-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

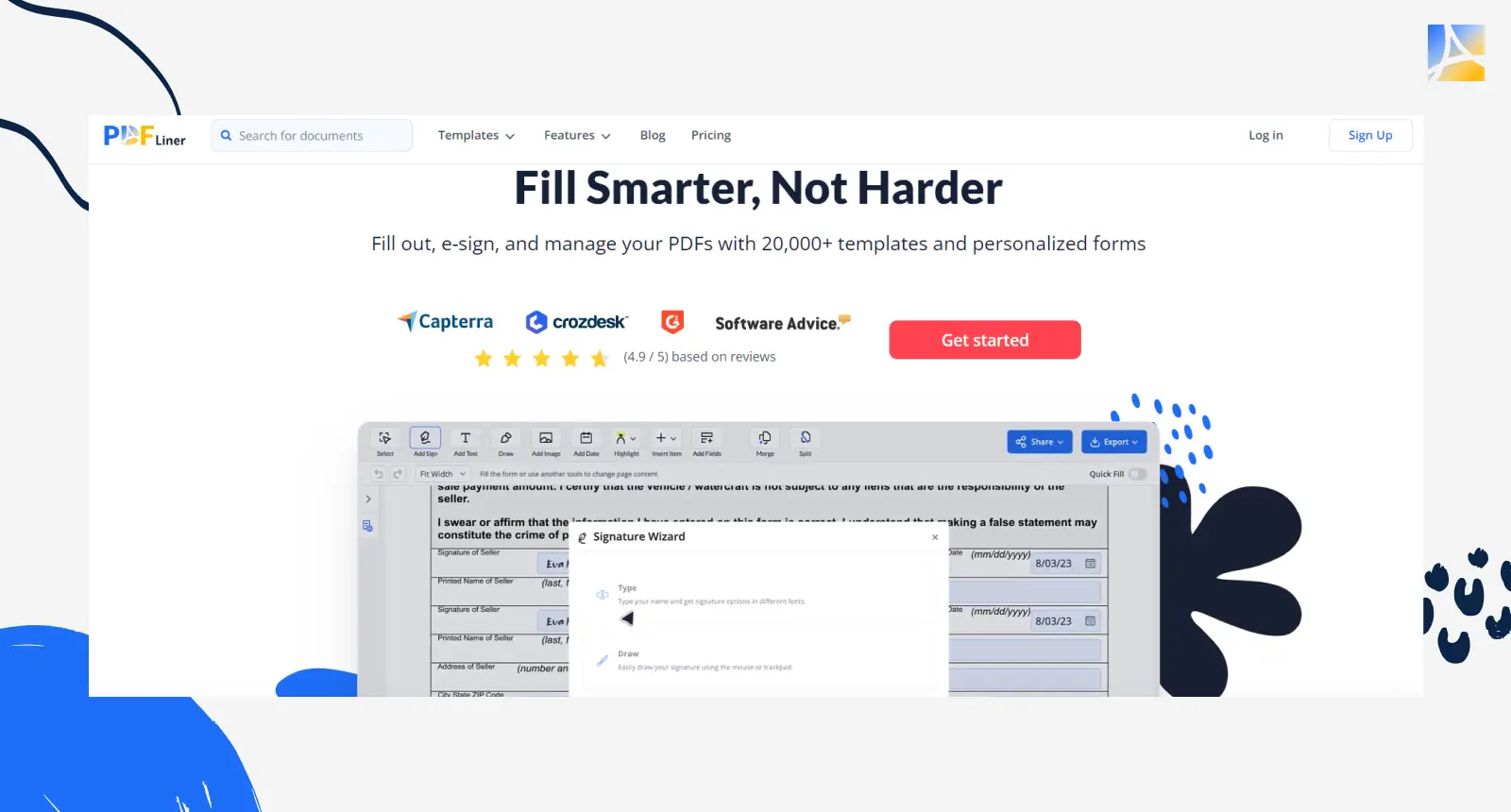

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Top 5 AI Tax Advisor Services: Use AI for Smart Tax Filing

.png)

Julia Hlistova

Last Update: Dec 20, 2024

"Artificial intelligence is the new electricity," said Andrew Ng, professor of computer science at Stanford University. Much like electricity revolutionized industries in the past, Artificial Intelligence is currently igniting a revolution in tax management. In this article, we'll guide you through our expertly curated list of top AI-driven tax software. By the end of your reading, you'll be ready to bid farewell to tedious calculations and embrace smarter, more efficient tax solutions that will pleasantly surprise you. So get ready and enjoy the ride!

Best AI Tax Advisor Tools for Small Businesses and Startups

An American businessman and investor Mark Cuban once wisely remarked, "Artificial intelligence, deep learning, machine learning—whatever you’re doing if you don’t understand it, learn it. Because otherwise, you’re going to be a dinosaur within three years." Embrace the future of tax preparation by exploring our comprehensive AI tool list for taxes provided below, and you are guaranteed to succeed in staying ahead of the curve.

