-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Correcting W-2 Form Errors: Complete Guide

.png)

Dmytro Serhiiev

Last Update: Nov 10, 2024

Making mistakes is something that happens to all of us. In case of making a mistake on your Form W-2, don’t stress. Instead of worrying about it, educate yourself on how to amend a W-2 form and take the necessary steps without delay. The good news is that you can correct the document even upon submitting it to the Social Security Administration (SSA). Keep on reading to learn more about the topic.

Fill Out Form W-2C 65cf3d3b8909157a430c07ce

Key Takeaways

- Employers must use W-2C and W-3C forms to correct errors and submit them accurately to the SSA.

- Employers should use Form W-2C for corrections and prepare Form W-3C to transmit corrected information to the SSA, ensuring all details are accurate.

- Employees should verify their W-2 for errors, contact their employer for corrections, and use the corrected W-2C to file taxes accurately.

- Minor errors, such as those affecting only the employee’s copy or cents discrepancies, may not require corrections.

Most Common W-2 Corrections

Before we switch to useful tips on your W-2 amendment, let’s take a look at the common errors people make when completing the form. ‘I made a mistake on my taxes’ is a common occurrence, and there are ways to correct it through the proper channels.

1. Wrong Social Security Number

Never leave the SSN box blank. Incorporate dashes when formatting the SSN. Bear in mind that a missing or wrong SSN on the W-2 can lead to delays in tax processing and even potential discrepancies in your earnings record with the SSA.

To sort out this issue, contact your employer's HR department or the entity responsible for issuing the form. They will lead you through the must-follow steps to correct the mistake. It's crucial to resolve it promptly to ensure the accuracy of your tax return and maintain the consistency of your Social Security record.

2. Wrong name spelling

Always utilize the employer’s legal name as opposed to their nickname. In case of a name change, always use the current name, not the previous one. While wrong name spelling might seem like a minor error, it can lead to complications during tax filing. Just like with the previous issue, to correct the name spelled wrong on a W-2 mistake, promptly contact your employer's HR department or the issuing entity. It's essential to address this because the IRS cross-references your name with your Social Security Number. Any discrepancies can result in delays or even trigger an audit.

3. Incorrect address

An accurate address is crucial for receiving tax documents and other important correspondence. To correct this mistake, get in touch with your employer or the responsible party for form issuance. They will guide you through the process of correcting your address. Ensuring your address is accurate on your W-2 is essential for the timely delivery of documents and problem-free tax preparation.

How to Correct a W-2 Form Errors: Employer’s Guide

Correcting W-2 forms as an employer is paramount as it significantly affects the payroll taxes you and your employee pay.To correct mistakes, you need to follow a specific process. Maintain a laser-like focus on accuracy as you follow these instructions for filing a corrected W-2 form:

1. Identify errors and areas for correction

First and foremost, pinpoint errors in the previously filled W-2 form. These errors will highlight areas for amendment. Double-check employee details such as names and addresses, and compare them thoroughly with your records. Carefully cross-check wage and tax details for numerical inconsistencies or discrepancies. Pay particular attention to boxes requiring special notations, such as adjustments to previously reported figures.

