-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Sign Form 941: Easy Steps to Take

.png)

Dmytro Serhiiev

It has become more common to sign documents using an electronic signature, as it is an easy and efficient way that is perfect for busy people. One of the tax forms that can be signed online and e-filed is IRS 941. This form has to be completed by employers that withhold income taxes from their employees who should pay Medicare or Social Security taxes.

How to Sign Form 941

There is no doubt that using a digital signature has numerous advantages. It is more convenient, speeds up the processing of documents, and offers a higher level of security. You don’t have to waste your time printing documents and mailing them in a traditional way. The form 941 instructions suggest that employers can sign the document digitally and thus save their time. This is especially useful as the tax form has to be filed four times a year.

Whether you are a taxpayer or you want to sign 941 on behalf of a taxpayer, you can do this electronically with the help of PDFLiner. All you have to do is:

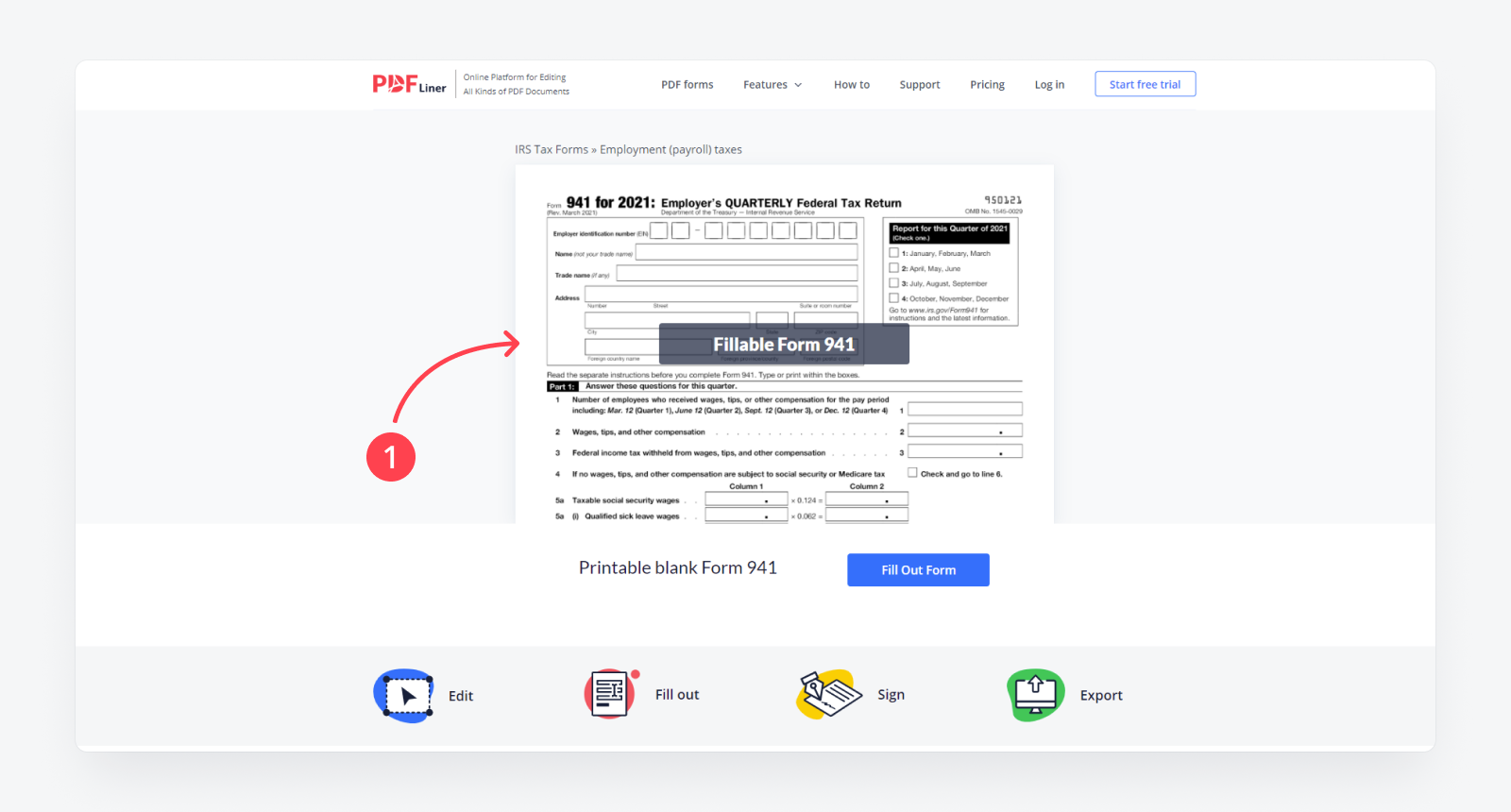

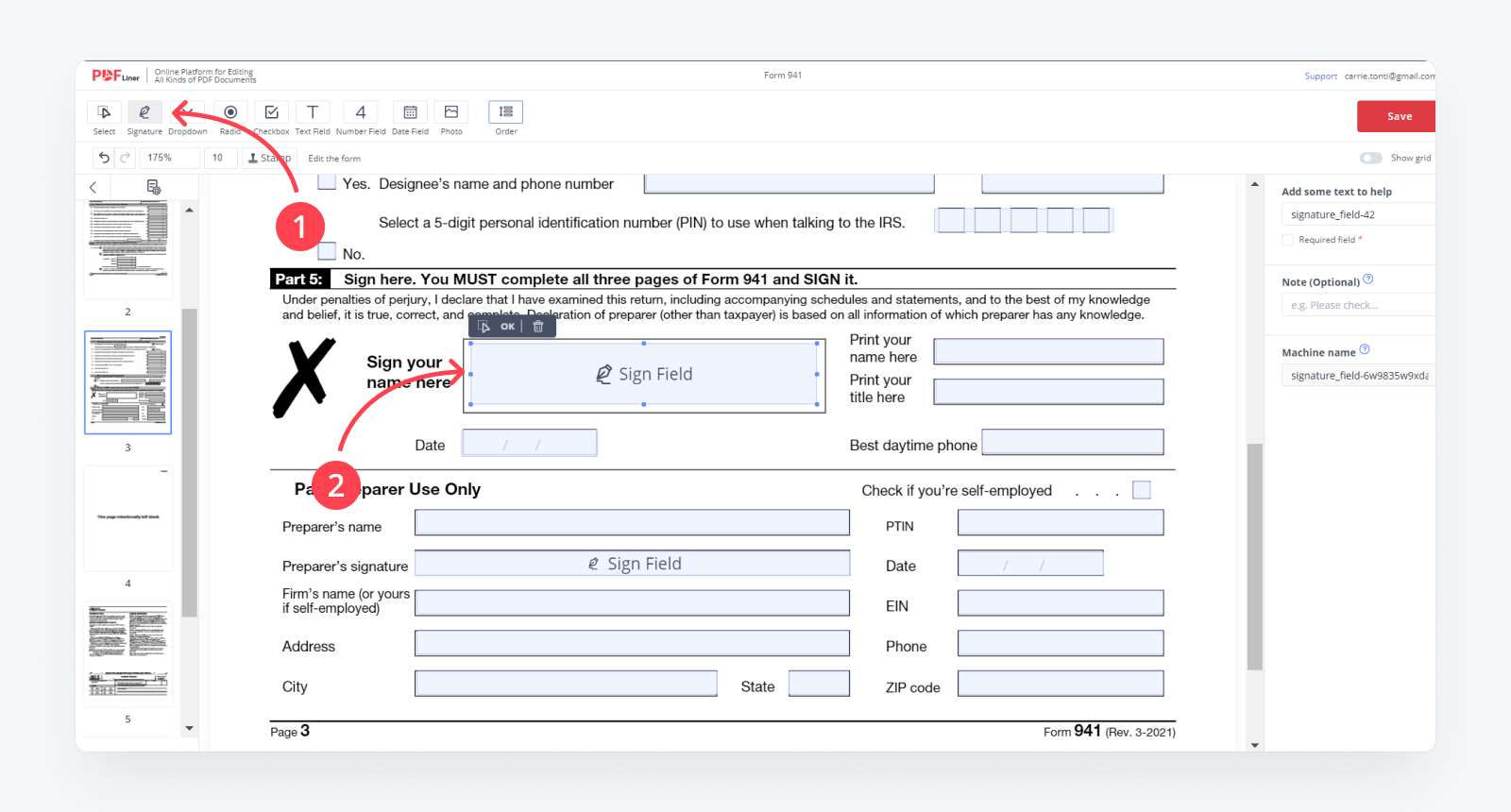

- Open the Form 941 in the editor.