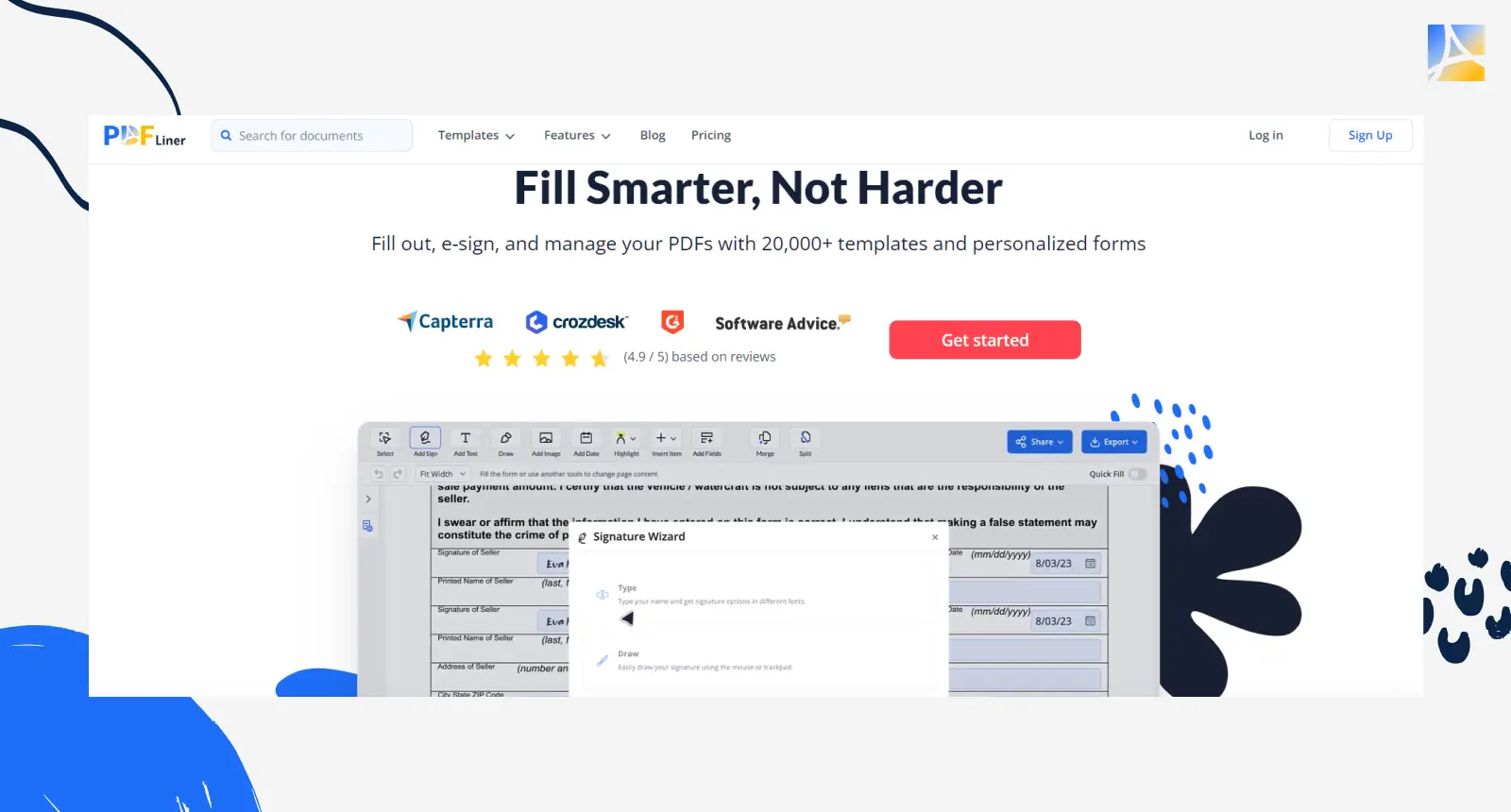

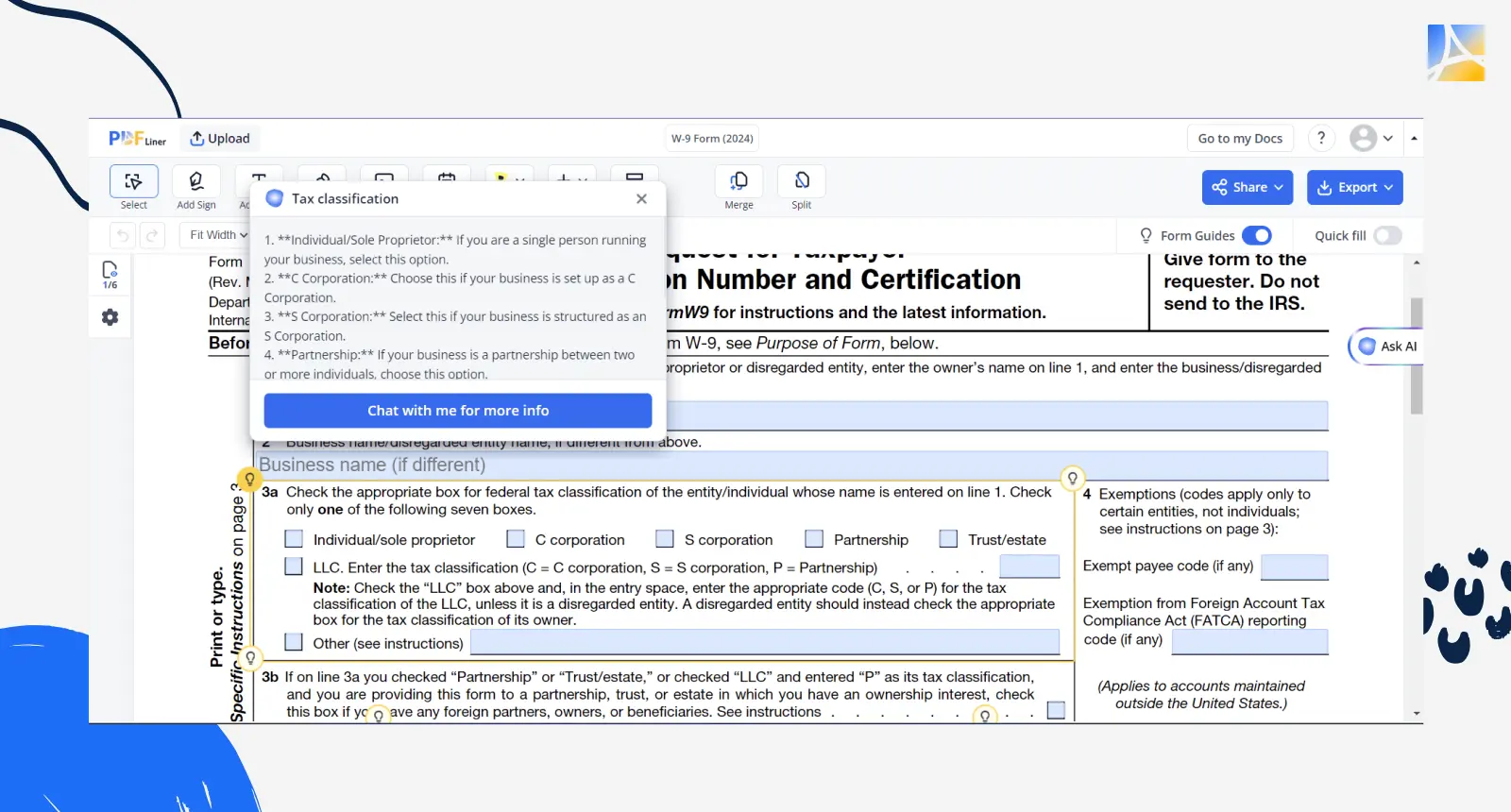

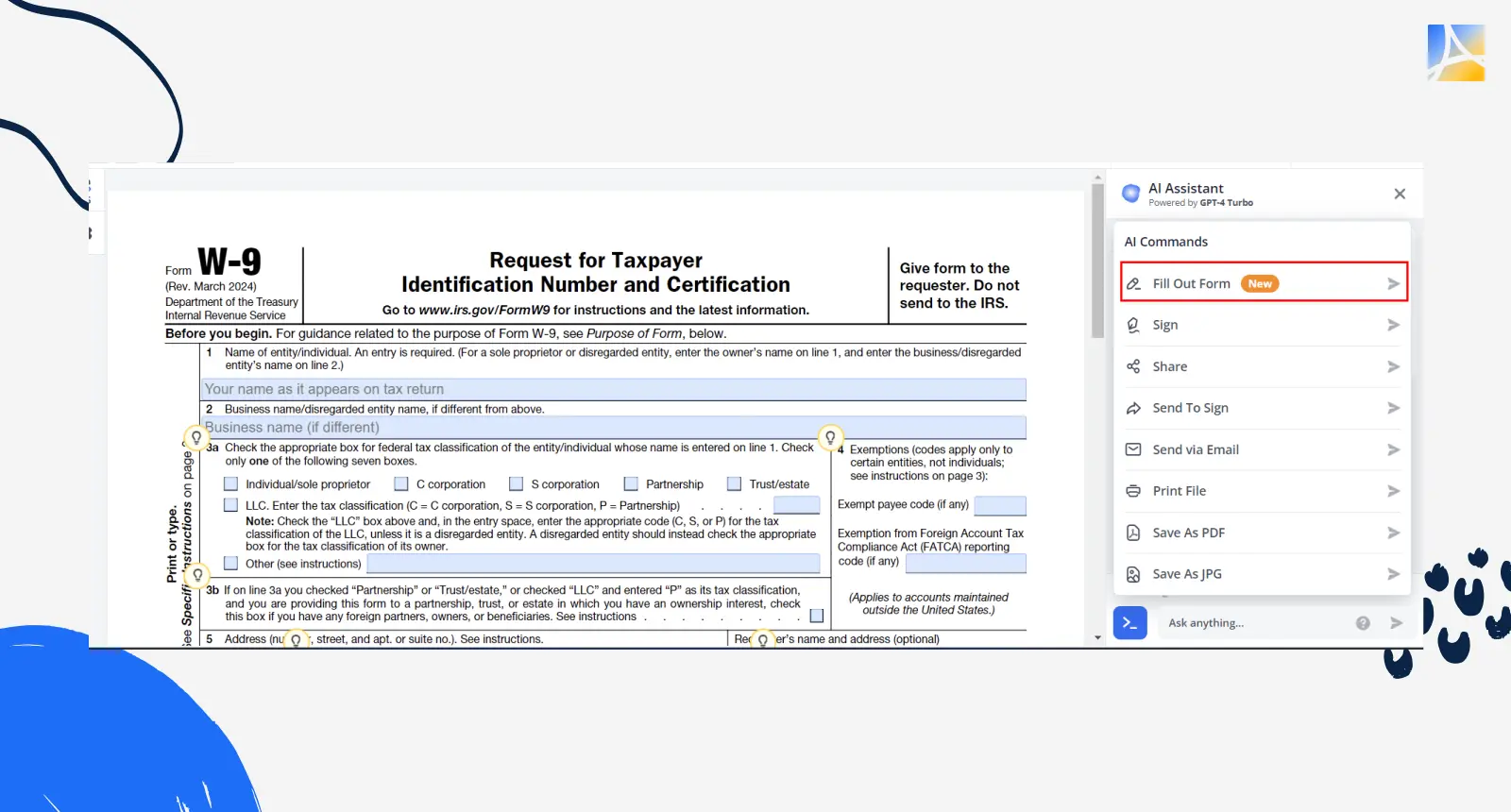

1. AI-based online tax advisor on PDFLiner: it’s a game-changer!

When that scary season comes knocking, PDFLiner emerges as one of the most effective and peace-of-mind-bringing online tax advisors for your business. This AI-based online assistant doesn't just lead the numbers. It professionally dances with data.

