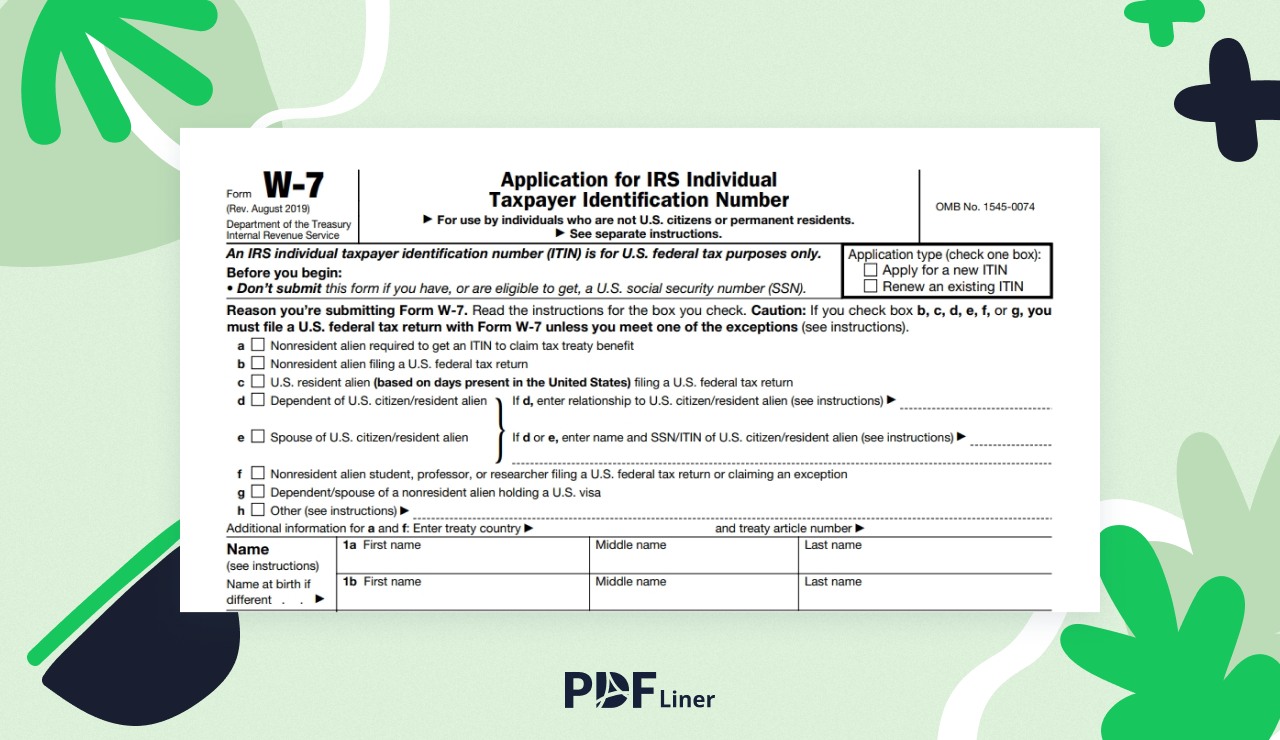

While you might not know the answer to the question “what is a W-7 form,” you might be familiar with ITIN or Individual Taxpayer Identification Number. Form W-7 is also known as an application for ITIN. It is not difficult to apply, but you have to be familiar with the procedure, how to get the form, and where to send it.

Fillable Form W-7 5e591bab920a7d66fc49b7a1

What Is a W-7 Form?

Many people who ask what is Form W-7 need to get their ITIN. This form is used as an application document for an Individual Taxpayer Identification Number. You can’t receive your ITIN which you might need for your work or IRS documents if you don’t file W-7. This form is widely used by non-citizens who can’t receive their Social Security Number. They need to include ITIN filing the federal tax return to the IRS revealing the income received from the US companies or individual citizens.

As for the US citizens, they usually provide SSN in case they need to identify themselves to the IRS. The IRS ITIN application is included in all tax return forms sent by non-citizens to the IRS if they don't have a Social Security number. While many non-citizens and permanent residents of the US still can receive Social Security Number, foreigners without work authorization who need to file a tax return may use Form W-7 to receive ITIN.

