-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How To Request a W-9 From a Vendor

Liza Zdrazhevska

Last Update: Dec 1, 2024

As Jack Kornfield wisely noted, “The trouble is, you think you have time,” and nowhere is this more evident than in business operations. Knowing how to request a W-9 the right way can save both your time and money. This article offers practical tips and real-life examples to simplify the process. Still asking yourself “Do I need a W-9 from all vendors?” Just keep reading!

Request W-9 Online 66276bcb6d042e174b07f22e

Key Takeaways

- A W-9 form is essential for accurate tax reporting and avoiding penalties when working with vendors. It provides necessary taxpayer information needed when payments exceed $600 annually.

- It's best to request a W-9 form early in the vendor relationship, preferably before any payments are made. Provide explanations and facilitate the process by offering a blank form if needed.

- Ensure the W-9 includes the vendor’s full name, business entity type, address, taxpayer identification number, and any applicable exemptions.

- Use strategies such as setting deadlines, providing clear instructions, and following up to expedite returning the completed W-9 form.

Why You Should Request a W-9

Getting a W-9 form from a vendor is important for a few vital reasons. This form provides the vendor's taxpayer identification information, which is paramount for tax reporting. When you pay a vendor more than $600 in a year, the IRS wants to know about it. This is where the W-9 comes in handy.

With all that said, here’s why you need a W-9:

- Tax Reporting. The IRS needs to know who you paid and how much. The W-9 gives you the vendor's details so you can report accurately.

- 1099-MISC Form. At the end of the year, you’ll use the W-9 info to fill out a 1099-MISC form, telling the IRS what you paid the vendor.

- Avoid Penalties. Not having a W-9 can lead to penalties or withholding issues. It’s better to play it safe!

Below, we provide a quick guide for requesting a W-9:

- Ask Early. When you first start working with a vendor, ask for their W-9. It’s easier to handle this upfront.

- Explain Why. Let the vendor know it’s for tax purposes. Most vendors understand this process.

- Provide a Form. If they don’t have a W-9, send them a blank one. You can download it from the IRS website or via PDFLiner.

- Follow Up. If they don’t return it quickly, give them a gentle nudge. Persistence is important.

When to Request W-9 From a Vendor

In the wise words of Benjamin Franklin, “Failing to prepare is preparing to fail.” This is especially true when it comes to requesting a W-9 from a vendor. Below, we explain when you should do it:

- Before Payment. Always ask for a W-9 before you pay the vendor for their services.

- New Vendors. When starting a new vendor relationship, get the W-9 right away.

- Annual Payments Over $600. If you plan to pay the vendor more than $600 in a year, request a W-9.

W-9 Requirements for Vendors

Understanding the W-9 vendor requirements is vital for keeping your tax paperwork in order. A completed W-9 form from the vendor provides all the necessary details for proper tax reporting. Here’s what must be included:

- Name. The vendor’s full name or business name.

- Business Entity Type. Indicate if they are an individual, corporation, partnership, etc.

- Address. The vendor’s mailing address: street, city, state, and ZIP code.

- Taxpayer Identification Number. This can be an SSN for individuals or an EIN for businesses.

- Exemptions (if any). Any exemptions from backup withholding.

Meeting these requirements in W-9 for vendors’ gives you all the info needed to report payments accurately and avoid potential fines or penalties.

So, next time you engage with a vendor, remember the process of putting on a seatbelt before driving. Because getting a properly filled out W-9 is pretty much the same in terms of it being a small step that can save you from a big crash later. Stay prepared, stay safe!