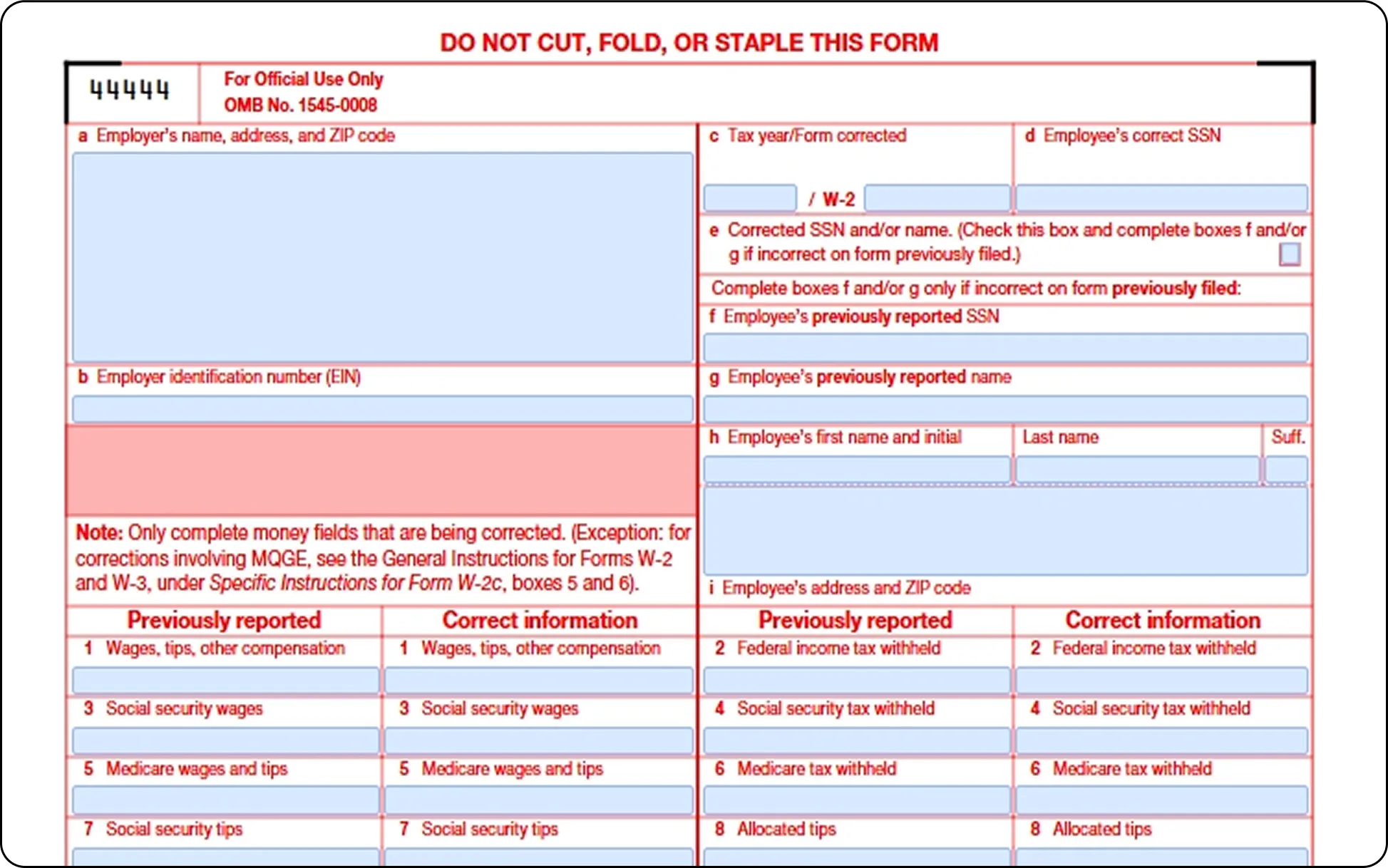

2. Fill out Form W-2C

Upon identifying errors, the next crucial action is to complete the W-2C form, also known as the ‘Corrected Wage and Tax Statement.’ Follow these 5 expert-provided steps to cope with the task:

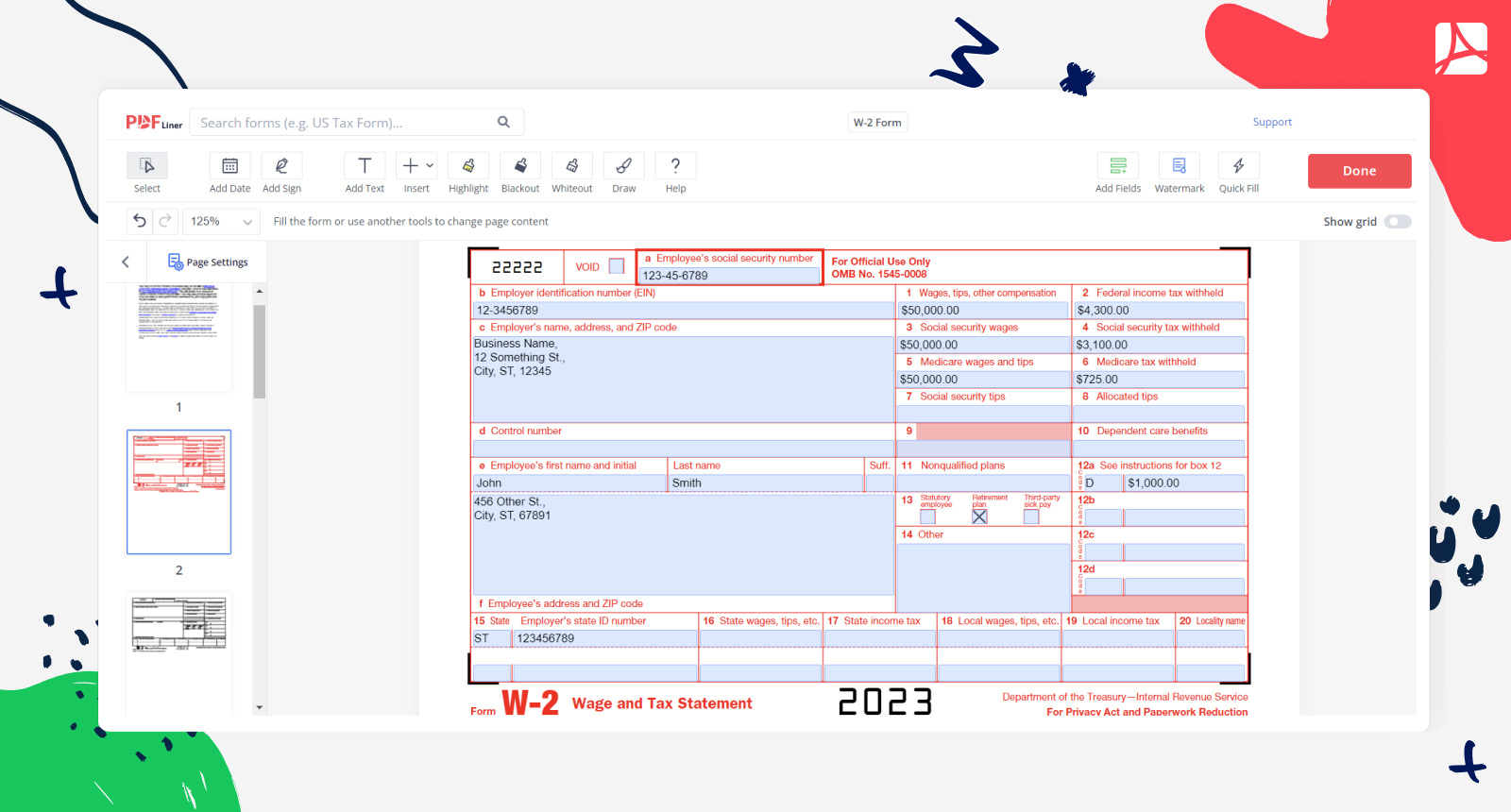

1. Find the template of the form via a service such as PDFLiner.

2. Type your company's name, address, and EIN exactly as they appeared on the original W-2 forms.

3. Provide the affected employee's information accurately: their name, SSN, and address.

4. For each incorrect box, indicate the corrected value alongside the original erroneous data. Use separate W-2C forms if multiple corrections are required.

5. Don’t forget to provide a clear and concise explanation of the reason for the correction, whether it's a mathematical error or incorrect data entry.

