-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Changes in IRS W-2 Electronic Filing Requirements: 2024 Update

.png)

Dmytro Serhiiev

The IRS is releasing important changes for employers in 2024. These changes will impact how employers file Form W-2 and other related files. In this post, we’ll let you in on how the update will influence your tax-filing processes and provide valuable tips on filing W-2 electronically. Stay tuned.

Fill Out Form W-2 6596e0950573f9514908ee3a

W-2 New E-file Requirements for Tax Preparers

In the words of Leon E. Panetta, ‘If we don't do something to simplify the tax system, we're going to end up with a national police force of internal revenue agents.’ Looks like the government is slowly taking wise steps towards the long-awaited tax system simplification.

You’ve probably heard that the IRS has ushered in vital changes to W-2 filing requirements. Beginning January 2024, the limit for must-do electronic filing will drop from 250 W-2s to just 10 informational returns. Here's what this means for tax preparers and why it's important:

1. Lowered limit

The IRS has significantly reduced the limit for digital filing. It means that if you're handling 10 or more informational returns, including Forms W-2 or 1099, you're now required to file digitally. The exception is if the IRS grants a waiver or provides an exemption.

2. No paper - no problem

With this W-2 change in filing, you can easily meet your wage reporting duty without sending away piles of paper. Furthermore, going digital saves time and contributes to environmental protection.

Follow this two-step requirement for online W-2 filing:

- Register for a BSO Account. To submit an electronic report for Form W-2, start by registering for a Business Services Online (BSO) account.

- Create an Account With Credential Partners. An important requirement is an account with one of two credential partners, Login.gov or ID.me. If you don't have an account, feel free to work it up based on the given instructions.

Who Is Affected by W2 Online Filing Changes?

The changes mentioned above in W-2 electronic filing requirements affect different people involved in taxes, but most of all it affects employers’ payroll system. For a buttery-smooth transition to the new rules, knowing who's influenced is paramount:

- Businesses and Employers. The changes influence companies that issue 10 or more informational returns, including Forms W-2 or 1099. These companies must now file the docs digitally unless the IRS grants them a waiver or exemption.

- Tax Preparers and CPAs. Experts whose field revolves around preparing and filing tax docs for their customers (including W-2s) are directly impacted. If you’re one of them, go the extra mile to stay updated on the new digital filing limit and assist your customers in adhering to the new requirements.

- Employees and Recipients. Employees and individuals receiving W-2s are not directly responsible for filing the forms. However, they will indirectly benefit from the changes. The thing is, digital filing can speed up file processing, as well as make it more accurate. As a result, delays in receiving tax refunds or important financial info will be avoided.

- IRS and Government Agencies. The IRS and other government agencies manage the transition and supervise compliance among businesses and tax preparers. Also, they’ll need to take charge of effective digital file processing.

How to File W-2 Forms Online in 2024

Below, we’ve provided a step-by-step guide on how to file W-2 forms digitally, based on the changes that will take effect starting January 2024:

1. Check the limit

Figure out if you adhere to the new digital filing limit. If you are responsible for 10 or more returns, including W-2s, then filing digitally is what you’ll need to do. The only exception here is an exemption from the IRS.

2. Register for the BSO account

To get started, start a BSO account. Visit official SSA website and begin the registration process without hesitation.

3. Select a credential partner

Choose one of the two credential partners, Login.gov or ID.me, for your account. No account yet? Follow the instructions to create one. Complete the procedure upon redirection to the IRS website.

4. Provide important information

Prepare all the necessary info about yourself and the businesses you're filing W-2s for.

5. Request BSO Services access

After successful registration, request access to BSO services. Your employer will then receive an activation code via mail.

6. Access available services

Upon activation, access the following services without delay:

- Blank form W2/W-2c Online;

- Wage File Upload;

- AccuWage Online;

- View Name and SSN Errors;

- Social Security Number Verification Service.

7. Pick your filing method

Opt for the method that suits your needs best:

- Upload a Wage Report. Use your own software based on the IRS specifications.

- W-2 Online. Complete and print up to 50 Forms W-2 without any additional software.

- W-2c Online. Print up to 25 Forms W-2C without any additional software.

8. Consider 3rd-party services

As an additional option, you can opt for a 3rd-party service for W-2 filing online on your behalf.

There are no changes in the form completing instructions, but if you are not sure how to fill out W-2 form read another guide on our blog.

Other Forms With Updated Electronic Filing Requirements

The IRS's shift to lower the electronic filing limit to just 10 informational returns, starting in 2024, is not limited to Form W-2. Some other forms must also be filed electronically, affecting various entities and individuals. Here's a closer look at these forms and their updated electronic filing requirements:

- W-2AS, W-2GU, W-2VI, and Form 499R-2/W-2PR. These are versions of Form W-2 for US territories and foreign countries. According to the updated filing requirements, employers in these areas must also file these forms digitally if they meet the 10 or more informational returns limit.

- Forms 1099. This group of docs includes various types, such as 1099-MISC, 1099-INT, and 1099-DIV. They are used to report income from various sources. Starting 2024, businesses, financial institutions, and other entities that issue these docs must file them digitally if they meet the aforestated limit.

