-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

What Is a Statutory Employee? Definition & Examples

.png)

Dmytro Serhiiev

Statutory employees, a captivating fusion of traditional employment and freelancing... Have you ever been intrigued by this term? In this article, we'll define statutory employee classification, offer some examples from an array of fields, explore their distinctions from independent contractors, review statutory employee tax documents, and unlock other important complexities of this extraordinary classification. Read on for details.

Printable W2 Form 6596e0950573f9514908ee3a

What Does a Statutory Employee Mean

A statutory employee is a worker who falls under a specific tax category recognized by the IRS. They have a unique status, combining aspects of both traditional employees and self-employed individuals. This classification determines how their taxes are calculated, and it's often applied to certain job roles where workers have independence but are still controlled to some extent by their employers. These employees may enjoy tax advantages and expense deductions not typically available to regular employees.

Now that we’ve provided a statutory employee definition, feel free to explore the takeaways of how these employees work:

- Control and Independence. Statutory employees are in the middle ground between traditional employees and self-employed individuals. They have a significant degree of independence at work but are still under the control of their employer to some extent.

- Tax Treatment. For tax purposes, these employees are treated differently than regular employees. They pay Social Security and Medicare taxes like self-employed individuals, which can lead to some tax advantages.

- Specific Jobs. Statutory employee status is often given to certain types of workers, such as salespeople, delivery drivers, or agent-drivers who distribute beverages (such as soda or beer). It's not a one-size-fits-all classification.

- Expense Deductions. Statutory employees can often deduct work-related expenses. This can be a significant perk, especially if you're the one fronting the bill for gas, vehicle maintenance, or even that snazzy uniform.

- Fringe Benefits. Some statutory employees may receive fringe benefits from their employer, such as retirement plan contributions or certain other goodies. This can vary, depending on the employer's policies.

- Flexibility. This classification provides a balance of tax advantages and a bit more flexibility compared to regular employees. It allows for deductions and tax treatment typically associated with self-employment.

To sum up, a statutory employee is someone in a unique employment category that blends features of both employees and self-employed individuals. They enjoy certain tax benefits and expense deductions, which can be advantageous, depending on their job role. Whether you're making sales, delivering packages, or representing a beverage company on the road, understanding your tax status is vital for financial planning.

Fill Out Form W-2 6596e0950573f9514908ee3a

Statutory Employee Examples

Now, let's illuminate the concept of statutory employee through real-life examples. These scenarios will bring clarity to how this classification applies in various professions and working arrangements.

Direct Salespeople

Picture Jane, she’s a direct sales dynamo. She represents a well-known makeup company, working on her schedule, and often hosts glam parties at home. Jane's like a business chameleon, embracing both independence and corporate branding. Her expenses for product samples, travel, and presentations? Deductible! Jane's a true statutory superstar, making the sales world her stage.

Licensed Real Estate Agents

Meet Sarah, the go-getter in the world of real estate. She's a licensed agent, working independently under the supervision of a real estate brokerage but is considered a statutory employee. She receives a Form W-2 from her brokerage, indicating her income and taxes withheld, similar to traditional employees.

Home Workers

Alex is the IT specialist with the freedom to set up the home office, manage tasks, and even deduct expenses such as internet and office supplies, Alex exemplifies the modern statutory employee, proving you can conquer IT challenges while working in your pajamas.

Full-Time Life Insurance Sales Agents

Imagine Bob. He's a full-time life insurance agent, charting his path to financial security. Bob revels in the dual role of an entrepreneur with corporate perks. This arrangement allows him to access employee benefits and simplifies tax compliance, as he doesn’t have to worry about self-employment tax.

Statutory Employee vs. Independent Contractor

Now, let’s briefly compare both notions based on the following vital criteria:

- Semi-Employees vs. Autonomous Entities. Statutory employees are somewhat like hybrid creatures, blending elements of both employees and self-employed individuals. They're more formalized than contractors but not quite full-fledged employees. In contrast, independent contractors are the free spirits of the work world. They operate as separate businesses, providing services to clients or companies.

