-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Sign W-9 Online: 4 Easy and Quick Steps

.png)

Dmytro Serhiiev

Last Update: Dec 10, 2024

The IRS Form W-9 is an official paper that banks, employers, and other businesses can ask their clients, freelancers, part-time contractors, and vendors, who work for them, to fill out. It specifies a TIN and tax certification required by a person requesting this document to complete their reports to the IRS. They may need this information to confirm your paid salary, IRA contributions, or debt cancellations.

Sign W-9 Online 6741158300573dd00e00c67f

Key Takeaways

- The W-9 form is essential for US individuals and legal entities to provide their taxpayer identification numbers and tax status to companies they work with, as required by the IRS.

- While both electronic and paper versions are accepted by the IRS, electronic filing is recommended for its simplicity and efficiency.

- Apart from signing the W-9 form, PDFLiner allows users to fill out and sign other documents, upload personal files, and use various editing tools for document preparation.

How to Sign W-9 Electronically on My Computer?

Who can sign a W-9 form, and why is it needed? US individuals and legal entities have to complete this form to give information about their taxpayer identification number and associated certification. The W-9 form was created and provided by the IRS and is used by the companies you work with to collect information about your tax status.

If your employer has asked you to complete this paper, but you are having difficulty with it or are unsure how to get a W-9, see our detailed instructions.

The IRS accepts completed files in both paper and electronic forms. Of course, the second option is a simpler, and therefore, more popular method among the taxpayers. You can select the W-9 Form on our website and use the PDFLiner editor to fill it out. It has only the essential tools and features you need to work with PDF files. It doesn't take much time to figure out what's what due to the tool's simple design.

Using our editor, you can also e-sign a W-9 Form. An electronic signature has the same legal value as a handwritten version. Thanks to them, you do not need to waste your time and money on printing and sending documents by mail or courier. Practice shows this way you can sign more papers in a shorter time, which allows you to pay more attention to other tasks. Plus, electronic signatures are difficult to counterfeit, which means all of your forms and blanks are safe.

To sign the W-9 Form in the PDFLiner editor, use the instructions below:

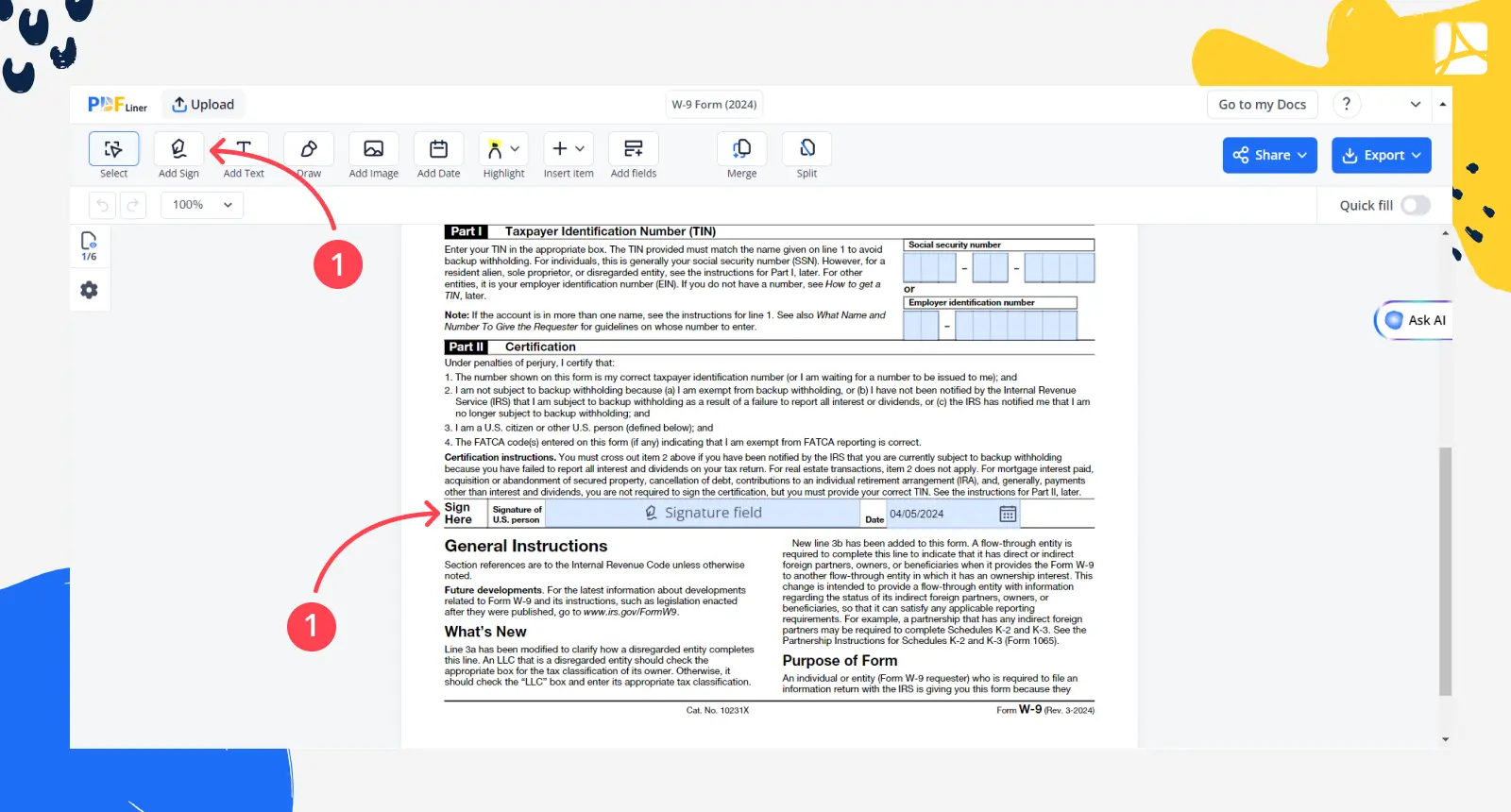

1. Open the fillable blank and click on the field in the document where you need to put the sign and select the 'Add Sign' function from the toolbar at the top of the page, or select a signature field on the form.