- Form 1095-B and Form 1095-C. These docs are used to report information about health coverage. Insurers and certain employers are responsible for digital filing of these forms if they have 10 or more returns to report.

When working on filing these forms, follow these tips from our experts:

- begin the digital filing process as early as you can to avoid last-minute stress;

- focus on maximum accuracy when completing the forms;

- explore the IRS specifications in detail to prevent possible errors;

- store copies of the docs you file in case of audits.

FAQ

What were previous W-2 filing requirements?

Before the recent changes, the IRS required employers to submit W-2 forms if they had 250 or more digitally. For those with fewer than 250, electronic filing was optional. This limit has now been lowered to just 10 forms, making electronic filing a more widespread requirement, effective from January 2024.

How to get a W-2 form online?

To get a W-2 form online, you usually need to log in to your employer's payroll or HR system. Many employers offer access to digital copies of your W-2 via secure portals. If you're looking for a template for the form, just make the most of PDFLiner's library of free templates.

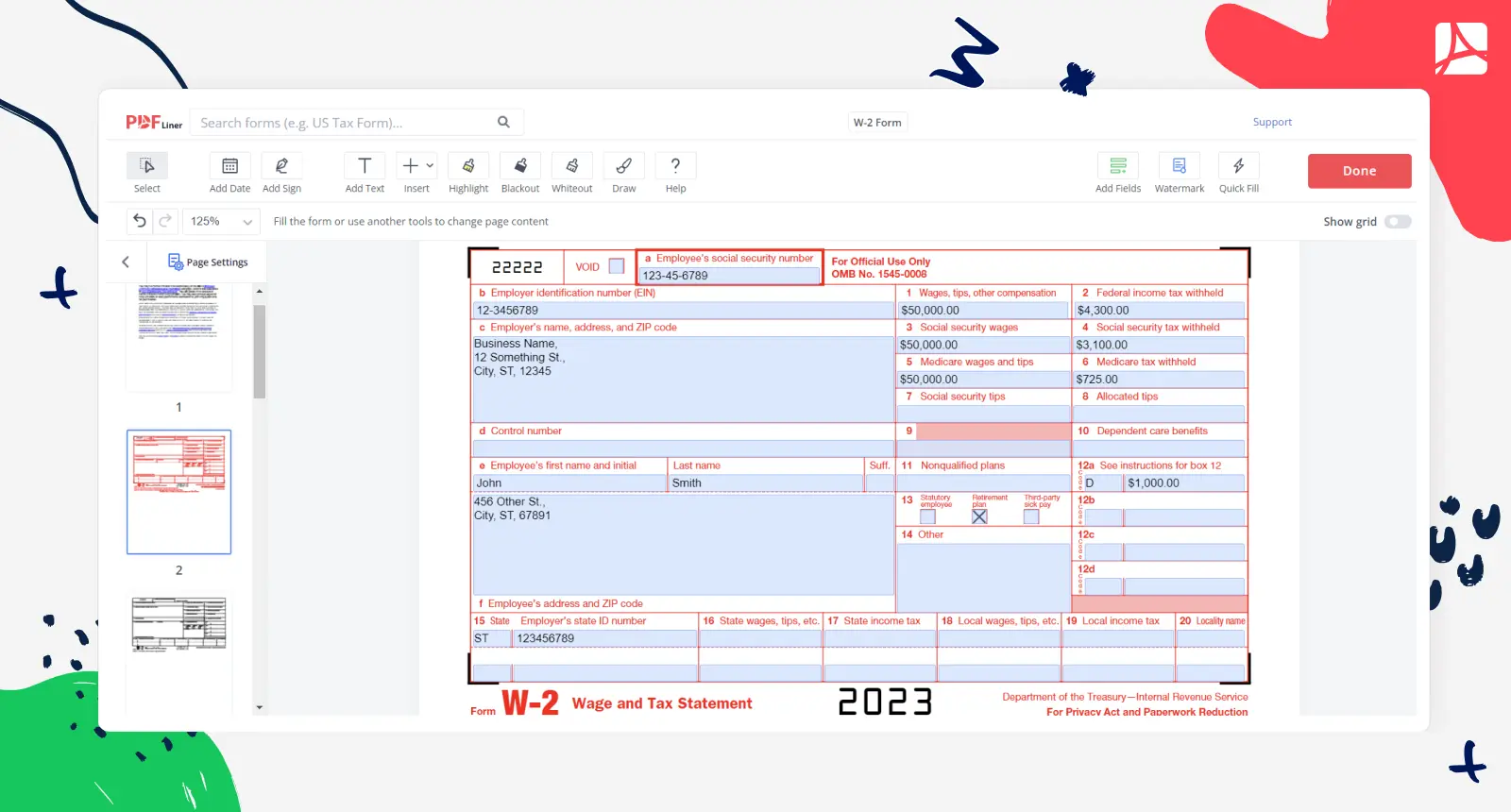

How to fill out a W-2 online?

Just use an approved tax software or online service like PDFLiner. These platforms make document completion processes a breeze. Before you submit your W-2 digitally to the IRS and provide copies to your employees, don’t forget to make 100% sure you’ve filled out everything correctly and following the requirements.

Fill Out IRS Tax Forms Online with PDFLiner

Enjoy fillable information return forms ready to save you a lot of hassle

.png)