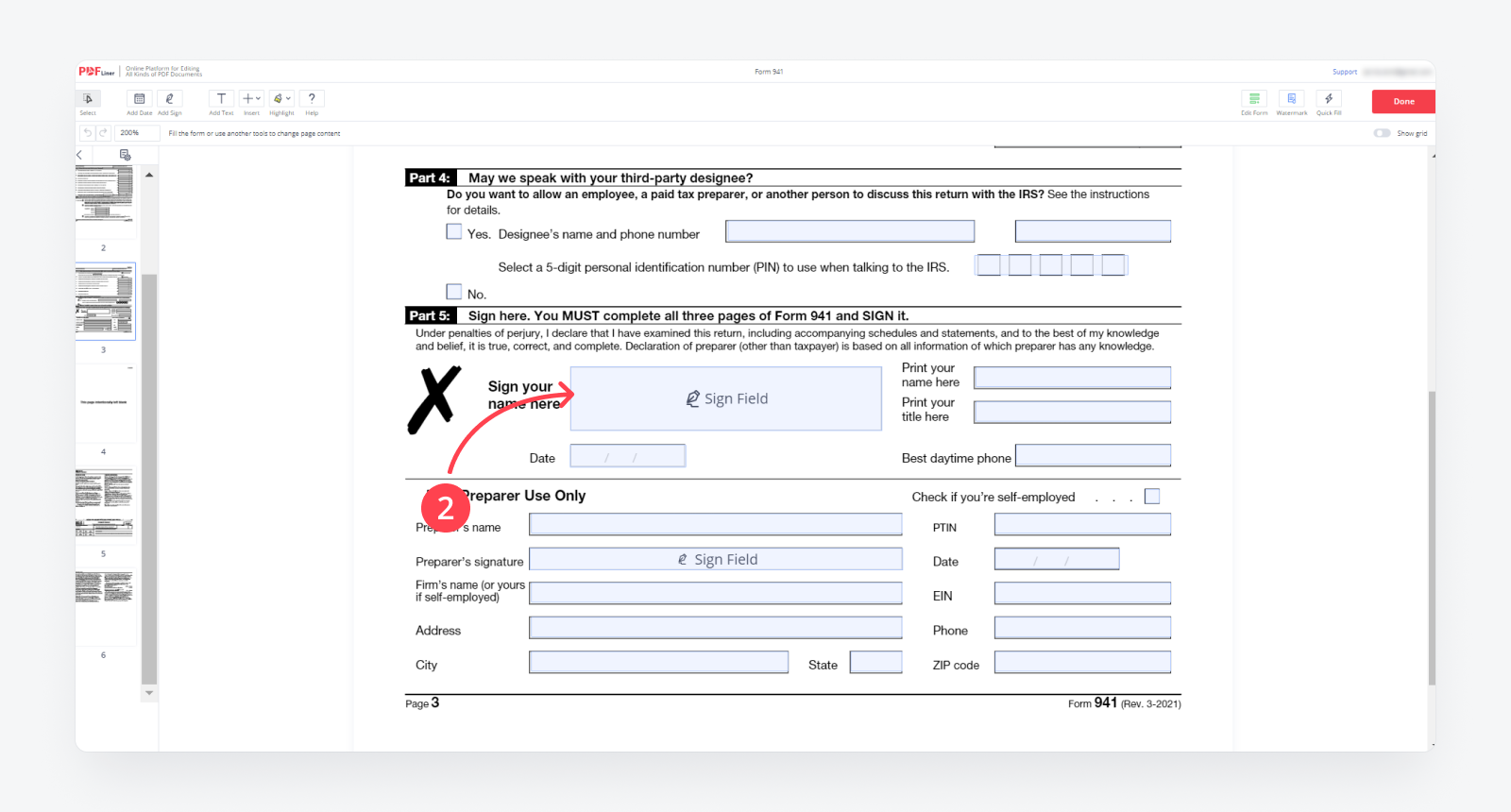

- Scroll to the end of the third page and left-click the “Sign Field”.

