-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Instructions on How to Fill Out W-3 Form

Liza Zdrazhevska

Last Update: Nov 21, 2024

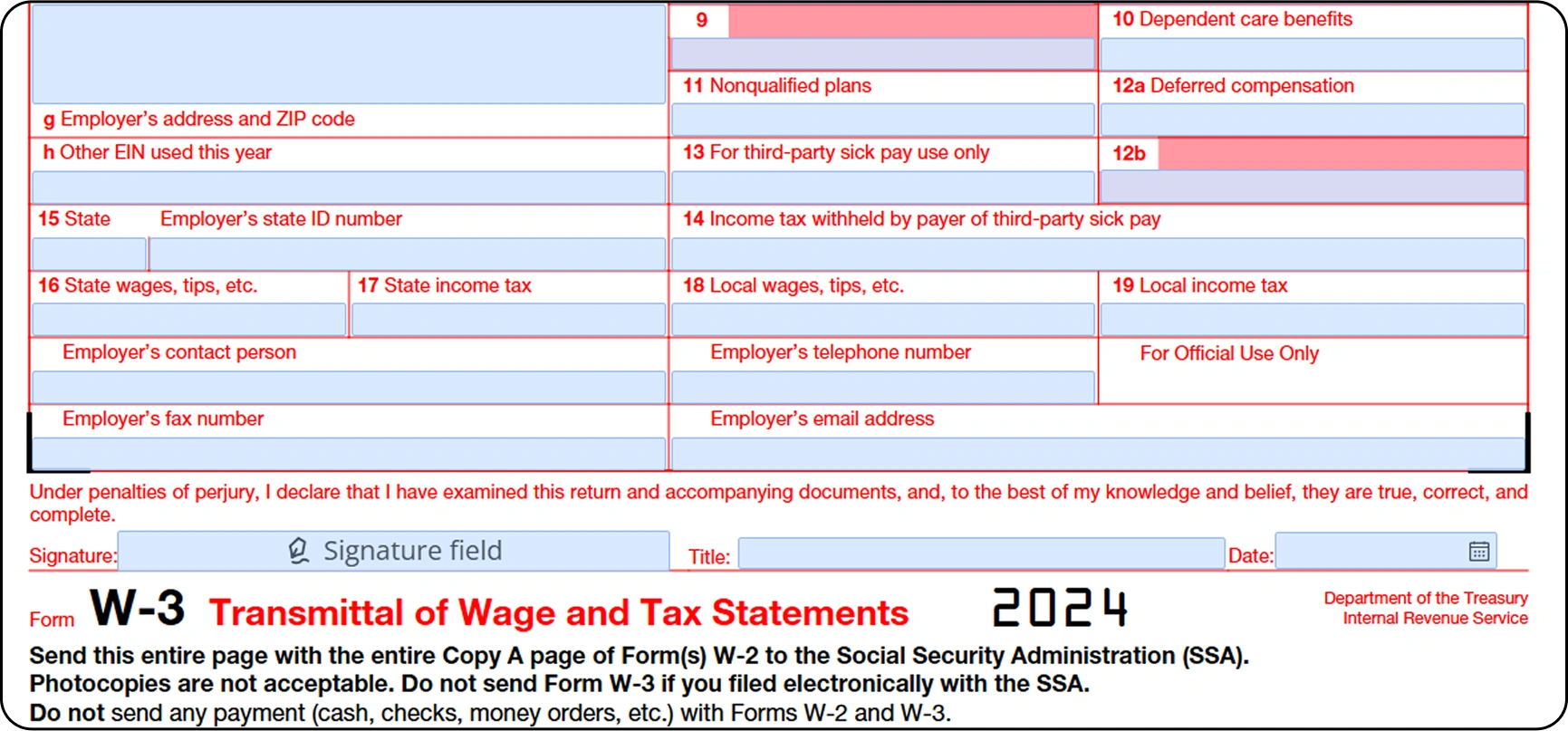

If you want to know how to fill out a W-3 form, read this article. The form is also known as Transmittal of Wage and Tax Statements. It is required only if you need to transmit the A Copy of the Form W-2. It is helpful for everyone who has employees. Read Form W-3 instructions together with the instructions for a W-2 form that reports the wages of each employee.

Fillable W-3 65bb5be2d1918f924e00be17

Key Takeways

- Form W-3 serves as a summary of all W-2 forms for a company, reporting total employee wages, Medicare taxes, Social Security, and federal income taxes to the IRS.