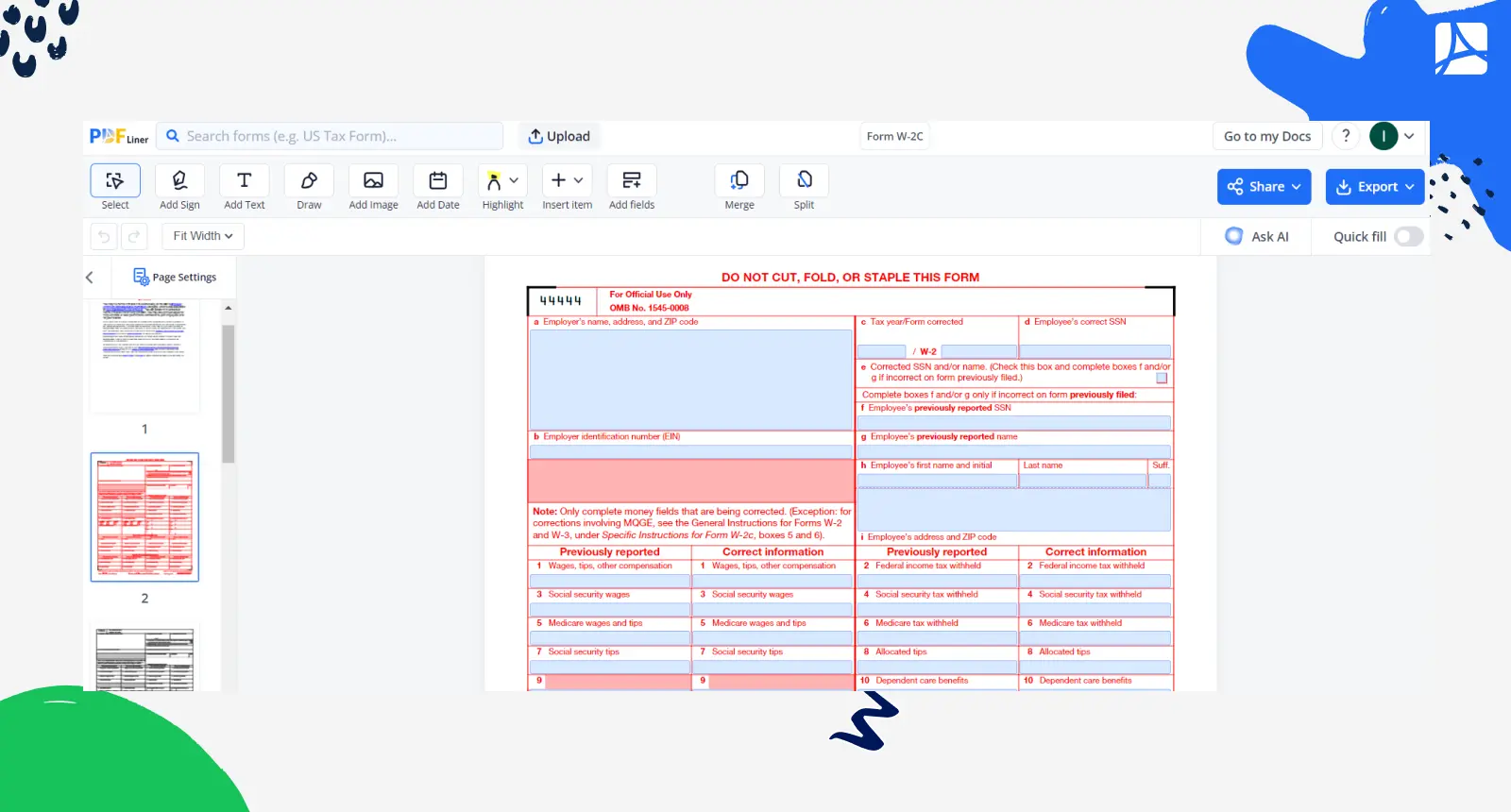

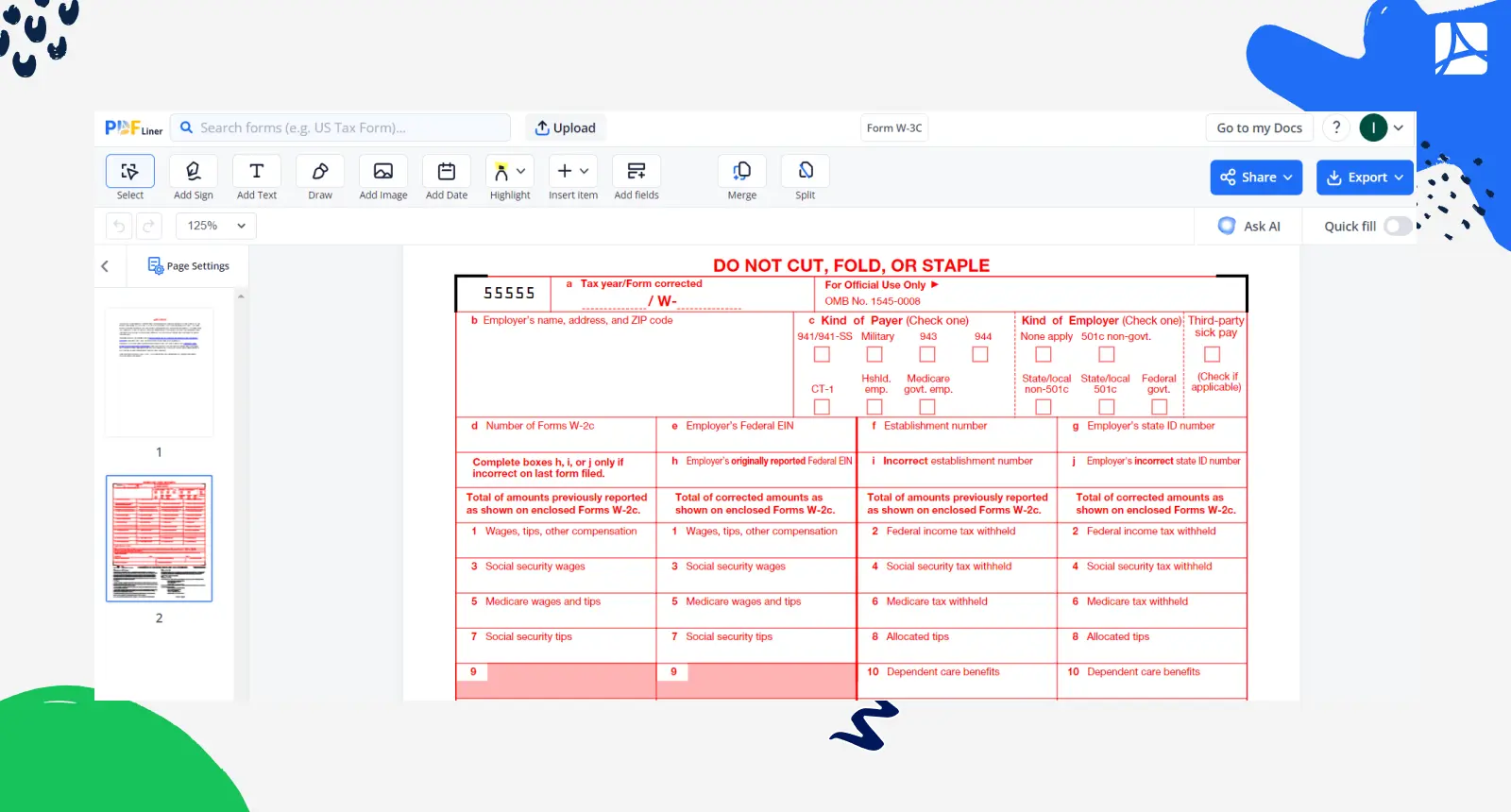

3. Prepare Form W-3C

In combination with the W-2C forms, you need to prepare Form W-3C, the ‘Transmittal of Corrected Wage and Tax Statements.’ Follow these 5 instructions from our experts to complete the mission:

1. Find the template of the form in the PDFLiner’s library.

2. Specify your company's precise legal name, address, and EIN exactly as they were indicated on the original W-2 forms.

3. On the W-3C, provide the total corrected amounts for all W-2C forms you're submitting. This should reflect the cumulative changes for all affected employees.

4. Verify that all details on the W-3C form are error-free and align with the information on the accompanying W-2C forms.

5. Mail or electronically submit the W-3C and W-2C forms to the Social Security Administration following their specific guidelines.

4. Send copies

Provide each affected employee with a copy of the corrected W-2C form. This is crucial, as they'll need it for tax filings. Attach a brief cover letter explaining the reason for the correction and any actions employees might need to take.

5. Monitor for confirmation

After sending the corrected W-2C forms to employees and the SSA, monitor for acknowledgments or confirmations of receipt. This ensures that your corrections have been duly noted. Pay attention to any correspondence from the IRS or SSA regarding your amendments. They may request additional information or provide feedback on your submissions. In case of any discrepancies or issues in the acknowledgment process, be prepared to address them promptly.

6. Keep records

