-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Substantial Employer Guide to Payroll Taxes

.png)

Dmytro Serhiiev

Managing payroll taxes, including withholding, filing, and remitting, can prove to be exhausting responsibilities. It's a financial routine where employers and employees engage in a tango, often without knowing the next move. In this article, we’ll take a closer look at some fundamental aspects of paying employment taxes and transform this knowledge into an airy foxtrot you can dance through with ease.

What Are Payroll Taxes?

Payroll taxes are a vital source of revenue for governments worldwide. These taxes are typically deducted from employees' wages and are imposed on both employers and employees. Their primary purpose is to fund various government programs and services, such as Social Security, Medicare, and unemployment benefits.

Here are more details on why payroll taxes are important:

- Funding Social Security. Payroll taxes contribute to the Social Security program, providing financial support to retirees, disabled individuals, and survivors.

- Supporting Medicare. These taxes also fund the Medicare program, which offers healthcare coverage to eligible individuals, primarily seniors.

- Financing Unemployment Benefits. Payroll taxes help finance unemployment insurance programs, providing temporary financial assistance to those who lose their jobs.

- Sustaining Government Operations. A portion of payroll tax revenue goes toward general government operations, maintaining public services, and reducing budget deficits.

How do payroll taxes work? Let's say, you earn $1,000 per paycheck, and your payroll tax rate is 10%. Your employer deducts $100 from your pay and chips in an additional $100 themselves. This $200 goes to fund things like Social Security and Medicare, fueling government initiatives.

In 2022, the United States collected roughly $1.48 trillion in payroll tax revenue. Predictions point towards a considerable uptick, with payroll tax revenue forecasted to reach $2.3 trillion in 2033. This growth reflects the increasing importance of payroll taxes in supporting essential government programs, especially as the population ages and healthcare costs rise.

Employer Payroll Tax Responsibilities

According to an expert Jane Bryant Quinn, ‘Employers must view payroll taxes as a fiduciary responsibility, treating them with the utmost diligence.’ Indeed, employer payroll tax responsibilities are a critical aspect of business finance. Below, our experts have listed those responsibilities in detail:

- Collection. Employers are tasked with collecting payroll taxes from their employees' paychecks, encompassing Social Security, Medicare, and federal income taxes.

- Matching Contributions. Employers often match employees' contributions to Social Security and Medicare, making payroll taxes a shared obligation.

- Accurate Withholding. Precise calculation and withholding of taxes is essential to avoid penalties and compliance issues.

- Timely Deposits. Employers must deposit withheld payroll taxes to the appropriate government agencies on schedule. Late deposits can result in fines.

- Reporting. Accurate reporting of payroll taxes on quarterly and annual forms, such as Form 941, is crucial to ensure adherence.

- Keep Records. Maintaining detailed payroll records is essential for audits and compliance verification.

Now, as you explore our Payroll Taxes 101 guide, take a closer look at these vital forms in the context of today’s topic:

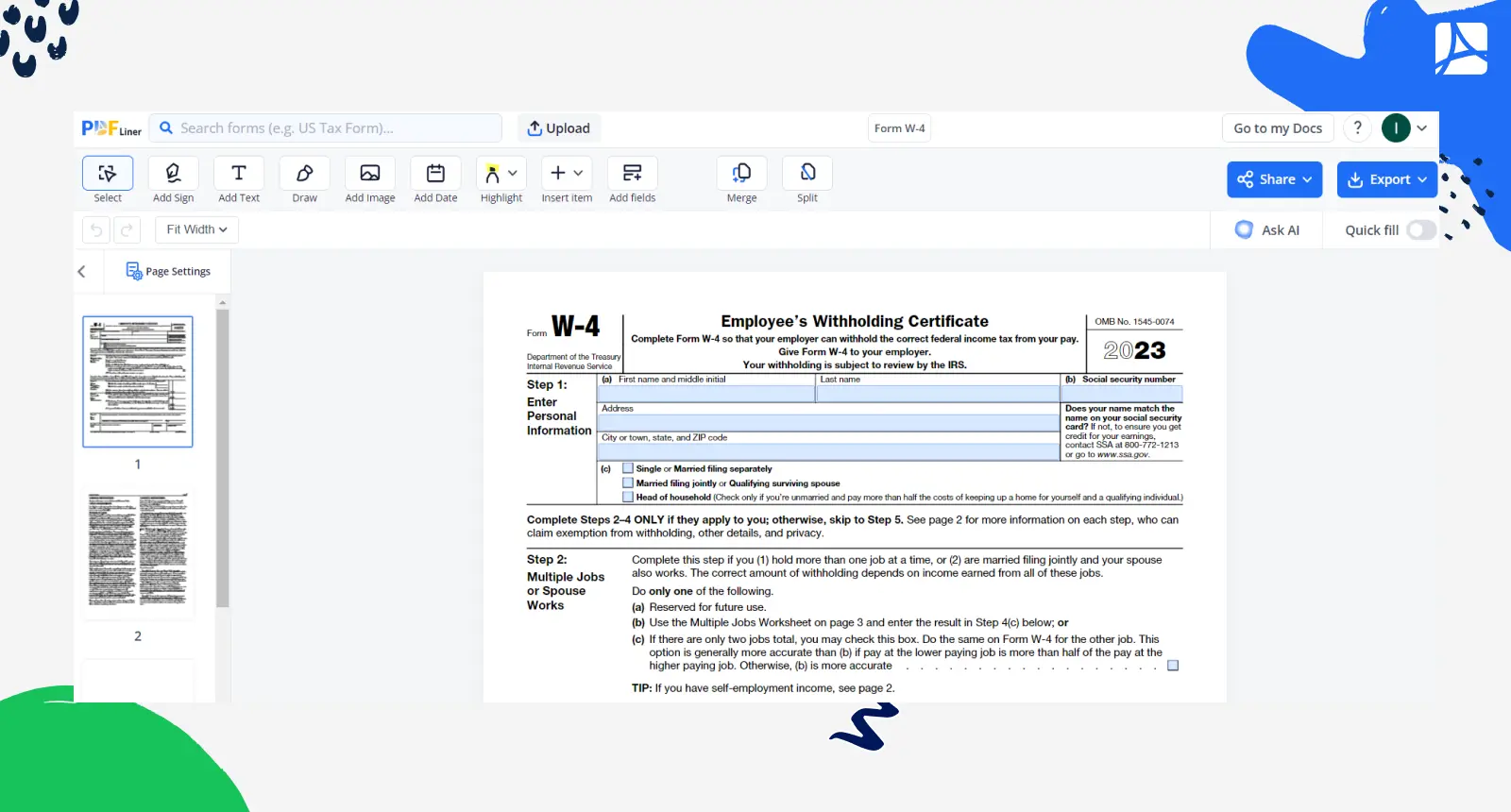

- Form W-4. It plays a crucial role in employment tax matters, serving as a vital document that ensures accurate withholding for employees. This form provides valuable information about an employee's situation, including their marital status, dependents, and any additional income sources. Employers rely on the details provided in Form W-4 to calculate the appropriate amount to deduct from each paycheck for federal income tax. Accuracy in employment taxes paid by an employer prevents employees from owing large sums at tax time but also helps employers meet their obligations. It's a vital tool in maintaining compliance, avoiding penalties, and ensuring a smooth payroll process for both employers and employees.

- W2 Form. This critical document summarizes an employee's annual earnings and the taxes withheld throughout the year. For employers, it ensures compliance with official regulations, facilitating accurate reporting and submission to federal and state authorities. For employees, it's indispensable for filing returns and determining refunds or liabilities. In a nutshell, Form W-2 is your tax report card. Employers send it to the IRS, showing their workers’ earnings and taxes withheld.

- Form 941. Being the superhero of employer payroll, this form is filed quarterly with the IRS, ensuring businesses are on track with Social Security, Medicare, and withheld income taxes. It's like a financial check-up, making sure the tax pulse is strong. This vital document guarantees that employers are meeting their obligations and keeping their financial health in solid shape. Just like your quarterly fitness routine, Form 941 helps employers flex their compliance muscles, keeps the authorities at bay, and prevents tax-related heartaches.

- Form 940. This annual report, filed with the IRS, ensures businesses are fulfilling their federal unemployment tax obligations. It's a bit like insurance for your employees, providing financial support in case of unexpected job loss. Form 940 verifies that employers are contributing their fair share to this safety net, helping individuals and the broader economy during challenging times. Filing it accurately and on time is essential to maintain compliance, avoid penalties, and uphold a strong financial safety net for American workers. It's a small but mighty tool in the employer's toolkit.

- Form W-3. Also known as the ‘transmittal form,’ this doc accompanies Form W-2, summarizing all employee wage and tax information, ensuring that the IRS gets the full picture of a business's financial responsibilities. It's the envelope that ties the payroll tax package together. Accurate and timely submission of Form W-3 is crucial, as it helps the IRS cross-check data and detect discrepancies, ensuring that employees' earnings and taxes align with what employers report.

