-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Top Tax Forms List to Use in 2025

.png)

Dmytro Serhiiev

The IRS issues a huge variety of forms that cover literally every life situation that a citizen and non-resident of the United States can have. Some are used regularly, others only in special, rare cases. We carefully studied all the types used and collected the top tax forms that are filled out most often.

Different Types of Tax Forms

In preparation for the tax season, you need to collect all the forms and documents that allow you to determine the amount of tax you should pay. Your list is influenced by various factors: income types, dependents, investments, pension contributions, etc. All these papers can be divided into several main tax form types, depending on what taxes they are intended to calculate:

- Income tax. It can be charged at local, federal, and state levels. Depending on your region, you may be charged a flat or flexible rate based on income.

- Sales tax. Your profits from the goods or services sold are also usually subject to the corresponding tax. The need to pay it and the amount depends heavily on the state and even the municipality.

- Excise tax. In essence, it is close to the previous type, except that only certain categories of goods are taxed, for example, alcohol, gasoline, tobacco, etc.

- Payroll tax. Paying such taxes rests with both an employee and an employer. Medicare, Social Security, unemployment taxes, and so on fall into this category.

- Property and estate taxes. If you own a vehicle and/or real estate, you must pay taxes to be able to pass on these items to your heirs (as the IRS says).

- Gift tax. When receiving large items as a gift (shares, cars, real estate, etc.), grantees are required to pay tax. In a donation situation, the responsibility for payment always falls on the recipients' shoulders.

Generally speaking, you use these types of tax forms to report what you earn, sell/buy and own. Of course, the lifestyle and sources of income are different for each person. The above list does not mean that all these taxes apply specifically to you. Your employer likely makes the most of the transactions if you have an official job.

If you do not own any property, have not received an inheritance, and do not rent out premises, you do not have to worry about paying other taxes. But even in such a situation, there is a certain tax forms list that even you need to know about.

We would like to note that most of the existing forms are intended for individuals who are citizens of the country or businesses working in America. However, there is a separate group of tax forms to use by aliens, foreigners, and non-residents who have earnings in the United States. We won't talk about them for now.

Most Common Tax Forms List for 2025

We studied the demand for tax forms to identify those used most often by taxpayers. As a result of our research, we have compiled a list of the top 10 most common tax forms.

1. Form W-9

Form W-9 is used in business-independent contractor relationships. It is filled in by a hired specialist and transferred to an employer. This document must contain taxpayer information such as EIN or SSN. Businesses use this data to fill out their tax forms, such as payroll reports, and submit them to the IRS. The original W-9 remains with the employer and is not transferred to the tax office.

2. Form 1099-MISC

This form is used to report so-called non-employee compensations to the IRS. If you rent out space, receive awards, have third-party income from royalties, and get many other payments (above $600 per year), you must submit a completed Form 1099-MISC. It is just one variation of Form 1099; the abbreviation MISC stands for Miscellaneous types of income.

3. Form W-2

Employers complete this form annually and send it to all officially employed workers. It should provide information on income for the past year and taxes paid. Based on this data, each employee fills out a personal tax return. Employers submit these forms for each employee to the IRS so that workers do not need to forward them to the tax office.

4. Form 1040

The second name of this document is Individual Tax Return. It is a standard form that US citizens must complete each year to report their income for the past period and request credits and deductions if they qualify.

5. Form 1099-NEC

Like the previous form, this document is for reporting various payments to non-employees. However, 1099-NEC provides information on payments to people who work for a company but are not officially employed. Most often, such templates are utilized if businesses use the services of freelancers.

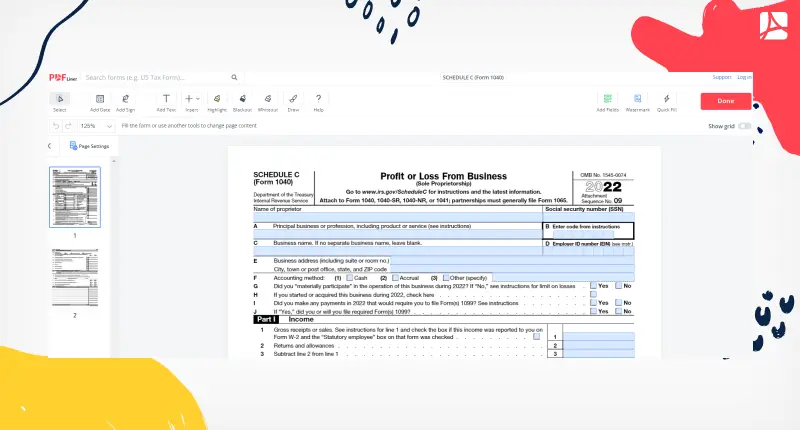

6. Schedule C Form 1040

It is one of the many additions to the previous file, which sole proprietors use to calculate income tax. If you are self-employed, own a small business, or have a steady income from, say, a hobby, you need to complete this form. It is quite flexible and allows you to report not only on revenue but also on various types of expenses.