Printable Form W-7 5e591bab920a7d66fc49b7a1

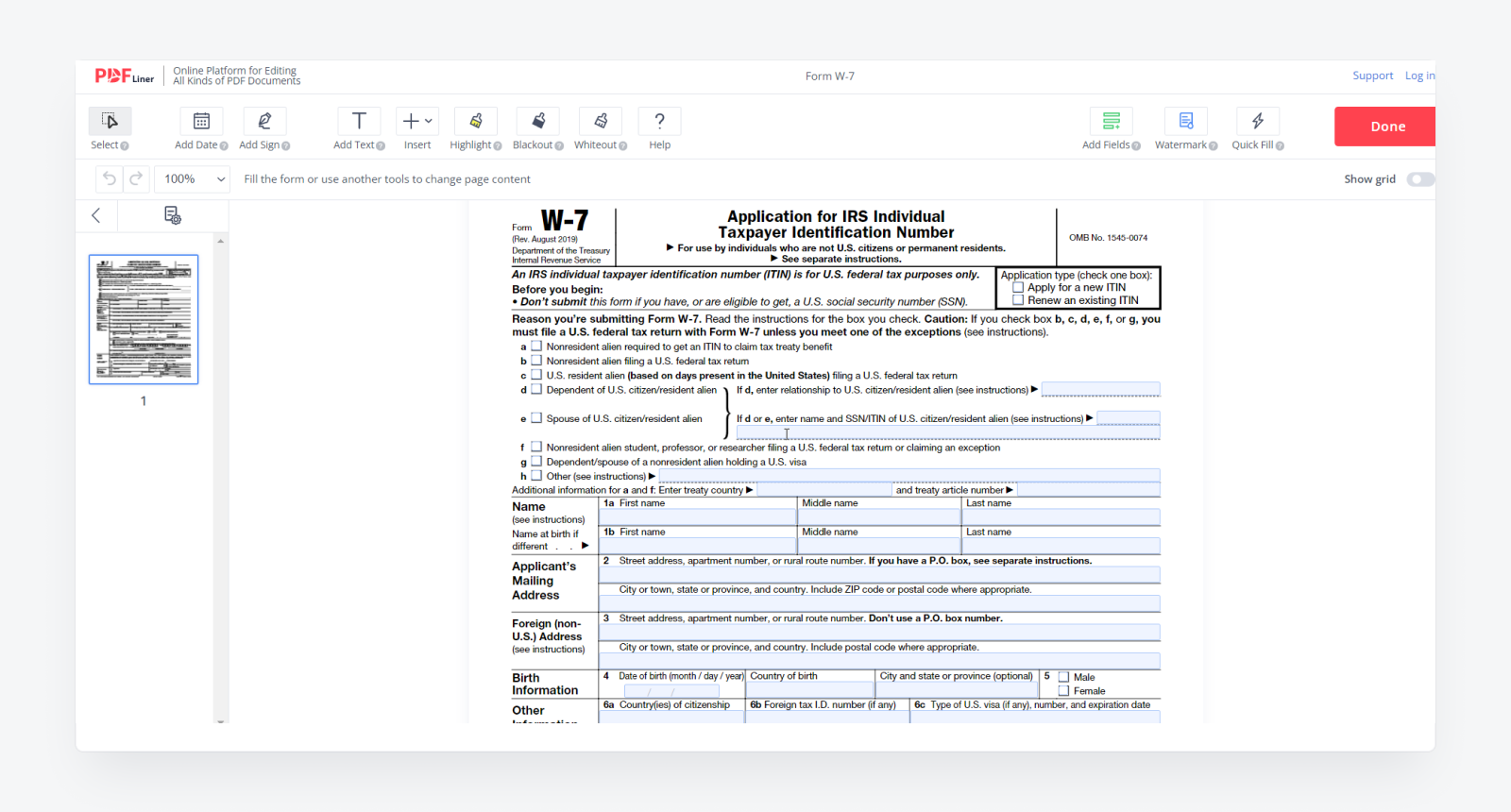

How to Get Form W-7

You can download W-7 from the IRS official website. Enter it and search for the form. It is free of charge, and you can easily open the form once you find it. Another way to get your ITIN number application is by pushing the button on this page on PDFLiner. The form is already there, and all you need to do is open it. PDFLiner provides you with fillable sections for your private information. Once you complete the form, you can download it or send it directly to the IRS. PDFLiner also allows you to create your own electronic signature in a few clicks.

How to File Form W-7

Once you prove to the IRS that you are not a US citizen and can obtain the foreign status by filling the W-7 form, you can send it to the officials. You have to submit the form to the IRS Taxpayer Assistance Center in person. Every major city has such centers. In every state, there are one or more centers that accept the W-7 form together with the tax return. You can mail your form to the nearby IRS ITIN Operations center. Wait from 6 to 10 weeks for the answer from the IRS.

Blank Form W-7 5e591bab920a7d66fc49b7a1

FAQ

Here are the most popular questions about Form W-7. Read the answers to find out more details about this form.

Where to mail form W-7?

You can submit the form directly to the IRS Taxpayer Assistance Center. There are centers in every state of the US and in the biggest cities in the country. If you want to send it by mail, you can find the local IRS box and send it there. You can use the standard address:

IRSITIN Operation

P.O. Box 149342

Austin, TX 78714-9342.

When to file W-7?

It is better to file a W-7 form in advance since it takes up to 10 weeks for the IRS to check out your information and create your personal ITIN. After that, you have to use this number with every tax return form you send to the IRS. You can file the form any time throughout the year.

Can I file a W-7 online?

Unfortunately, this form can’t be submitted electronically. According to W-7 instructions, you need to submit it personally. You may also send it by mail to the nearest IRS center.

How to check the status of an ITIN application?

To check your status, call 1-800-829-1040. This is the IRS phone number. You may also contact them via the official website.

Fill Out Forms At No Time with PDFLiner

Start filing your documents electronically and save loads of time!

Blank Form W-7 5e591bab920a7d66fc49b7a1