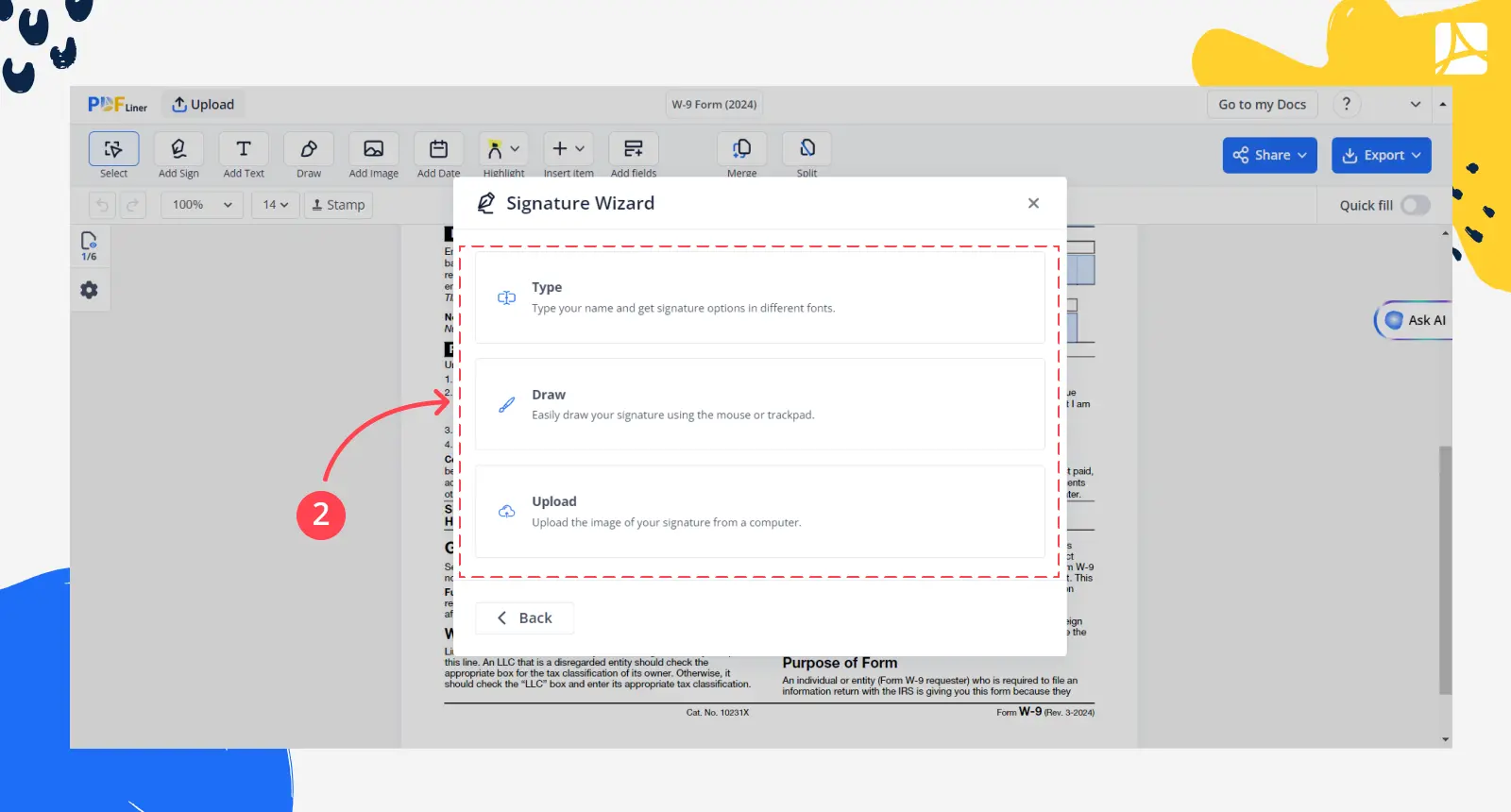

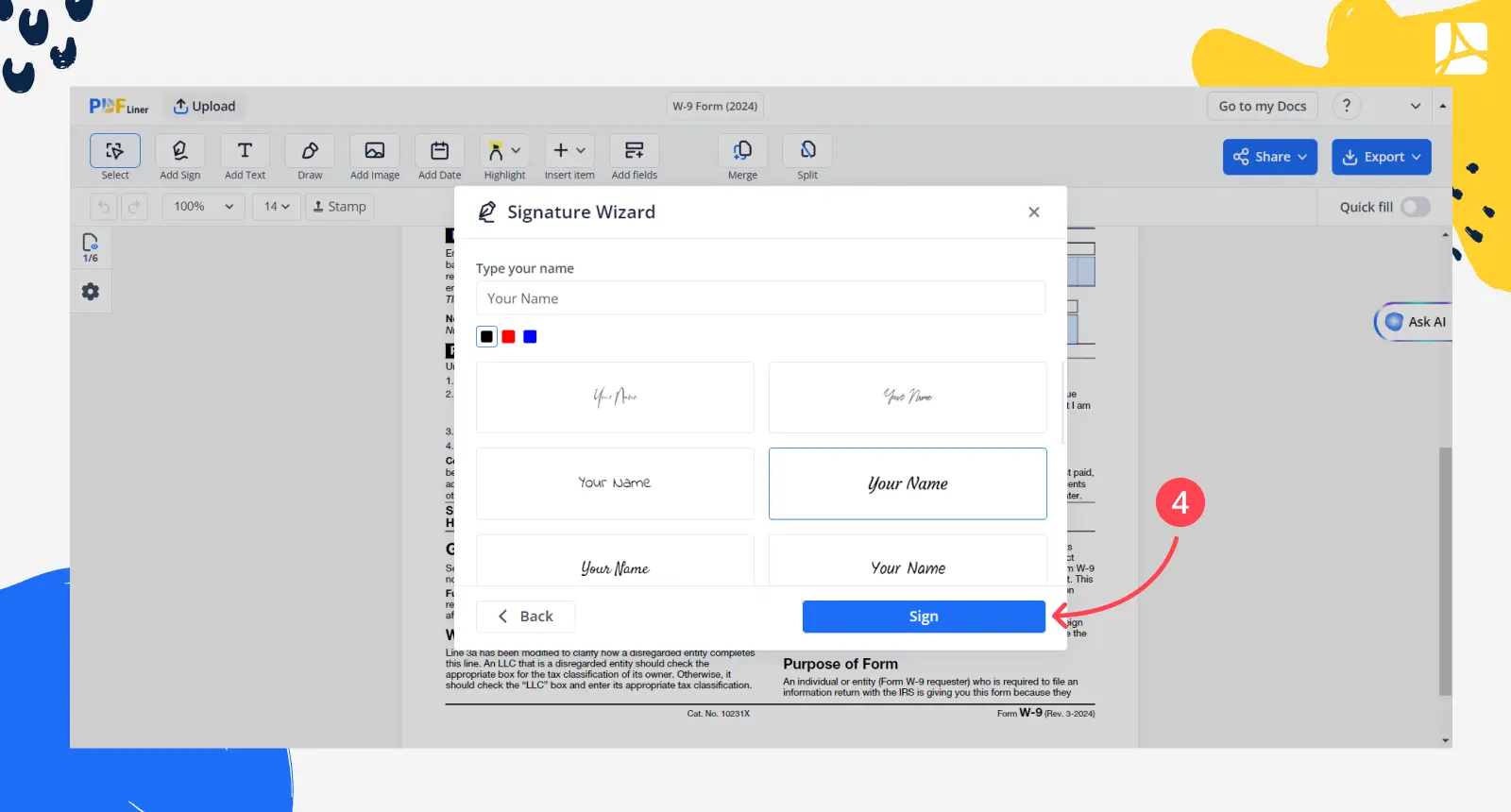

2. In the window that appears, you need to pick the signature option that suits you. You can enter it by hand using your mouse or trackpad, or upload it if you already have a ready-made digital signature.