- Tax Distinctions. Statutory employees pay Social Security and Medicare taxes like self-employed individuals, providing them with certain tax advantages. Think of it as the best of both tax worlds. Independent contractors, in their turn, are responsible for their own taxes, including self-employment tax. This can translate into more financial responsibilities but also greater control over deductions and business expenses.

- Flexibility Degree. Statutory employees often strike a balance between independence and employer control, following specific company guidelines while enjoying some autonomy. As for independent contractors, they enjoy greater flexibility in setting their schedules, choosing projects, and deciding where to work.

Last but not least, statutory employees are a specialized classification often used in specific professions, whereas independent contractors are more versatile and common across various industries. The former enjoy some tax perks, while the latter have greater autonomy but also more tax responsibilities.

While the precise number of taxpayers who file under the statutory employee status remains unaccounted for in statistical records, it’s interesting to note that around 50% of the workforce is anticipated to consist of independent contractors by the year 2030.

Fill Out Form 941 65f86b5466fb65a8340566e5

Statutory Employee Taxes

Let's break down the specificities in the context of statutory employee taxes:

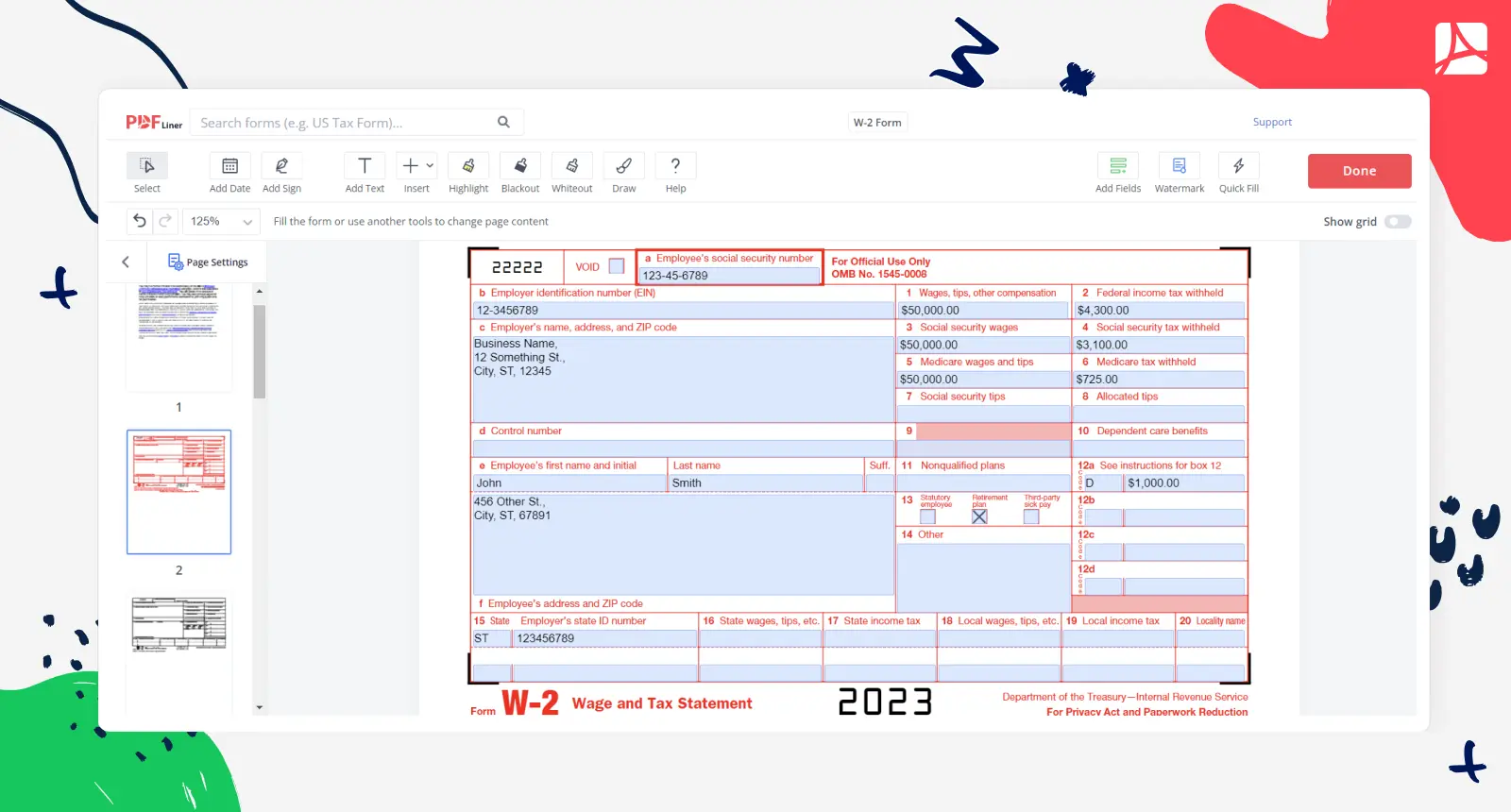

- Form W-2. Statutory employees receive a W2 Form printable version from their employer, outlining their earnings, tax withholdings, and other financial details. They won't get a Form 1099-MISC since this document is sent to independent contractors.