Unique offerings or advantages

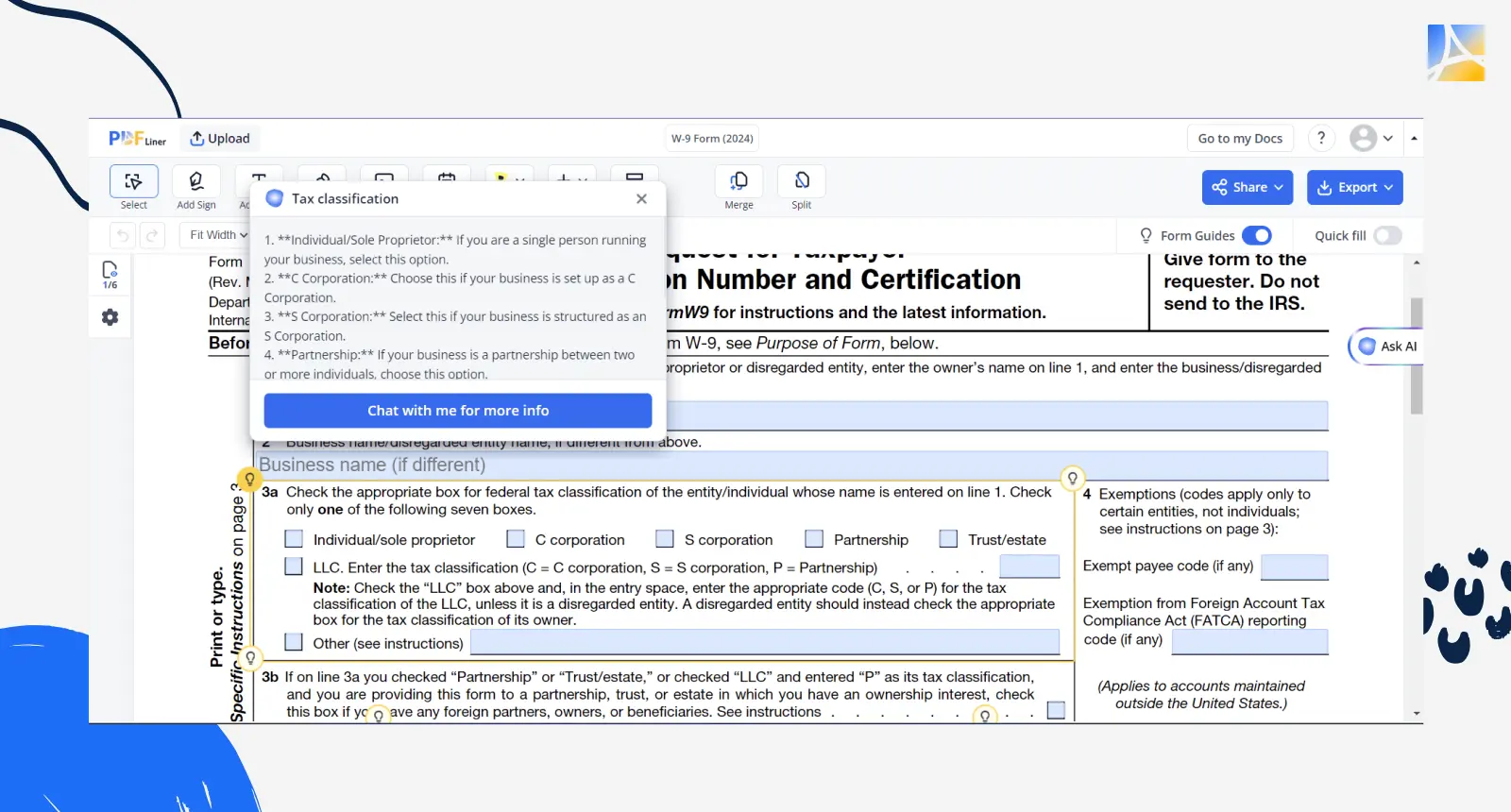

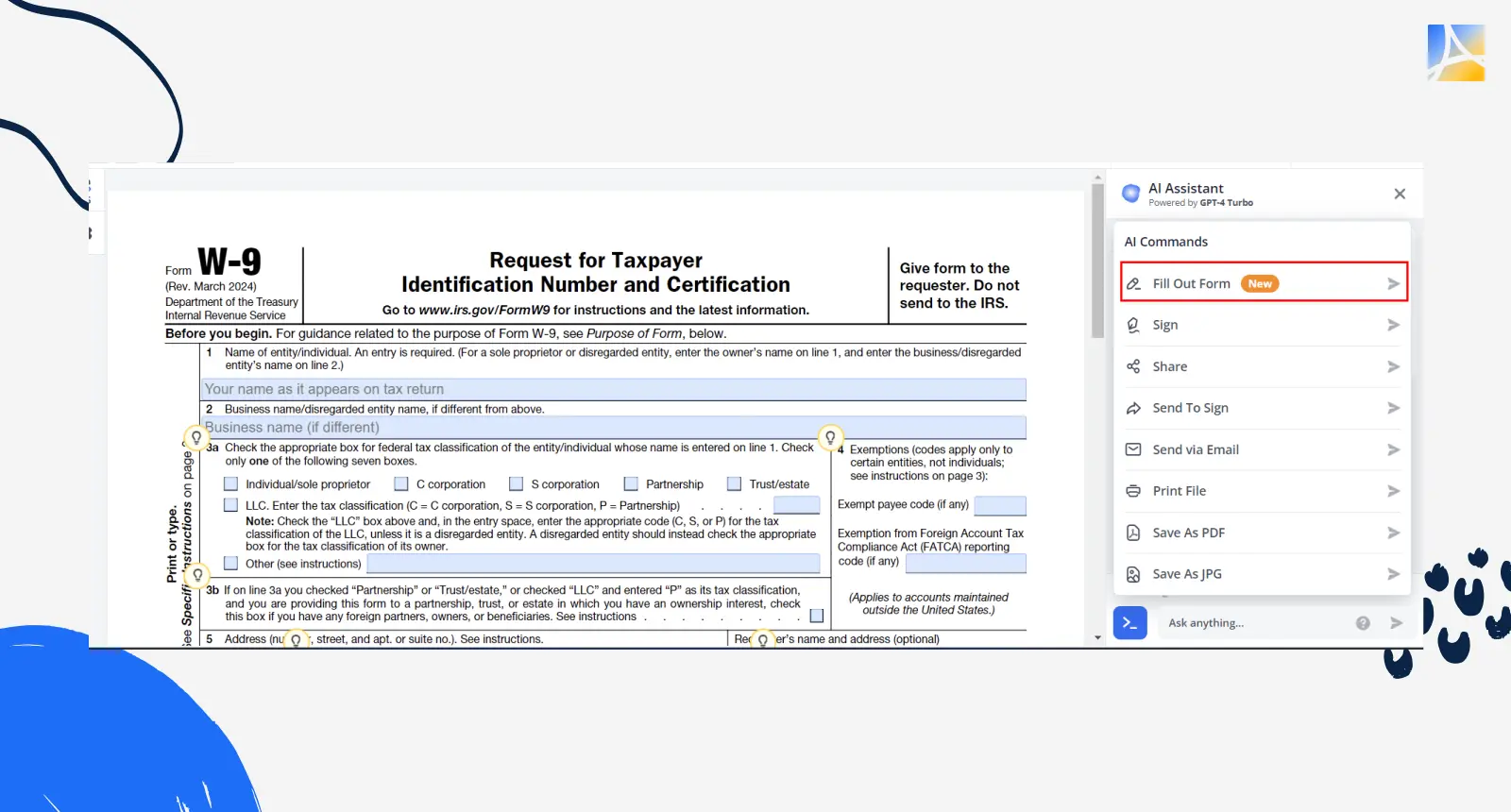

- Smart AI Tips. Crafty advice to boost your business deductions. Automatic Form Filling: AI Assistant will ask you questions, summarize them, and then fill out the form, all you have to do is sign it.

- Automatic Form Filling: AI Assistant will ask you questions, summarize them, and then fill out the form, all you have to do is sign it.

- Summarize lengthy documents with ease: PDFLiner's AI Summarizer offers an excellent feature where you can utilize 30,000 free tokens to summarize documents. This tool helps in quickly getting the essence of lengthy documents, aiding in efficient decision-making.

- Easy-Peasy Editing. Simple features to upload, fill out, and send all your papers.

- Safe & By-the-Book. It locks down your data and sticks to the strict rules.

- Not only for Taxes: There are many other use cases when the AI-powered form PDF editing saves you tons of time.

Pricing

PDFLiner's has three straightforward plans (Single Use, Self-Employed, Company Growth) to fit big and small businesses. It's not the bargain bin of tax software, but the peace of mind and slick features make it a savvy spend.

Best AI Tax Advisor Tools for Small Businesses and Startups

An American businessman and investor Mark Cuban once wisely remarked, "Artificial intelligence, deep learning, machine learning—whatever you’re doing if you don’t understand it, learn it. Because otherwise, you’re going to be a dinosaur within three years." Embrace the future of tax preparation by exploring our comprehensive AI tool list for taxes provided below, and you are guaranteed to succeed in staying ahead of the curve.

1. AI-based online tax advisor on PDFLiner: it’s a game-changer!

