-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Apply for ITIN Using IRS Form W-7: What Do You Need?

.png)

Dmytro Serhiiev

If a non-citizen of the U.S. without permission for work needs to get an Individual Taxpayer Identification Number, they should fill out the IRS Form W-7. ITIN is usually required when you have to send tax returns. Non-citizens can do it too if they receive some income from U.S. sources. Here you will find the comprehensive Form W-7 instructions and a guide on how to get an ITIN.

What Is an ITIN Number?

ITIN number is used to identify a person when they have to file tax forms to the IRS. U.S. citizens have Social Security numbers for this purpose. Non-citizens who are authorized to work also have Social Security numbers. However, non-citizens without this authorization should get an ITIN.

Form W-7 5e591bab920a7d66fc49b7a1

How to Apply for an ITIN Number?

First of all, you should fill out the IRS W-7 Form Application for ITIN. There is no need to fill the W-7 form every time since ITIN remains the same for the next tax returns. If it’s not used for three years, it expires. Also, all ITINs that were issued before 2013 will expire.

Besides the W-7 form, you have to attach the tax return that requires the number and the documents that identify your personality and foreign status. There can be one paper that verifies both statements.

For instance, a valid passport is suitable in this case. However, you can file documents identifying personality and foreign status separately. There is a list of the possible documents on the IRS website.

Where to send a W-7 form?

If you were wondering how to file a W-7 form here is an complete guide for you. These documents can’t be filed online, unless you are a Certified Acceptance Agent (CAA). There are three ways you can submit your ITIN application:

1. Mail the application package (filled W-7, tax return, proof of identity, and foreign status documents) to the IRS:

- Internal Revenue Service

- Austin Service Center

- ITIN Operation

- P.O. Box 149 342

- Austin, TX 78 714−9342

All documents have to be original, and you will receive them back within 60 days, so make sure you don’t need them during that period of time. This year, you would also need to submit your tax return to this IRS office.

2. Submit the application with a Certified Acceptance Agent (CAA) approved by IRS. This way you won’t have to mail your original documents.

3. Another way is to apply for ITIN in person in the IRS Taxpayer Assistance Center. You can find it in most cities, and there is at least one in each state. In this case you would need to call and schedule an appointment at your local Taxpayer Assistance Center.

In most cases, it takes from 6 to 10 weeks to get a response after applying for an ITIN number. You will receive a letter with the confirmed information, or the IRS workers will inform you in another way. The tax return, which you have sent together with the W-7 Application Form, will be completed too.

Form W-7 5e591bab920a7d66fc49b7a1

How to Get the W-7 Form?