- Social Security and Medicare. Statutory employees handle both sides of Social Security and Medicare taxes. These two taxes are grouped under the term “Federal Insurance Contributions Act (FICA) taxes,” and split as follows. The employer and the employee each contribute 6.2% for Social Security, resulting in a combined total of 12.4%. For Medicare, both parties contribute 1.45%, adding up to 2.9%. This makes the total of all FICA tax contributions 15.3%. Along this particular tax road, employers and statutory employees walk through FICA taxes together.

- Deductions. These employees can deduct their expenses using a Schedule C, similar to how businesses do it. This form lets them list their income and qualified expenses like advertising, office costs, travel, and taxes.

Statutory employees also bear the responsibility of annually paying their own income taxes. This implies that employers do not withhold federal, state, or local income taxes from their paychecks. As a result, these employees should be ready to pay taxes regularly or all at once during tax season.

Statutory Employment Tax Documents

Getting the gist of tax documentation is paramount when it comes to tax obligations. Below, we’ll briefly review statutory employee example tax forms used in this specific niche.

Form W2

It’s a crucial document that guides statutory employees on their tax way, providing a clear map of earnings, deductions, and tax withholdings. Here's why it's vital:

- Income Reporting. Filled out Form W-2 reports an employee's total earnings, allowing both parties to reconcile income accurately.

- Tax Withholdings. It details the taxes withheld throughout the year, helping statutory employees determine their actual tax liability.

- Compliance. Accurate W-2s ensure compliance with tax laws, avoiding potential penalties.