- Employers need to file Form W-3 with the Social Security Administration (SSA) as it must accompany the W-2 forms; employees do not receive this form.

- The form requires detailed information such as employer's EIN, number of W-2 forms, wages, taxes withheld, and Medicare details. An electronic option is available for easier completion and submission.

- Form W-3 can be sent to the SSA either by mail or electronically. The SSA encourages online filing for efficiency and ease.

What Is a W-3 Form?

Many taxpayers don’t know the definition of what is a W-3 form and how to complete it. However, it is an important document for any employer. Form W-3 goes together with a W-2 form, summarizing the information that was provided. It contains the list of information about employees, taken from Form W-2. You can’t file this document alone, and you have to attach copies of W-2 forms to it. If you are looking for how to get a W-3 Form, it’s pretty easy. Simply click on a blue button in this article or go to the official IRS website and download a copy of the form there.

The IRS requires information on the total sum you’ve paid your employees. Use Form W-3 for this. It also includes Medicare taxes, Social Security, and federal income.

Printable W-3 65bb5be2d1918f924e00be17

Who Needs a W-3 Form?

Usually, employers need to learn how to file a W-3 form in the first place. Since they provide detailed information on payments for employees, they need to send Form W-2 to the IRS, as well as its attachment, Form W-3. As an employee, you don't receive this form. The main copy of the document must be sent directly to the SSA. It contains detailed information on salaries, social security, Medicare, and taxes of each employee. You also need to keep one copy to yourself together with Form W-2 Copy D.