When that scary season comes knocking, PDFLiner emerges as one of the most effective and peace-of-mind-bringing online tax advisors for your business. This AI-based online assistant doesn't just lead the numbers. It professionally dances with data.

Unique offerings or advantages

- Smart AI Tips. Crafty advice to boost your business deductions. Automatic Form Filling: AI Assistant will ask you questions, summarize them, and then fill out the form, all you have to do is sign it.

- Automatic Form Filling: AI Assistant will ask you questions, summarize them, and then fill out the form, all you have to do is sign it.

- Summarize lengthy documents with ease: PDFLiner's AI Summarizer offers an excellent feature where you can utilize 30,000 free tokens to summarize documents. This tool helps in quickly getting the essence of lengthy documents, aiding in efficient decision-making.

- Easy-Peasy Editing. Simple features to upload, fill out, and send all your papers.

- Safe & By-the-Book. It locks down your data and sticks to the strict rules.

- Not only for Taxes: There are many other use cases when the AI-powered form PDF editing saves you tons of time.

Pricing

PDFLiner's has three straightforward plans (Single Use, Self-Employed, Company Growth) to fit big and small businesses. It's not the bargain bin of tax software, but the peace of mind and slick features make it a savvy spend.

Pros

Easy-to-get-to-grips-with interface customized to suit an array of business needs.

Time-saving with effective document management.

AI guidance helps pinpoint potential savings.

Cons

It’s not for free.

For business owners eager to ace their IRS game without the headache, PDFLiner is a game-changer. It's your brilliant personal assistant who never takes a coffee break.