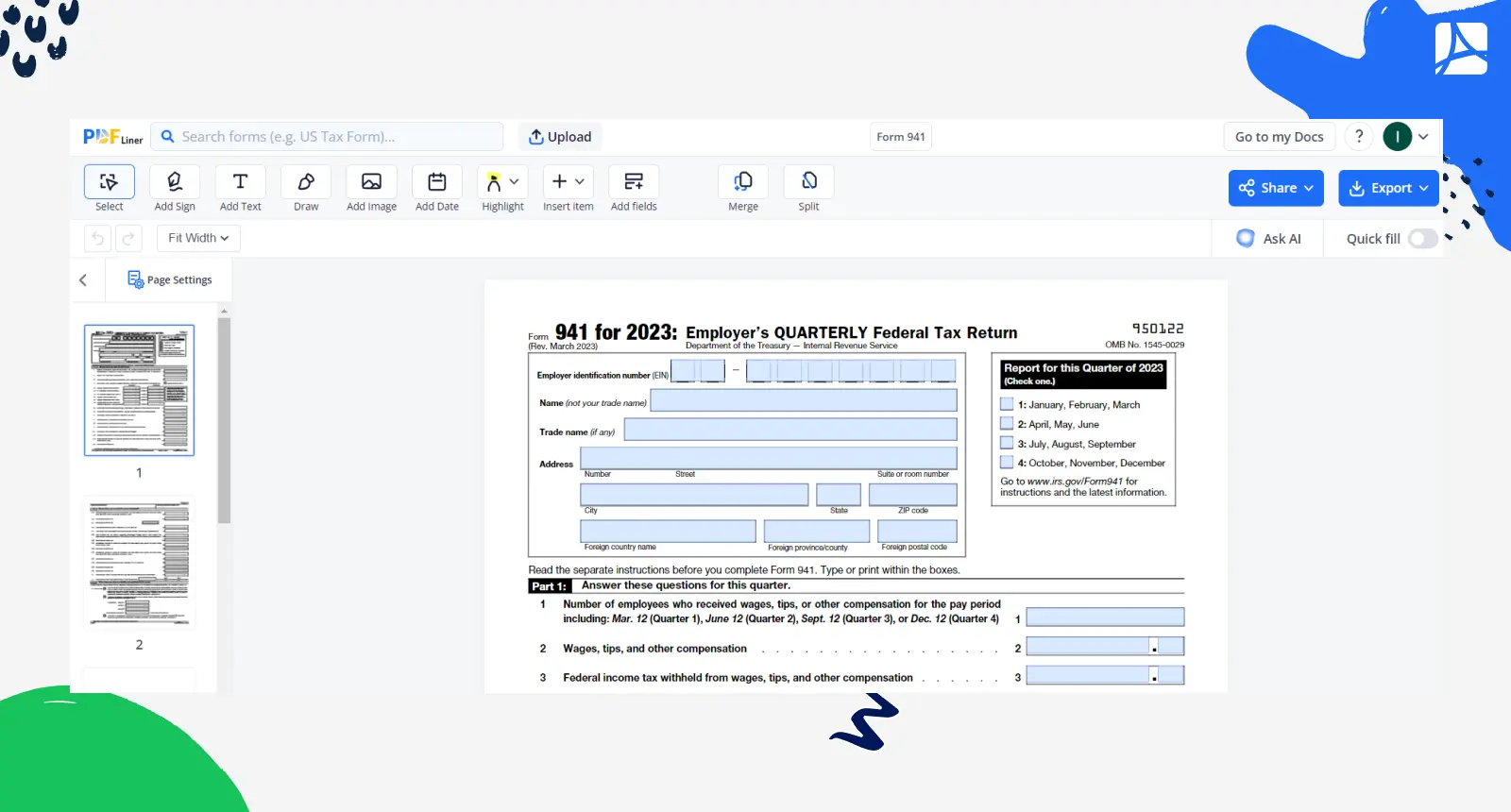

Form 941

The document serves as the bridge of communication between employers and the IRS. Employers use Form 941 to report their quarterly federal tax liabilities, including income taxes withheld from statutory employees' wages. It guides employers in depositing the appropriate amount of federal income tax, Social Security, and Medicare taxes. It will also guarantee the smoothest sailing if you manage to fill out your 941 properly via a top-notch, time-saving file editing platform such as PDFLiner.

