-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Tax Preparation Checklist: Get Ready for the Season Beforehand

.png)

Dmytro Serhiiev

Experts recommend getting ready for the tax season in advance. You will save a lot of time if you have all the documents you need to fill out the forms at hand. Although the full list might vary depending on the individual situation, we have tried to write the tax preparation checklist as detailed as possible.

What Documents Do I Need to File the Taxes

Any tax form asks, first of all, for your personal data as a US citizen and taxpayer. So the standard list of personal documents for tax preparation contains the following items:

- your SSN;

- your tax ID number;

- your identity protection PIN;

- the same documents for your spouse and/or dependents;

- account numbers for refunds.

Depending on your personal and family situation, you might qualify for various tax deductions, credits, and other adjustments. Accordingly, you need to have supporting documents on hand to fill in the tax return and reduce the size of the tax itself or the amount of taxable income. To make adjustments, you need to include the following papers in your tax checklist:

- IRA (retirement) contributions;

- educational expenses and student loans;

- health insurance payments;

- medical bills;

- moving expenses, etc.

Also, in your list of documents needed to file taxes, there should be papers confirming your right to itemized tax credits:

- child care expenses;

- home mortgage interests;

- theft losses;

- charitable donations;

- credit energy, and so on.

These lists are not exhaustive and can be smaller or larger depending on your life situation. Of course, you do not need to have all the listed papers. You must also provide proof that you have already paid local and state, personal property, and real estate taxes and vehicle license fees. If you are self-employed, the list of required documents can be much wider. For example, you might need to specify the estimated tax payments you made during the tax period. If you do business abroad, you will also need to specify foreign bank account details.

Other things needed for taxes include copies of your last year’s tax return. This item is not mandatory; however, ready-made papers can serve as a good reference for you, especially if you used the services of specialists and they did everything right. In general, it is not superfluous to refresh the memory of the data for the last reporting period so that all the numbers converge this year.

Although you probably have most of these documents on paper, the IRS encourages taxpayers to file forms electronically. It greatly speeds up the processing of incoming files. Also, when filling out forms with software such as PDFLiner, you are much less likely to make a mistake, which means you won’t have to fill out amendments to fix it.

Tax Prep Checklist for 2023

To file a personal tax return and pay federal taxes, in addition to personal information and tax filing documents, you also need to prepare other forms that reflect your family, personal, and financial situation.

Income from work

The first essential item in your tax documents checklist is the papers that record information about your income:

- W-2 (for officially employed);

- Forms from the 1099 series (for self-employed);

- 1099-G (for unemployed).

The 1099 series of forms is perhaps one of the most extensive. Depending on the suffix (letters at the end of the title), it can reflect a variety of income you received during the tax period, for example, from renting out premises, pensions, investments, alimony, gambling, and so on. The complete list of required Forms 1099 depends on the number and types of sources of your income.

Usually, documents on financial contributions in your favor are sent by employers or payers for whom you worked as an independent contractor. All of them should be in your hands before the start of the tax season, as you need information from them to fill out various forms. If you do not receive the required paperwork from the checklist for personal taxes, contact the responsible person or the IRS directly. Distribution of income documents is a direct responsibility of employers.

Other income

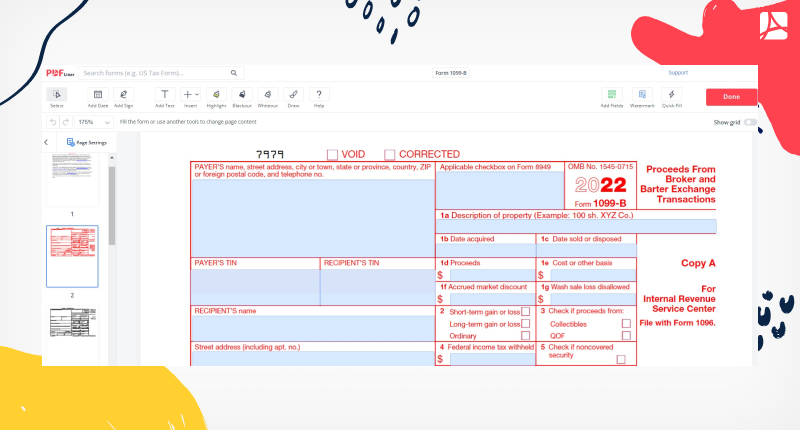

If you have other sources of income in addition to your main job, your tax return checklist will include more highly specialized forms. Usually, these are different variations of Form 1099:

- dividends or interest (1099-INT, -OID, and -DIV);

- sale of shares and brokerage transactions (1099-B);

- nonemployee compensations (1099-NEC);

- miscellaneous income (1099-MISC);

- gambling income (W-2G), and so on.

As with the main income forms, Form 1099 variations must be transmitted to you by payers, that is, banks and financial institutions that make money transfers.

Individual Income Tax Return

All this preparation for the tax season is so that you can fill out Form 1040 without any issues. It ranks first in any tax prep checklist. It is the main document of every American taxpayer, which must be completed and filed with the IRS annually. You should always use the W-2 information you get from your employer to fill it out; you might also need the following forms:

- Form 2441 (Child and Dependent Care Expenses);

- Form 8839 (Qualified Adoption Expenses);

- Form 8919 (Uncollected Social Security and Medicare Tax on Wages);

- Form 8995 (Qualified Business Income Deduction);

- Form 8814 (Parent’s Election to Report Child’s Interest);

- Form 4972 (Tax on Lump-Sum Distributions);

- Form 8812 (Credits for Qualifying Dependents);

- Form 8863 (Education Credits);

- Forms 1099 (various payments);

- Form 8888 (Allocation of Refund).

You need to take information about various financial receipts, credits, and refunds from these additional forms. The Form 1040 has several attachments called Schedules that provide the IRS with more information about your situation, such as financial losses.

Extension of time to file

The purpose of any such guide or income tax preparation worksheet is to help you file your tax return on time. However, life situations are different, and you should know that you can get an automatic extension of the deadline if, for some reason, you do not have time to collect or fill out paperwork on time. Form 4868 was explicitly designed to request a six-month grace period. Keep in mind that to complete this form, you will still need to calculate your estimated income tax amount and pay it by the standard deadline. All other documents can be sent later.

The term “tax season” refers to the period from January to mid-April, when all taxpayers, both entrepreneurs and individuals, fill out and send out various tax forms. Get started early with our tax preparation guide to make sure you have all the necessary paperwork or get the ones you don’t.

FAQ

Preparing for tax season is no easy task. You will find more information about it in the answers of our experts.

Can I fill out my tax forms electronically?

Yes, the IRS encourages filing a standard Form 1040 electronically as it speeds up processing and protects against data loss or theft. However, there are forms that the IRS does not accept via email. Moreover, if your Form 1040 has Schedules or other documents attached that are not processed electronically, you will need to file your tax return by mail. A complete list of forms can be found on the IRS website.

Is it better to efile or mail taxes?

The electronic version is faster, safer, and more reliable than sending documents by mail. Officially, the IRS does not disclose information about the processing time of papers. Still, according to some sources, the processing of electronic files takes about two days, while printed versions are processed much longer.

Can I file taxes without proof of income?

To fill out Form 1040, it is highly desirable to have all documents confirming your income. If your employer or payer did not send you a W-2 or 1099, you should use Form 4852, which is a “substitute” for these files.

Can I e-sign my tax forms?

Yes, you can e-sign Form 1040 using the appropriate software. However, Self-Select of Practitioner PINs should also be used to confirm the correctness of the data on your tax return. It protects you from identity theft.

File Taxes Online at No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!