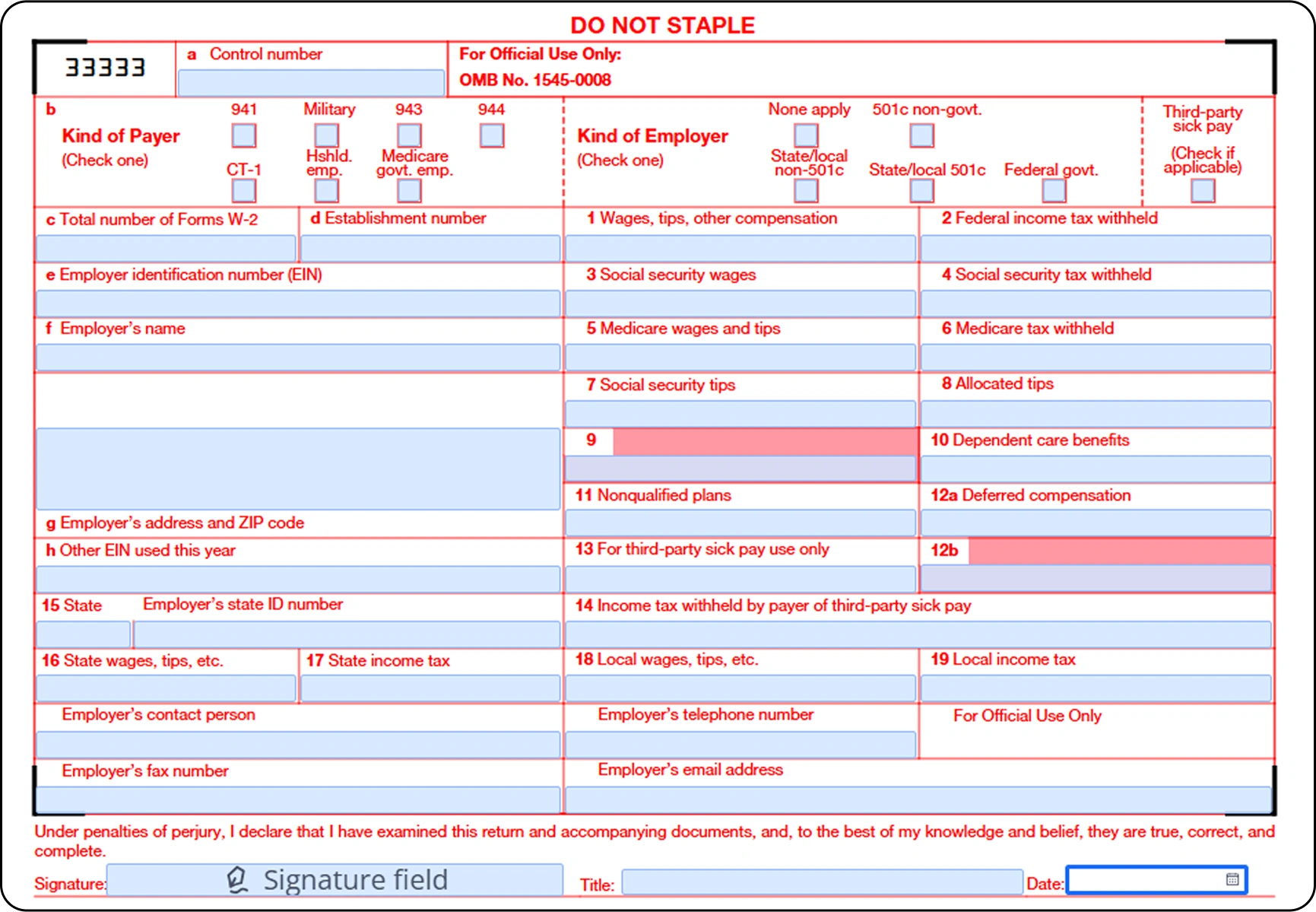

How to Fill Out a W-3 Form?

Filling a W-3 form is not that complicated if you know what the SSA requires from you. There are instructions in the official IRS form. Follow them, and you will be able to fill everything in no time.

You may also use PDFLiner to complete the form since it guides you from one section to another and offers an electronic signature feature. Helpful recommendations support you while editing the form. Make sure you provide the right information before you send the document to the officials. It is only 2 pages long, and the first page contains explanations from the IRS. Follow these IRS Form W-3 instructions:

- Provide the control number in the section above.

- Put a tick to choose the right type of payer and employer.

- Indicate the total number of W-2 forms and the number of the establishment.

- Provide the EIN of your employer and write down their name and detailed address.

- Include the other EIN that was used during the year.

- Section 1 contains the number of wages and tips.

- Section 2 is for the withheld federal tax income, while section 3 is for social security wages.

- Section 4 is for the withheld social security tax.

- Section 5 requires information on Medicare wages, while section 6 needs tax withheld on Medicare.

- Section 7 is for social security tips, and section 8 is for the allocated tips.

- Sections 9 and 12 b must be left blank.

- Section 10 is for the number of dependent care benefits.

- Section 11 reveals non-qualified plans, and section 12a is for the deferred compensation.

- Section 13 is for the amount of third-party sick pays.

- Include withheld income tax by the payer of the third-party sick pay-in section 14.

- In section 15, name the state and ID Number of the employer.

- Sections 16 and 17 contain data on state wages, tips, and income tax.

- Section 18 is for the local wages, while section 19 is for the local income tax.

- Leave the employer’s contact information and fax number.

- Provide your phone number and email address.

- Put the signature, title, and date below.

How to Sign W-3 Form?

The completed W-3 form requires the signature of the person who filled out the document. You may use the standard way, which is to print the form and sign it manually before you send it. However, if you want to file W-3 online, you need to scan the form with the signature back, which means an extra headache you don’t need. PDFLiner offers you to create or download your electronic signature in a few steps:

- Press the field that must be signed.

- Press the “Add new signature” button.

- Choose whether you want to write down the signature in the field, upload it, draw, or add from the phone’s photo.

- Press “Sign.”

If you would like to know more about the PDFLiner signature tool, you can find a complete e-sign guide on our website.

How to File W-3 Form?

You will find the SSA standard address in the form. You can send the document directly to the main office:

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-001

If you don’t want to perform numerous actions, including going to the post office and buying an envelope, you can always e-file the form together with W-2. Use the SSA or the IRS official website. The SSA always encourages users to send their forms online. Use PDFLiner to complete the form and send it to the SSA email together with the W-2 form afterward.

Printable Transmittal Form 65bb5be2d1918f924e00be17

FAQ

Even though you’ve learned the W-3 form definition, you might still have some questions. Search for them in this section.

When do I file a W-3 form?

The form must be sent at the same time as Form W-2. They have to be sent together until January 31 of the tax year. If this date falls on a holiday or weekend, the deadline is extended to the next business day. You have to ensure that your form comes to the SSA by the deadline. This timing is crucial not only for the paper but for electronic filing as well.

How to download a W-3 form?

You can either download it from the IRS official website or use PDFLiner. The form is popular, and you can find it on the Internet as well. However, you don’t have to download it if you want to send it online. Use the convenient PDFLiner editor to complete the form. Once everything is done, put your signature there and send it to the SSA.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

W-3 Form 65bb5be2d1918f924e00be17