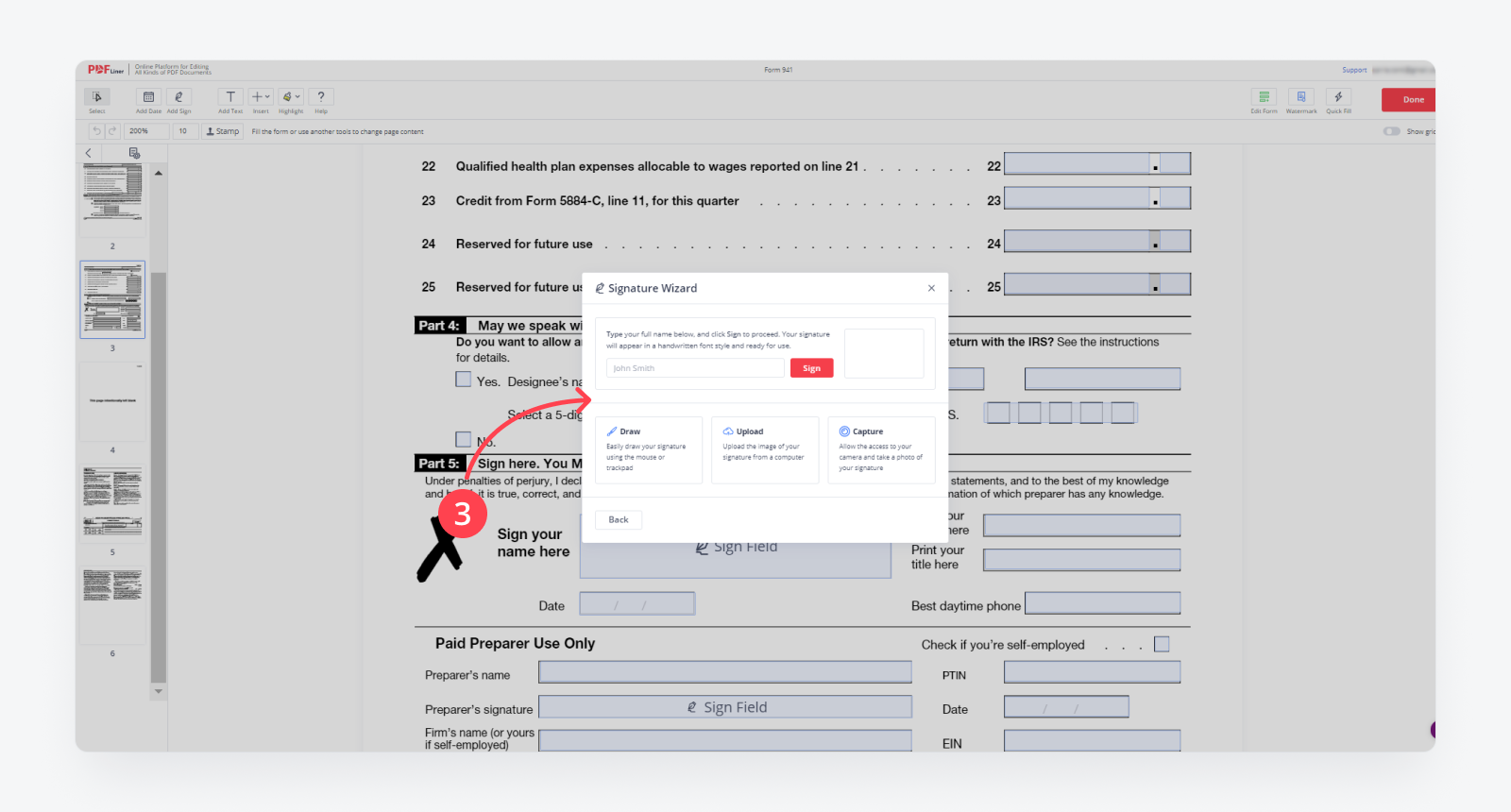

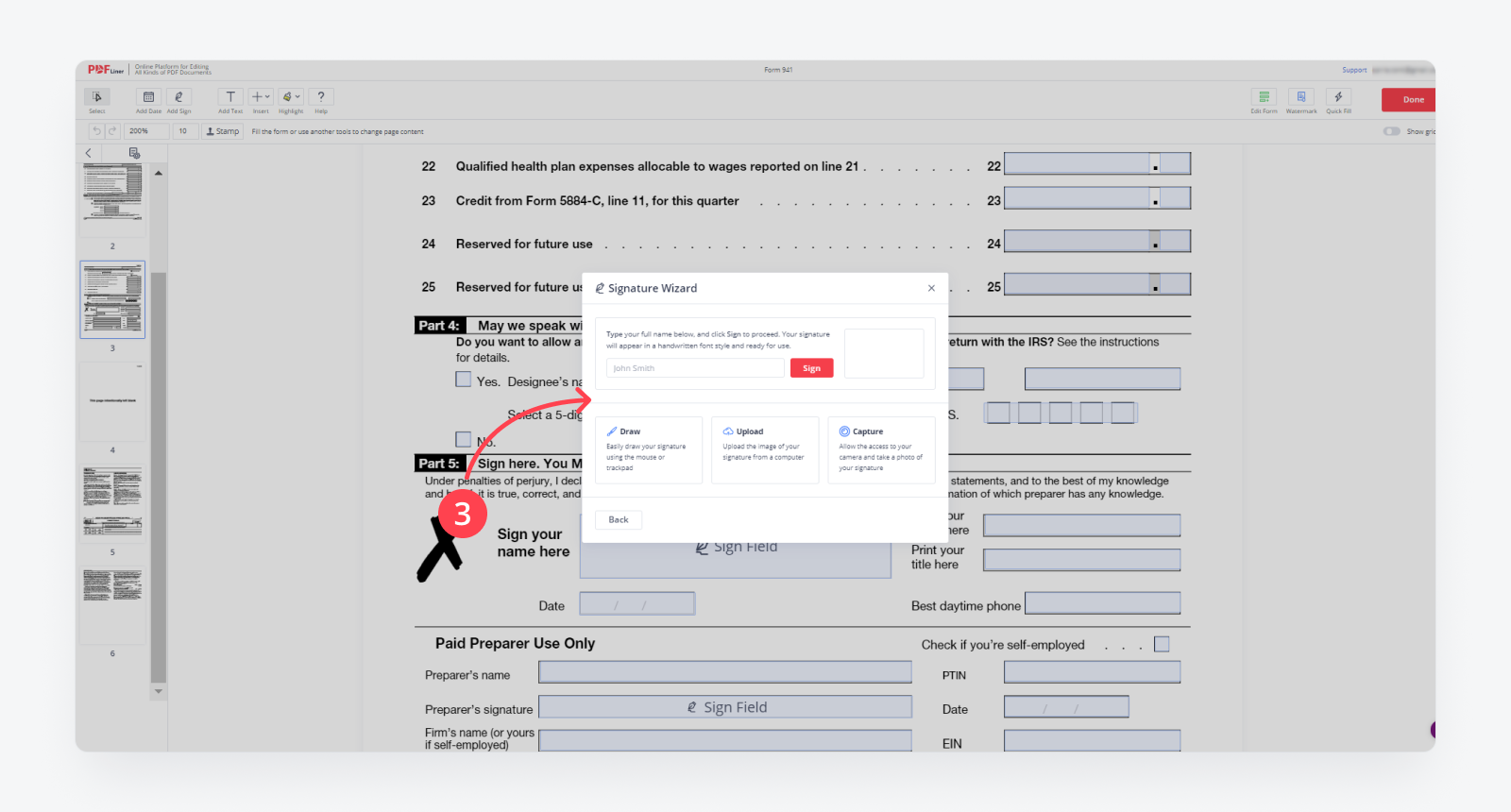

- Select how you want to generate your electronic signature.

- Sign the document in the required section.

For online 941 filing, you can also upload the form on our site. In this case, the process is the following:

- Upload your Form 941

- Wait until it’s loaded.

- Click in the “Add sign” tool on the upper toolbar

- Select a signature you have or click on ‘Add new signature.’

- Use one of the tools to make a signature and click ‘Done.’

- Place your signature on the bottom of the third page.

The electronic signature feature can be used not only to e-sign form 941. You can easily use it to sign any document by simply uploading it to the platform.

If you want to know how to get form 941, we have an entire article prepared on this topic.

Who can sign Form 941?

The IRS form 941 needs to be signed by a taxpayer or a properly authorized agent of a taxpayer. If you resort to using a paid preparer to sign and complete this form, they have to complete the paid preparer’s section.

Can I e-sign Form 941?

Yes. According to the 941 quarterly instructions, the form can be signed electronically, and you can do this with the help of PDFLiner.

Do I need to sign my tax return if I e-file?

Yes. If you decide to e-file your tax return, it is a mandatory step that you use your electronic signature.

Form 941 online 65f86b5466fb65a8340566e5