Safeguard all records related to the corrected W-2 forms, including copies of the original W-2S, W-2C, and W-3C forms, employee acknowledgment receipts, and any communication with the IRS and SSA. Stay updated on the IRS guidelines for retaining these records, which typically require keeping them for at least four years.

Correcting a W-2: Employee’s Guide

Correcting errors on your W-2 form as an employee or satutory employee is a must-do for accurate tax reporting. To update the W-2 form and get rid of any mistakes, you need to follow these 4 specific steps:

1. Check your W-2

Begin by carefully examining your W-2 form. Make sure that personal details such as your name, Social Security Number, and address are accurate and match your records. Double-check the wage and tax info to identify discrepancies or numerical errors. Note any inconsistencies between your records and the W-2. Pay attention to boxes on the form that may require specific notations or corrections, such as adjustments to previously reported figures.

2. Contact your employer

Get in touch with your employer as soon as possible to discuss the identified errors on your W-2. Communicate clearly and professionally, explaining the discrepancies you've found. Politely ask your employer to issue a corrected W-2 form with accurate information. If needed, follow up with your employer to ensure they are actively working on the corrections and inquire about the expected timeframe for receiving the updated W-2.

3. Receive a corrected W-2C

After the initial contact with your employer, confirm that they are taking action to correct the errors on your W-2. Wait for your employer to provide you with the corrected W-2C form. This document should reflect accurate information. Upon receipt, carefully review the corrected W-2C to ascertain that all errors have been addressed and the details are now accurate.