Requesting a W-9 From a Vendor: Step-By-Step Guide

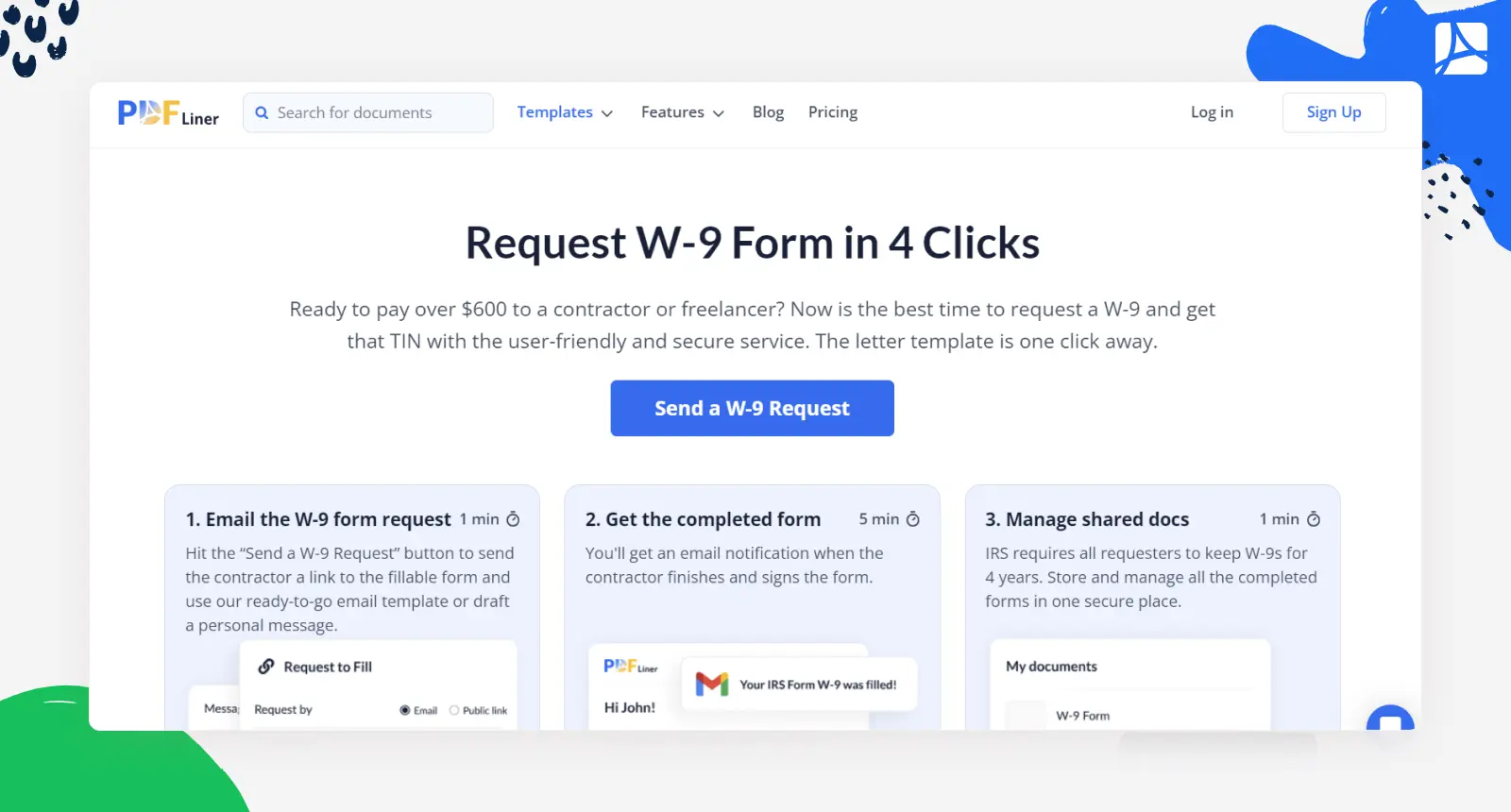

Requesting a W-9 from a vendor might seem difficult. However, with PDFLiner, it’s actually as easy as pie. Follow this step-by-step guide to request W-9 from vendors while making the most of our file editing and sharing platform:

Step 1. Click the button

First and foremost, you need to initiate the process. Log in to your PDFLiner account and head to the W-9 request section. There, you’ll find the “Request a W-9 form” button.