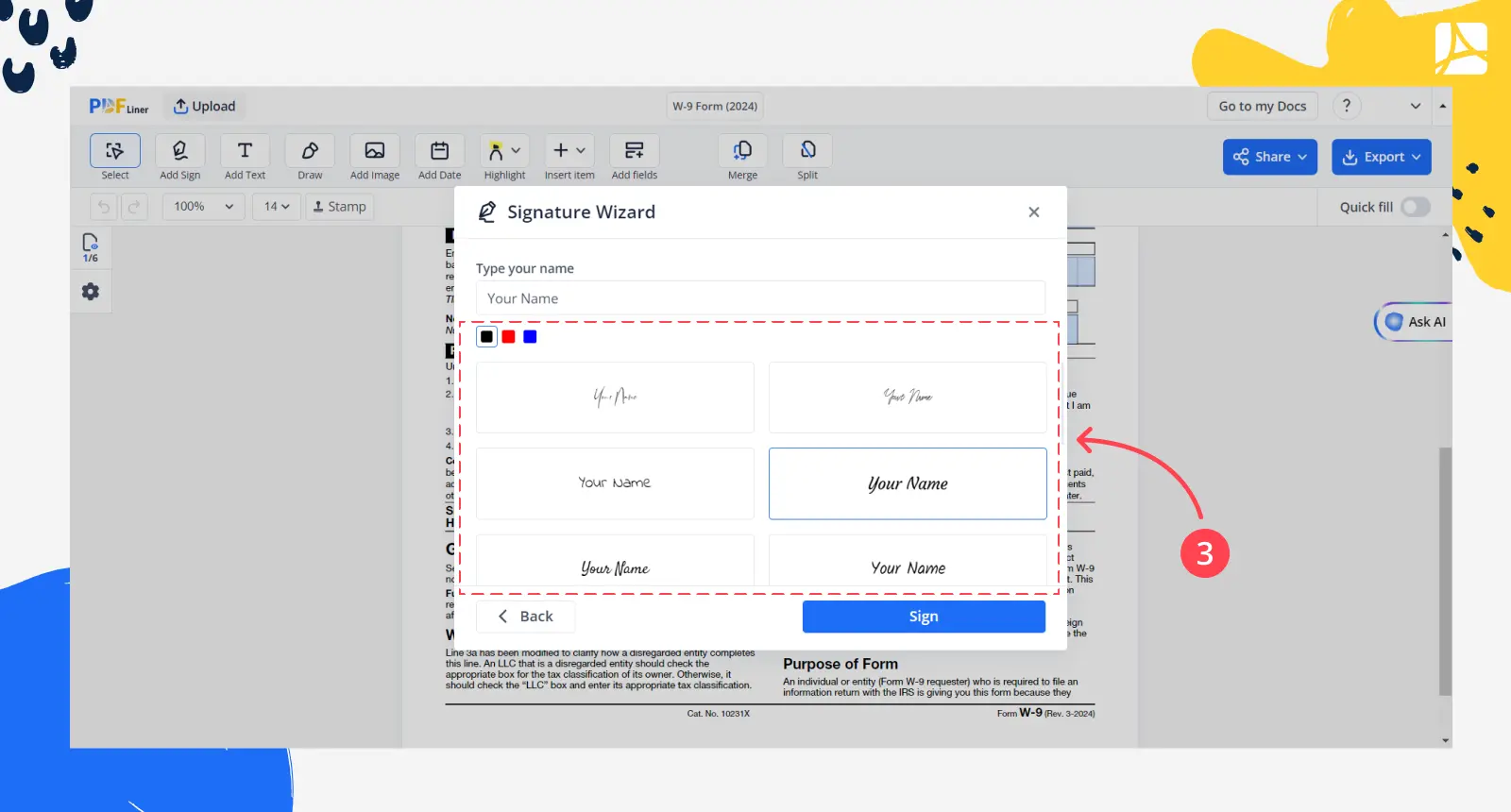

3. If you select the "Type" option you may choose the color and writing style of your signature.

4. Then press the 'Sign' button, and your signature will appear in the required field. The finished document can be sent to a recipient.

Please note that using the editor, you can fill out and sign not only the W-9 Form but also any other blank from the list on our website. You can also upload the paper from your device and use all the tools available.

FAQ

You will find some more helpful information in the answers to our customers' questions.

What is the purpose of a W-9?

This form is completed by freelancers, part-time employees, and other self-employed workers. However, it is used by employers or businesses that pay salaries to these people to complete their own reports to the IRS.

Who can sign a W-9?

Any employed freelancer who is a US resident must complete and sign this document if requested by their employer or bank. US citizens who work full time should use a different form.

Do individuals need to sign a W-9?

Yes, individuals must also complete and sign this form as required. True, there are some lines that they don't need to fill, so be careful.

Sign Your Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!