-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get Form 8962: Just a Few Steps

.png)

Dmytro Serhiiev

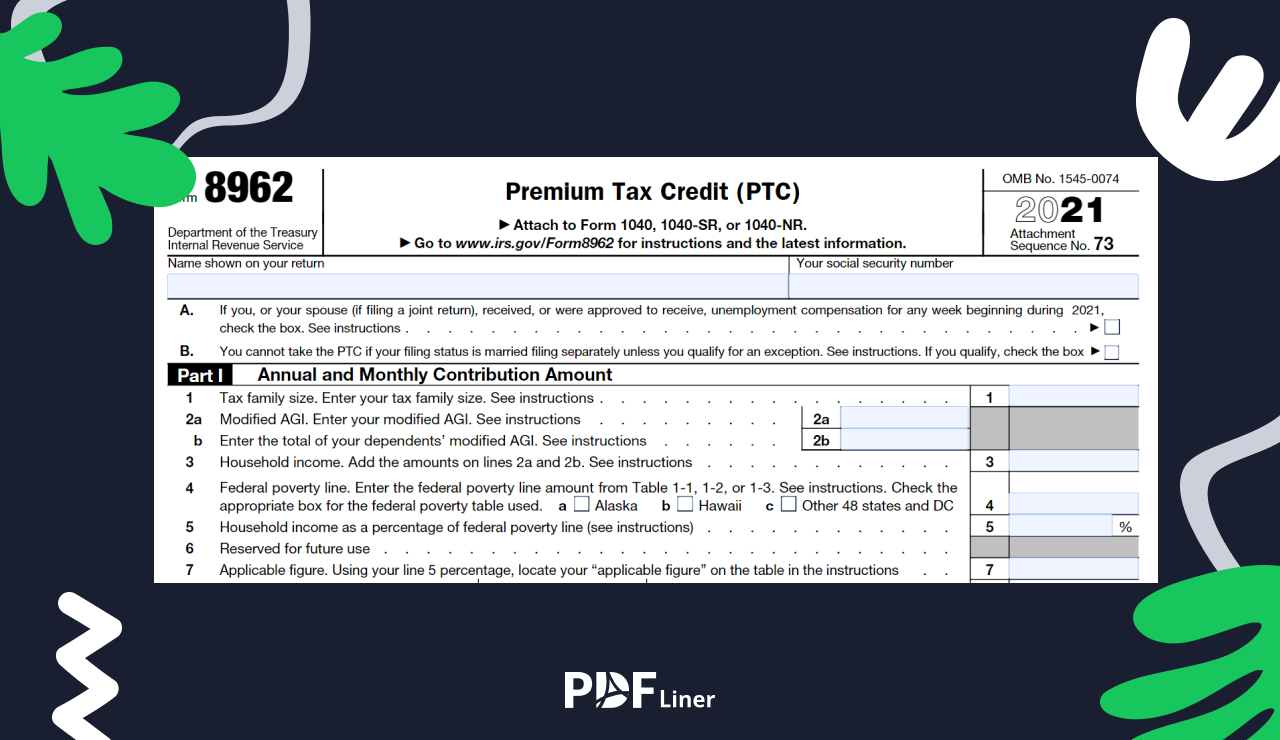

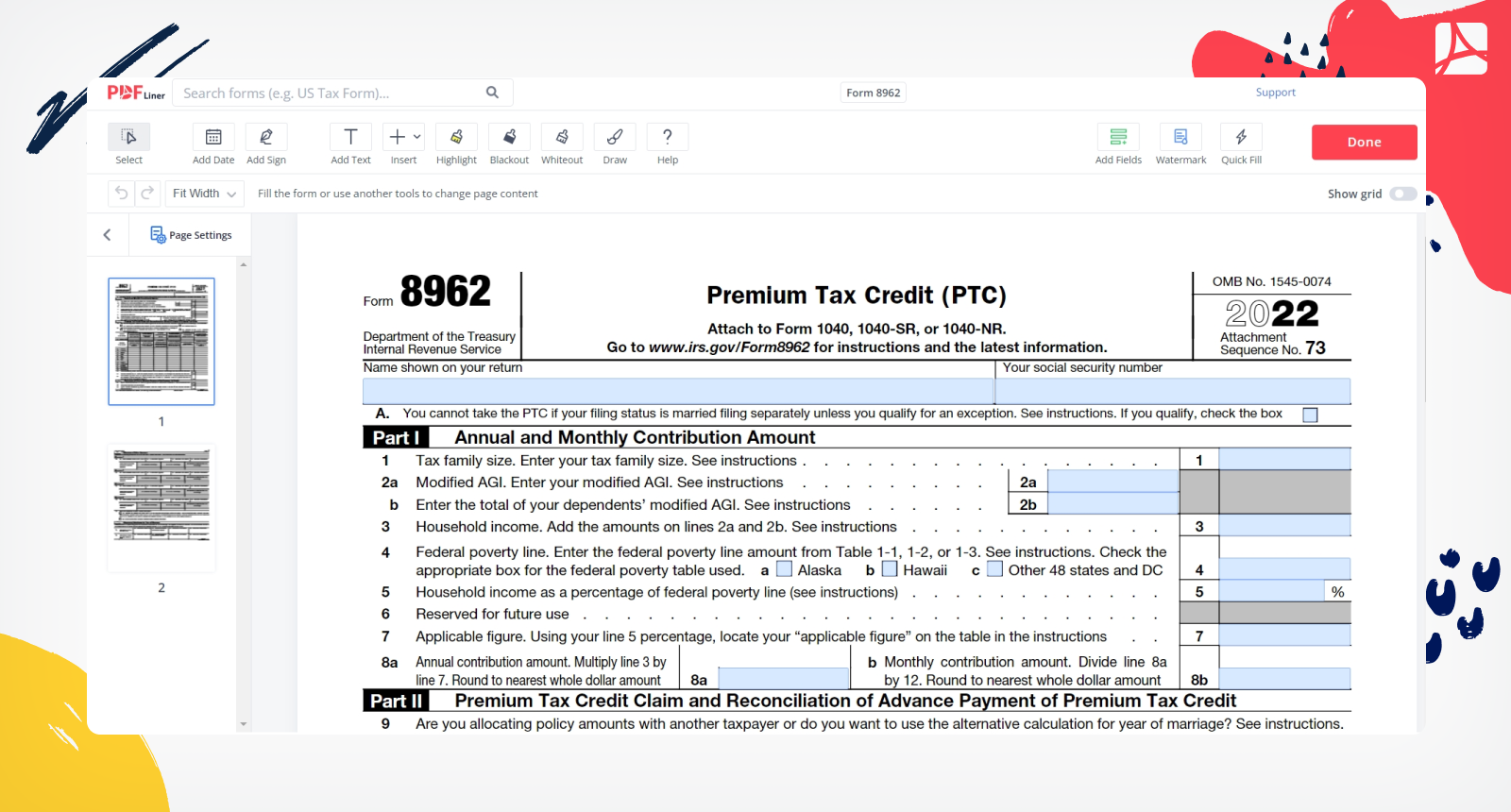

So what is Form 8962 used for? The Federal Tax Form 8962 (or a Premium Tax Credit form) is issued by the Internal Revenue Service (IRS) to let taxpayers, including you, calculate and claim a premium tax credit in case you paid any premiums for your health insurance purchased on the HIM (Health Insurance Marketplace). This is a good option to reduce your tax liability for the entire tax year. The form also lets you figure out whether you are eligible for APTC (Advanced Premium Tax Credit) compensation or owe the IRS. Now, let’s get to the point and see where to get Form 8962 latest version!

How to Get Form 8962

You can get an IRS form 8962 copy online in two ways:

- PDFLiner – this service is eligible to provide the latest versions of the IRS tax forms and other federal document templates. Here you can not only view and download the form, but also fill it out online and print, save, or share an accomplished copy. Moreover, it will always stay on your cloud as an archive record.

- Official IRS website – this resource has a large benefit in case you are in search of the most detailed overview of the form. The IRS is the issuer, so here you can find the fullest description with numerous pages explaining every line and existing filing case. Still, it’s a bit difficult to get through this all, so we recommend starting out with a simplified instruction. Make sure to click the link and check out our detailed and straightforward Form 8962 instructions on how to fill out Form 8962.

Form 8962 657c6309996d2af9c80a2596

FAQ

What is an 8962 form?

Tax Form 8962 is a federal tax form by the IRS that is designed to let you calculate your premium tax credit and see if you’re eligible to claim for it. File it only if you paid health insurance premiums and receive the advanced payments of premium tax credits afterward.

Where to send form 8962?

Include your 8962 form along with your annual 1040 form and submit it to your local IRS office by mail or electronically. You can use the IRS e-file system on the official website or any authorized platform.

Can you get Form 8962 online?

Of course, you can get a copy of Form 8962 online! Go back to the paragraph “How to get Form 8962?” and pick up the method you like the most.

Do I need to file Form 8962?

You are eligible for this form only if you paid premiums for your health insurance purchased on the Health Insurance Marketplace.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fill Out 8962 Form 657c6309996d2af9c80a2596