4. Use W-2C to file taxes

Use the corrected W-2C to file your taxes. This way, the IRS receives accurate information regarding your income and taxes paid. Include the W-2C with your tax return, making sure to file by the deadline to avoid penalties. Retain a copy of the corrected W-2C, as well as all related correspondence, for your records. This serves as evidence in case of any future inquiries.

How to File a Corrected W-2

Filing the corrected W-2 form is crucial when you've made errors on your employee's wage and tax statement. Correcting these mistakes ASAP guarantees accurate tax reporting and prevents any potential issues with the IRS. Follow these 9 expert tips on filing a corrected W-2 change like a pro:

1. Understand the reasons for the correction

Before you begin, identify the specific errors on the original W-2. Common issues include incorrect employee information, wages, or tax withholding amounts.

2. Use the correct form

Employers should use Form W-2C for corrections. If you are an employee, notify your employer of the errors.

3. Complete the form with 100% accuracy

Carefully fill out the W-2C, making sure all fields are accurate and up to date. Double-check all the corrected information.

4. Attach a letter of explanation

Provide a letter that explains the reason for the correction. Include details like the error type, how it was discovered, and what the corrected amounts should be.

5. Distribute to the employee

Once you make amendments, provide the corrected W-2 to the affected employee as soon as possible.

6. Submit to the SSA

Employers must send a copy of the corrected W-2C to the SSA. Use Form W-3C to summarize the corrected W-2 forms.

7. Don’t forget to keep the records

Maintain a record of all corrected forms and correspondence in case you need to reference them in the future.

8. Focus on filing on time

Make sure that you file the corrected forms before the deadline, which is usually the end of February. Late filing can result in penalties.

9. Seek professional assistance

If you are unsure about how to correct a W-2 or if you need in-person instructions on how to change the address on the W-2, consider consulting a tax professional or the IRS for guidance. Overall, always stay updated on how you can avoid tax mistakes before they even get the slightest chance to happen.

W-2 Correction Deadline

In the words of Margaret Mitchell, ‘Death, taxes and childbirth! There's never any convenient time for any of them.’ It’s true, but strict deadlines exist to help you find that time. On the whole, there is no specific deadline to file Form W-2C, i.e. correcting your W-2. However, the SSA recommends you file Form W-2C as soon as you notice a mistake(s) on your original W-2 or W-2C forms. Then send a copy of the W-2C to affected employees by the end of February.

To meet this specific deadline, start the correction process ASAP, and be thorough in filling out the W-2C form accurately. Last but not least, maintain clear records and consult tax professionals for complex corrections whenever necessary.

When Correction Is Not Needed

Further on, we'll explore those rare cases when you can actually put your W-2 correction pen aside and enjoy a less bureaucratic tax season. So, when are corrections unnecessary? Find scenarios below:

1. The mistake is only on the employee’s copy

To resolve the issue, simply provide the employee with a corrected copy for their records. Keep the corrected version in your own records, ensuring the IRS receives the accurate data on time.

2. Wrong code in Box 12, but the dollar amount is accurate

To resolve the issue, you should provide a brief explanation to the employee. In the future, double-check Box 12 codes to ensure accurate reporting and alleviate potential confusion.

3. Error in state or local tax information that doesn't impact federal taxation

It's still crucial to deal with this issue for state tax reporting accuracy. Reach out to your state tax agency for guidance on amending the state-specific information, ensuring you remain compliant with local tax regulations.

4. Errors in cents that don't significantly affect the total amounts

For minor errors involving cents that have no impact on the total amounts, correcting your W-2 isn't obligatory. Yet, precision is key in tax reporting. We advise you to ensure accuracy in all aspects of your W-2 to prevent potential discrepancies, even if they appear insignificant. Diligence today can save you from hassles later on.

FAQ

Where to get Form W-2C?

Access the form directly on the official IRS website. It's also available for free in the PDFLiner’s library of pre-designed forms. You can download, print, or fill it out online within the platform’s feature-packed digital editor.

How far back can you amend a W-2?

You can amend a W-2 for the current tax year and up to three years after the tax return due date or the date you filed the original return, whichever is later. If you need to make corrections beyond this timeframe, it's advisable to consult with a tax professional to explore your options, as amending older returns can be more complex.

How to correct a Social Security Number on W-2?

Begin by contacting the Social Security Administration to update the information in their records. Next, complete a Form W-2C with the correct SSN and submit it to the SSA and the employee. Be sure to file this correction as soon as you can to avoid any issues within your tax affairs.

Fill Out Your Tax Forms Online with PDFLiner

Fillable IRS tax forms will save you loads of time and effort