How to Calculate Payroll Taxes

Calculating payroll taxes is paramount as it guarantees employees receive the correct compensation after tax deductions. Accurate calculations also ensure businesses meet their tax obligations, avoiding costly penalties and maintaining financial integrity. It's the key to both employees' financial security and a company's regulatory compliance.

Below, we’ll cover the topic of tax calculation in detail:

1. FICA Tax. The FICA tax, covering Social Security and Medicare, involves contributions from both employees and employers. Each party pays an equal share, resulting in a total employee contribution of 7.65%, matched by an additional 7.65% from the employer. These combined FICA taxes are allocated to fund Social Security and Medicare obligations.

2. Social Security Tax Rate. As of today, it stands at 12.4%, divided into two equal parts: 6.2% for employees and 6.2% for employers. To compute the tax amount for an employee, multiply their gross wages by 6.2%.

The Social Security tax has a wage base limit (up to $160,200), meaning earnings above this threshold are not subject to Social Security tax.

3. Medicare Tax Rate. The standard rate is 2.9%, split evenly between employees and employers at 1.45% each. To determine the Medicare tax amount for an employee, multiply their gross wages by 1.45%.

High earners, making over $200,000 for individuals or $250,000 for couples, are subject to an additional 0.9% Medicare tax. It's essential to keep up with IRS updates on a regular basis to ensure accurate calculations and adherence to Medicare tax regulations.

4. Self-Employment Tax. This tax combines the Social Security and Medicare taxes. This taxes employers should pay for themselves. The total rate is 15.3%, with 12.4% going to Social Security on earnings up to a certain limit and 2.9% to Medicare on all earnings. However, high earners may owe an additional 0.9% Medicare tax on income above $200,000 for individuals or $250,000 for couples. To calculate, multiply your net self-employment income by 15.3%.

At the end of the day, calculating payroll taxes is all about precision. Ensure you're aware of the tax rates, understand your deposit schedule, use reliable tools or software, and maintain meticulous records. Don't forget to factor in any additional taxes for high earners to avoid compliance hiccups.

How to Deposit Payroll Taxes

Depositing payroll taxes might sound as exciting as watching paint dry, but it's a crucial task for every responsible employer. Here's the step-by-step guide to help you cope with this task:

1. Know your schedule

Determine whether you're on a monthly or semi-weekly deposit schedule. The IRS assigns this based on your payroll size. The majority of small businesses follow a monthly schedule.

2. Do the tax math

Sum up the federal income tax withheld from your employees' paychecks, plus your share of Social Security and Medicare taxes.

3. Get an EIN

If you haven't already, ensure you have an Employer Identification Number (EIN).

4. Pick a payment method

Decide whether to use the Electronic Federal Tax Payment System (EFTPS) or a trusted tax professional to deposit your taxes.

5. Make your deposits

‘On time’ is the keyword here. Monthly depositors typically have until the 15th day of the following month, while semi-weekly depositors have tighter deadlines, but remember, don't procrastinate!

6. Keep records

Maintain a thorough record of your deposits so that you can prove your compliance if Uncle Sam comes knocking.

As J.C. Watts once said, ‘Death and taxes may be inevitable, but they shouldn't be related’. That said, deposit day doesn't have to be daunting. With a dash of organization and a sprinkle of punctuality, you'll easily get to grips with how to pay tax for employees.

FAQ

Do you get payroll taxes back?

Payroll taxes are non-refundable. They fund Social Security and Medicare, providing benefits during retirement or disability, and healthcare coverage, respectively. You won't receive them back like income tax refunds.

Who is eligible for a payroll tax refund?

As we have discussed previously, payroll taxes are not refundable. Income tax refunds, on the other hand, may be eligible for those who overpaid.

What is the journal entry for payroll taxes?

The journal entry for payroll taxes typically involves debiting ‘Payroll Tax Expense’ and crediting ‘Accrued Payroll Taxes Payable.’ This records the liability until the taxes are remitted to the appropriate authorities.

How often do employers pay payroll taxes?

Employers remit employment taxes, including payroll taxes, on diverse schedules. Payment frequencies vary, with some paying monthly and others following a semi-weekly schedule, depending on factors like payroll size and IRS regulations.

Document Management is Easy with PDFLiner

Stay organized and keep all your PDFs in one place