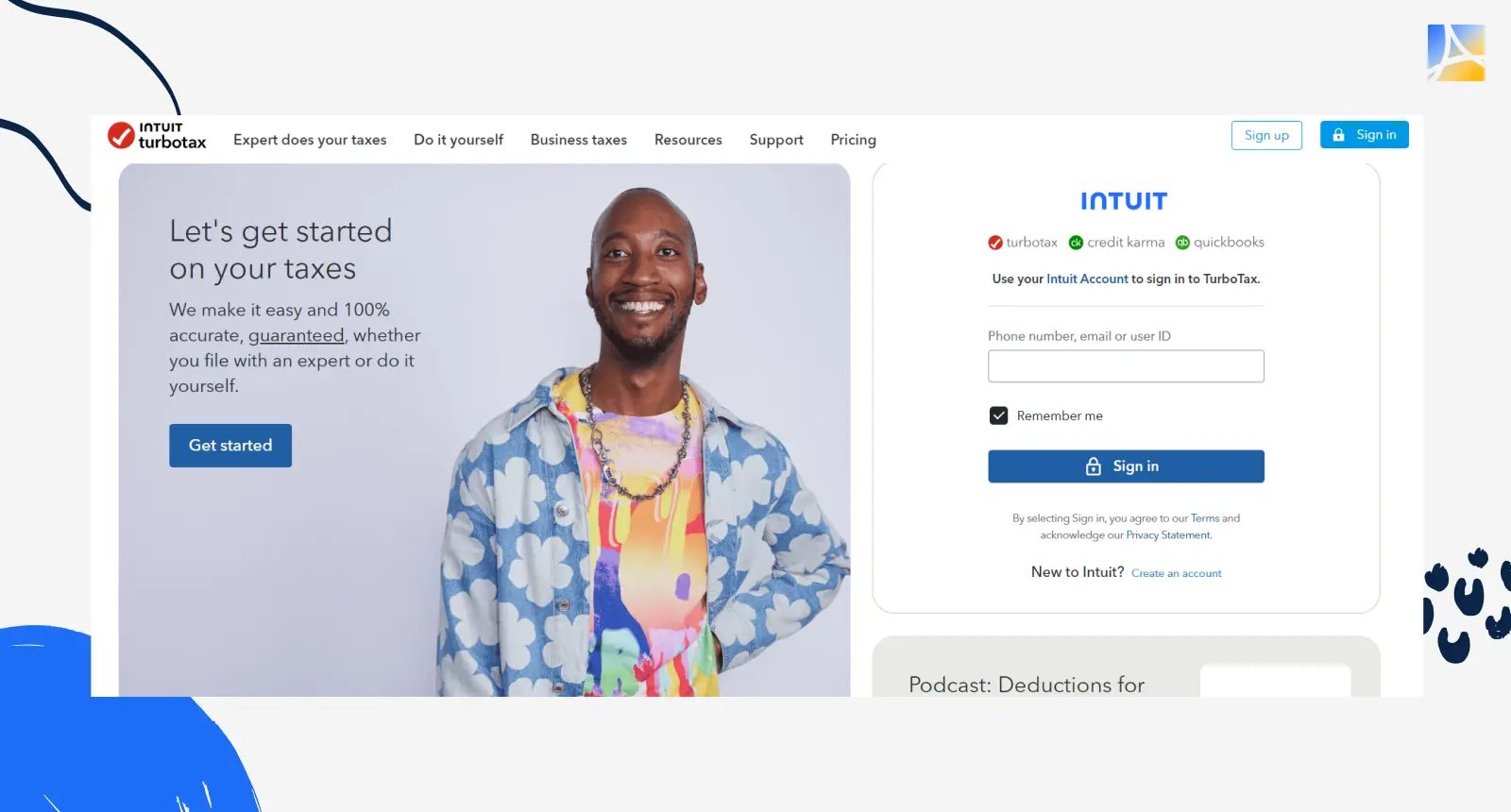

2. TurboTax simplifies business taxes for maximum returns

If you're on the prowl for a solid AI tax advisor, this service stands out as a beacon of sanity, especially for businesses. This expert doesn’t sip your coffee either but certainly helps you save some beans!

Unique offerings or advantages

- SmartLook. A feature allowing users to connect with live CPAs or Enrolled Agents.

- Max Refund Guarantee. It makes sure you get every penny back.

- Industry-Specific Deductions. Tailored advice for various business sectors.

Pricing

The service offers a tiered pricing system, from the free do-your-own-taxes plan to more advanced everything-done-for-you packages catering to business needs. While not a steal, it's a worthy investment considering the time and potential savings.

Pros

User-friendly interface.

Comprehensive guidance for various business structures.

Robust error-checking to minimize audits.

Cons

Costs can escalate with added features.

Might not fully replace the nuanced advice of a dedicated consultant.

This software is a good choice for businesses looking to manage their docs well and get bigger refunds without a big accounting team.

3. Liberty Tax: the smart choice for your business needs

Previously known as eSmart Tax, Liberty Tax emerged as a nifty online AI tax software solution tailored for businesses. We've provided some vital details about it below.

Unique offerings and advantages

- Personalized Guidance. They get to know you and your situation and only then do they focus on the maximum possible refund.

- Feature-Packed. From tax calculators to W-4 withholding calculators, the platform offers a suite of tools to answer your queries.