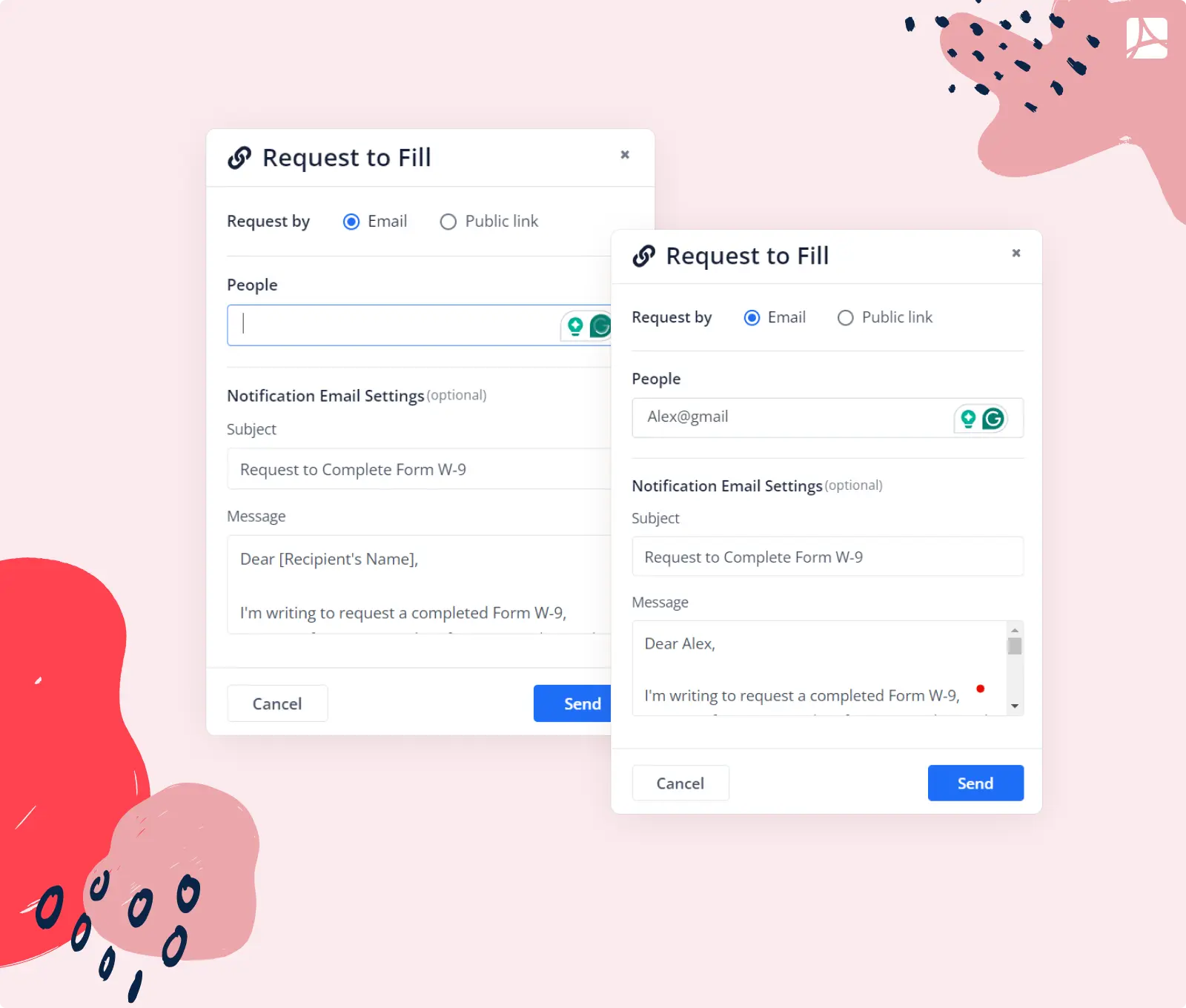

Step 2. Enter the recipient’s email address

Now, it’s time to who needs to fill out the form. In the pop-up, you’ll find the “People” field. Here’s where your first paste comes in. Enter the vendor’s email address into this field. Make sure you get it right — you don’t want your W-9 request landing in the wrong inbox!

Step 3. Add the recipient’s name & hit “Send”

PDFLiner has thought ahead and prepared a letter template for you. All you need to do is replace the placeholder “Recipient's Name” with the actual name of your vendor. It’s that simple. Take a quick glance to make sure the template fits your needs, and you’re almost done.

Upon adding the vendor’s name, get ready for that second paste. Add your email address for confirmation and hit the “Send” button at the end of the form. You’ll receive a confirmation message, and your vendor will get the request.

At the end of the day, you can see how PDFLiner simplifies the requisition W-9 from vendors and thus guarantees that you get the necessary tax info fast and easily.

6 Useful Tips for Getting a Completed W-9 Back

Time is money, and when it comes to getting a completed W-9 back from a vendor, efficiency is paramount. Chasing down forms can be exhausting, but with the right approach, it doesn't have to be.

Below, we’ve shared 6 expert-approved tips to speed up the process and save your peace of mind along the way.

1. Explain the importance

Getting a completed W-9 back from your vendor isn’t just paperwork — it’s important for avoiding backup withholding. If the vendor doesn’t provide their taxpayer info, you may have to withhold 24% of their payment for the IRS. That’s a hefty chunk of change no one wants to deal with.

Explain this to your vendor in bright colors. This makes the importance clear and encourages quick action. Nobody wants to lose money or face extra steps, so stressing backup withholding often speeds up the process.

2. Provide clear instructions

Don’t leave them scratching their heads — be crystal clear! This makes the process forthright and prevents confusion. Remember, the easier it is for them, the quicker you get your form. Clear instructions save time and prevent back-and-forth, which in turn makes everyone’s life a little easier.

3. Make it easy to return

Make returning the W-9 form as easy as possible for your vendor. Provide a pre-addressed and stamped envelope if they’re mailing it. If it’s electronic, send them a direct link or attach the form to the email.

Make it so easy that they think, “Wow, that was easier than ordering pizza!” The easier it is, the more likely they’ll get it back to you speedily. Remember, simplicity is your friend here.