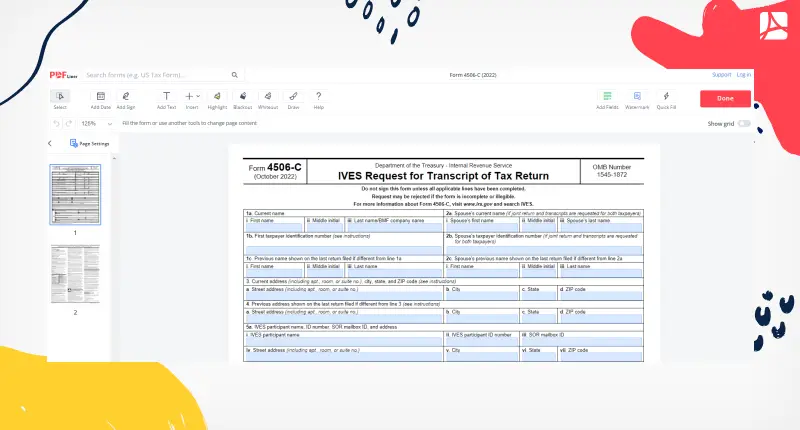

7. Form 4506-C

This form is used by the Income Verification Express Service so that lenders can request tax transcripts from borrowers. The underwriting process involves a detailed study of income to assess the reliability of borrowers. Of course, authorized members of IVES can obtain such information only with the taxpayers' permission.

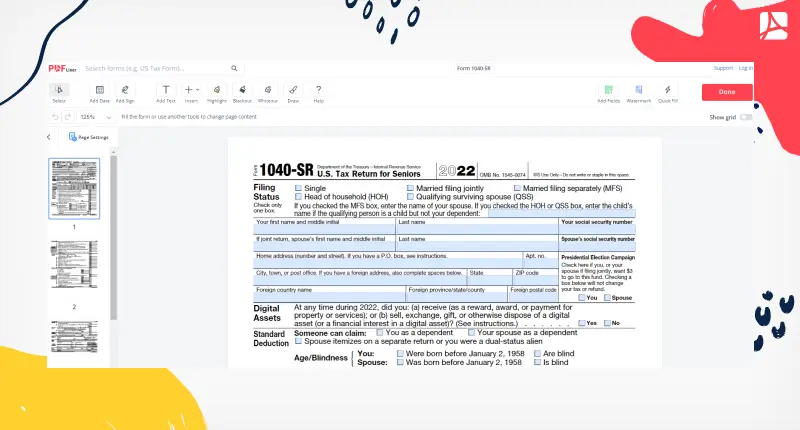

8. Form 1040-SR

It is an analog of Individual Tax Return, designed specifically for seniors. Its main difference is that it has a convenient table, which simplifies deductions calculations. The larger print was used for this document, as older people are more likely to complete forms by hand than electronically. You should be 65 years or older to be eligible to use it.

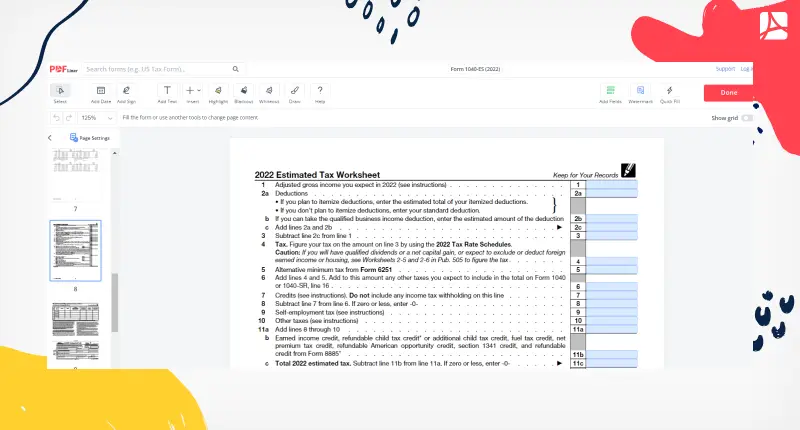

9. Form 1040-ES

This variation of an Individual Tax Return is intended for use by freelancers and independent contractors. With its help, they can determine the approximate amount of taxes at the end of each quarter. The use of this document does not relieve you of the obligation to complete the standard Form 1040 at the end of the tax year.

10. Form 941

Employers must complete Form 941 to report quarterly all taxes they have withheld from their workers' paychecks. Keep in mind that how often you fill out this form depends on the nature of your activity. For example, seasonal businesses should submit Form 941 only in the quarters they are open.

As you can see, some of the basic tax forms described are intended to be filled out by employees, others by employers. Below, you can explore the PDFLiner form demand chart we have created for your convenience.

FAQ

You can find more information about different tax form utilization in this section.

What tax forms do I need?

A detailed list depends on your personal situation. Typically, for tax season, most US citizens should provide the IRS with Form 1040, income documents (e.g., W-2 or 1099), Schedules that give the service a deeper look at their financial condition, and papers proving their eligibility for credits and deductions.

How many tax forms are there?

In total, the IRS issues more than 800 various forms and schedules designed to be used in different situations and by different categories of taxpayers. The tax service regularly reviews them and removes irrelevant or adds new, more effective templates.

How to fill out tax forms online?

What forms to send with the tax return?

You can use online software like PDFLiner for it. On this site, you will find one of the most extensive form libraries and detailed guides on filling them out. You can enter the required information into the form and send it to the right address right on the spot.

What forms to send with the tax return?

In addition to the Form 1040 (or some variation of it), you need to attach any Schedules that apply to your situation, copies of income documents (such as Form W-2), and a payment voucher (Form 1040-V) if you want to pay tax right away.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

.webp)