- Mobile-Friendly Services. File on the go with their user-friendly app, scan documents, and access your Liberty Tax Wallet anytime.

Pricing and benefits

- Competitive Pricing. Customized packages for various business needs. It guarantees value for money.

- Referral Rewards. Refer friends and earn extra cash.

- Fast Refunds. Get your refunds up to 5 days faster with Direct Deposit on a DeepBlue Debit Account.

Pros

They serve their clients year after year with top-notch planning and preparation services.

Enjoy real-time transaction alerts, cash-back offers, and more.

Cons

Occasional inconsistency in customer service.

Some users might find the interface overwhelming due to its plethora of features.

The platform offers the flexibility, tools, and expertise to make tax season a breeze for both seasoned entrepreneurs and startup business owners.

4. TaxSlayer: great tax software for quick & confident filing

It is your go-to cloud-based DIY tax software that promises to make filing a breeze, especially for businesses. They provide you with all the right tools without burning a hole in your pocket.

The service’s AI capabilities

- Precision-Packed. Their 100% accuracy guarantee makes sure your returns are error-free.

- Smart Assistance. Get personalized money-saving tips and guidance adjusted to your business needs.

Types of filers who benefit most

- Busy Business Owners. File on the go with their user-friendly mobile app.

- First-Time Filers. With unlimited phone and email support, they've got your back from start to finish.

- Self-Employed Professionals. Opt for their Self-Employed package designed to handle complex situations effortlessly.

Pricing packages

- Classic. Ideal for straightforward situations.

- Premium. For those who need a little extra support and guidance.

- Military. Tailored for our brave men and women in uniform.

- Simply Free. File your federal return for free if you have a simple situation.

- Self-Employed. Best bet for freelancers, contractors, and small business owners.

Pros

Fastest refund.

Unlimited support.

Maximum refund guarantee.

Cons

Complex pricing.

The Simply Free package has limitations based on complexity.

With over 50 years of trusted service, TaxSlayer is committed to making tax filing less stressful and more dependable for millions of Americans.

5. ATX: your loyal business tax assistant

ATX, powered by CCH Axcess Workstream, is the secret weapon for businesses aiming to conquer their tax challenges with ease and precision.

Features and technology enhancements

- Huge Form Library. Access over 6,000 niche-specific forms. They particularly feature federal, state, and local returns.

- Smart Tools. Identify e-filing errors, track refunds with Refund Meter, and navigate between forms effortlessly.

- Comprehensive Research. Instant access to IRS form instructions, schedules, and award-winning resources.

- User-Friendly Interface. Designed to minimize errors and speed up the e-filing process.

- Additional Integrations. Easily import information, share files with clients, and more.

Pricing packages

- ATX 1040. Ideal for individual federal and state returns.

- ATX™ MAX®. Perfect for unlimited state individual returns and 3 states for business.

- ATX Total Office. Offers unlimited e-filing for both individuals and businesses.

- ATX Advantage. The all-inclusive package with improved asset management and additional research options.

- ATX Pay-Per-Return System. A flexible solution for professionals filing a limited number of returns.

Pros

Quick processing and e-filing with minimal errors.

You will get every dollar you're entitled to.

Enjoy 75 free e-files with various packages.

Cons

Multiple packages and add-ons might be quite overwhelming.

Basic packages might lack advanced calculations and additional features.

With ATX, you're not just getting top-level software. You're laying your fingertips on a comprehensive solution powered by AI for tax filing and designed to meet the unique needs of businesses.

How to Choose the Best Tax Advisors Online

In the wise words of Albert Einstein, "The measure of intelligence is the ability to change." Likewise, top-notch tax advisors should keep up with the times and use AI tools to design innovative, custom-fit solutions.

Does choosing the best AI tax advisors online make you feel like looking for a needle in a haystack? No worries. Below, we’ve provided a simple guide to help you sail through this brave new world like a champ.

- Look for Credentials. Go for tools with the right qualifications and a solid history.

- Focus on Specialization. Check if the AI system specializes in the areas relevant to you, e.g. personal or corporate filings.

- Prioritize User-Friendly Interface. Top tax software should offer a buttery-smooth user experience and make it easy for you to handle data.

- You Need ‘Em Spot-On and Swift. Choose AI systems that are both fast and precise in their calculations and advice.

- Test-Drive Their Customer Support. While AI is great, having human support for tricky questions is a must.

- Look for Transparent Pricing. Know what you're paying for upfront to avoid any nasty surprises.

To wrap up, when pondering what tax program is best, remember that the best tax platform seamlessly blends cutting-edge tech with good old-fashioned expertise. So, keep your eyes peeled for a mix of technology, user-friendliness, and human customer service. With the right AI assistant by your side, going through the tax season can actually be fairly easy.

Fill Out Forms Smarter with AI Tax Advisor

Go through the tax season easily using the right service