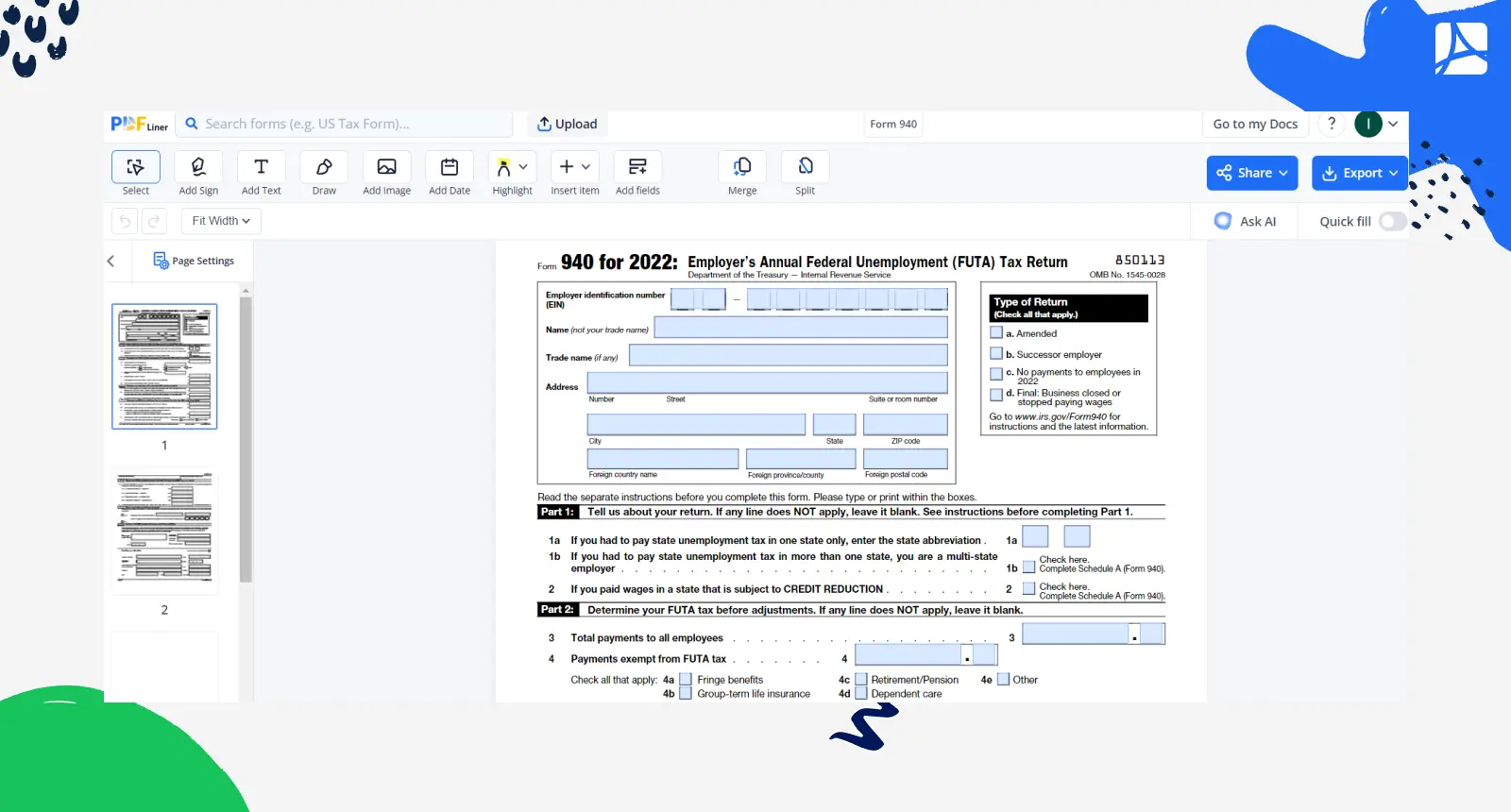

Form 940

Employers use Form 940 to correctly classify and report wages, tax withholdings, and other vital details of statutory employees. This form is submitted annually, enabling employers to report and remit federal income tax withholdings, Social Security, and Medicare taxes on behalf of these employees. When managing this document, calculate tax obligations in the most thorough way possible, preventing under- or overpayment.

Fill Out Form 940 6596be651e28410ced06e5c5

FAQ

What is statutory employee income?

It refers to earnings received by individuals classified as statutory employees, often treated as a combination of an employee and self-employed. It encompasses wages, salaries, and other compensation, subject to income tax and FICA taxes.

What is a statutory employee on W-2?

It’s an individual recognized as an employee by their employer, though they also have the independence and characteristics of a self-employed worker. They receive a Form W-2 for tax reporting, indicating their status and income for the year.

What is a statutory non-employee?

A statutory non-employee is an individual who performs services for a company but is not treated as an employee. They typically work under specific circumstances, such as direct salespeople or licensed real estate agents, and report their income using Form 1099-NEC instead of Form W-2.

Handle Your Taxes Easily with PDFLiner

Fill out and send fillable IRS Tax Forms online and save time

.png)