4. Set a deadline

Be clear about when you need the form returned, like saying, “Could you please get this W-9 back to us by Friday?” Narrowing the process down to a deadline helps prioritize the task and guarantees speedy results. Plus, it shows that you mean business. Deadlines make everyone move a little faster — that’s a proven fact!

5. Offer assistance

Lending a helping hand can make a big difference in getting a completed W-9 form back from your vendor. Sometimes, they might need a little nudge or a piece of advice, something like this: “Hello, if you need any help with this W-9 form, just get in touch with us ASAP. We’re here to make it as painless as can be for you!” Offering a bit of support shows that you care and can speed up the process.

6. Follow up whenever needed

Don’t wait too long — send a gentle reminder if you haven’t heard back. You can write, “Hello! Just wanted to follow up on that W-9. Please let me know when you’re planning to fill it out and send it to me.” Don’t forget to mention their name for maximum attention on their side.

A polite reminder of this kind shows you’re on top of things and helps keep the process moving forward. Plus, it’s a good excuse to touch base and make sure everything’s going smoothly. All in all, a timely follow-up can make all the difference and help you get that paperwork back fast.

W-9 Request Letter Examples

Below, you will find some examples of W-9 request letters.

Example 1

Dear Brian,

I hope you’re having a great day. It’s been a pleasure to work with you on {Project Name}. We’re definitely looking forward to continuing our partnership.

For the purpose of keeping our records straight and the IRS happy, please fill out and send us a W-9 form. It's very important for monitoring what we pay you — and keeping the taxman pleased!

Below, you’ll find a quick guide covering what you need to do:

- Download the W-9 Form. You can download the W-9 form directly from the IRS website via this link.

- Fill in the Form. Complete all sections of the form. If you have any questions about what exactly to specify, don’t hesitate to reach out.

- Return the Form. Upon filling out the form, email it back to us at {Your Email Address} or send it by mail to {Your Mailing Address}. If you prefer, you can also use our secure online portal at {Portal Link} to send the form digitally.

We understand that paperwork isn’t the most exciting part of what we do. We promise that we'll make this as painless as we can for you. If you need help or have questions, feel free to reach out to me directly at {Your Phone Number} or {Your Email Address}.

Thank you in advance for your attention to this issue, Brian. We appreciate your cooperation and look forward to receiving your completed W-9 form soon, preferably by this coming Friday.

Kind regards.

Example 2

Hi Sarah,

Hope you’re doing great. Our team has been very impressed with your designs. Your work is a stellar contribution to our brand’s image.

Can you please fill out and send us a W-9 form now? This will help us keep things organized, tax-wise.

Below, I’ve provided 3 easy what-to-do-next steps for you:

- Download the W-9 Form. You can either get it directly from the IRS website or download it via PDFLiner.

- Fill It Out. Fill in the blanks and e-sign it. If you have questions about what to put where, just drop me a line or give me a call.

- Send It Back. You can email the completed form to me at [email protected]. Alternatively, you can send it by mail to our office at 456 Oak Street, Cityville, USA.

I know paperwork is boring, but we’re going the extra mile to make this easy for you. It is really important to us. If you need any help or have questions, get in touch with me directly at (555) 789-1234 or [email protected].

Thanks for your help with this, Sarah. We greatly appreciate it!

Best regards.

Example 3

Hey Alex,

Hope you're doing well! I wanted to touch base about something really exciting (just kidding, it's paperwork).

We love your freelance work on our recent project. Your creativity has been awesome!

To keep everything above board and make sure we have all our tax ducks in a row, could you do us a solid and fill out a W-9 form? It's basically providing your taxpayer info so that we can dot our i's and cross our t’s on the paperwork front.

Here's what you need to do:

- Download the W-9 Form. You can grab it from the IRS website using this link.

- Fill It Out. Just fill in the blanks, sign it, and that's it. If you need assistance or come up with questions, feel free to reach out.

- Send It Back. You can send the completed form to me via email at [email protected] or by mail to our office at 789 Maple Avenue, Anytown, USA.

If you have any questions or need assistance, feel free to shoot me a message at (555) 123-4567 or [email protected].

Thanks a bunch for your help with this, Alex. Looking forward to getting everything sorted!

Warm regards.

To wrap up, as the saying goes, “A stitch in time saves nine,” and mastering tax forms for vendors is no exception. Follow the tips we have provided in this post for smooth sailing throughout the tax season. Remember, a little preparation now prevents big headaches later. With clear instructions and gentle nudges, requesting a W-9 becomes a straightforward task, leaving you more time to focus on what truly matters — your business.

Get Filled Out W-9 In No Time

Send requests and track the progress with an easy-to-use platform

.png)