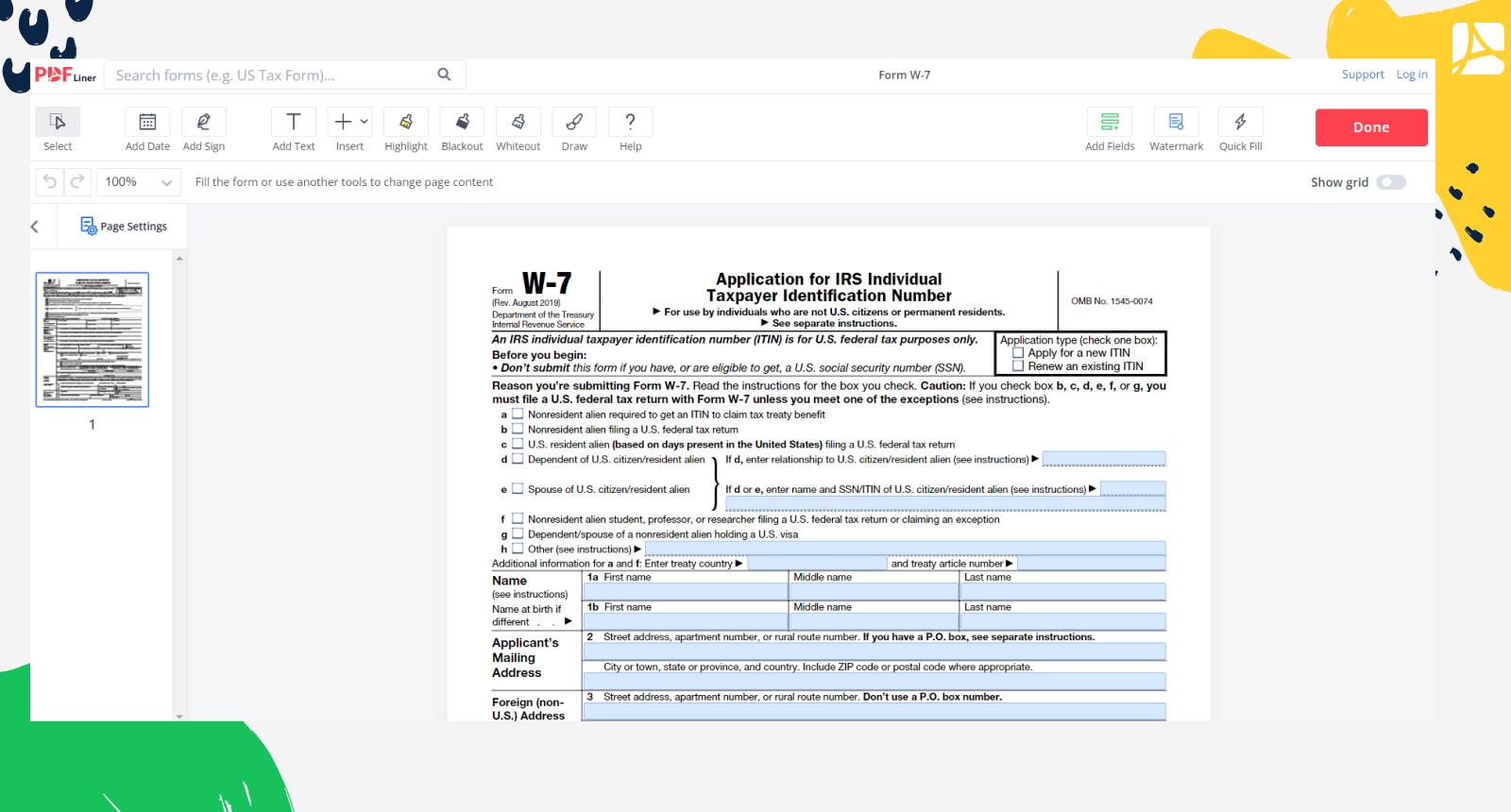

You can get the W-7 form for free, and you don’t need to pay any fees to file it. Nowadays, the blank can be filled out online. You can download a template on the official IRS website. It’s also available in the PDFLiner’s template library. The PDFLiner editor also allows you to fill in the fields in the form and save a copy in your account. It’s very convenient since there are text, date, and signature fields in the editor. You just need to fill out your information. Then you can print a form or send it by email.

How to Fill Out the W-7 Form?

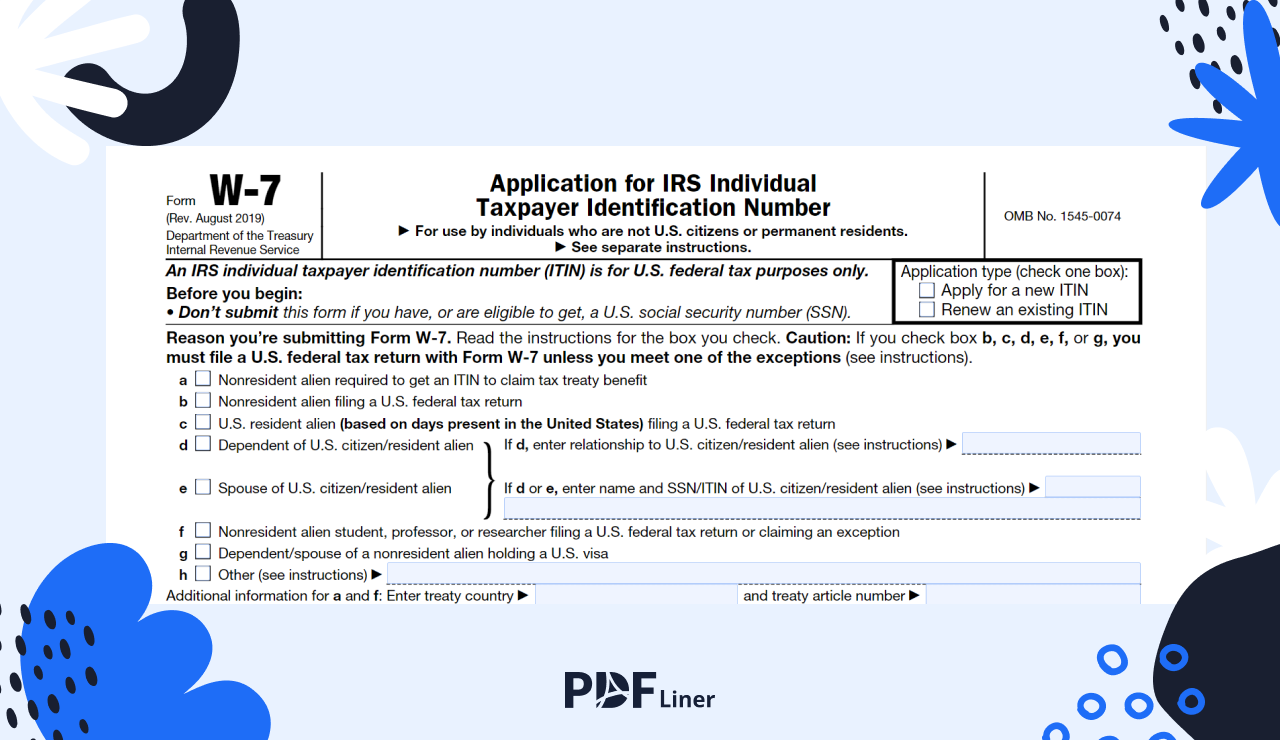

The IRS Form W-7 doesn’t need much time to be filled out as it consists of only one page. Follow this guide to complete it.

- Indicate the reason why you need to get an ITIN. There is a list of the possible occasions, and you just need to tick one. Some of them require specification.

- Fill out your personal information. The name has two lines because the non-citizen might have another name that was given at birth.

- The next two sections include your current address and the one you had in your country. Then you should fill out your birth information.

- Section 6 contains additional data, including foreign tax I.D., type of U.S. visa, etc. Form W-7 can be filed to renew ITIN. If you had an identification number before, you should write it in line 6f. Otherwise, you can just skip it.

- There should be a signature of the applicant and delegate name in the last section. Don’t forget to clarify the delegate’s relationship with the applicant.

You can quickly fill out the W-7 form on the PDFLiner editor and sign it online. It’s convenient because it takes a little time, and you don’t need to print out the form.

How to Sign the W-7 Form?

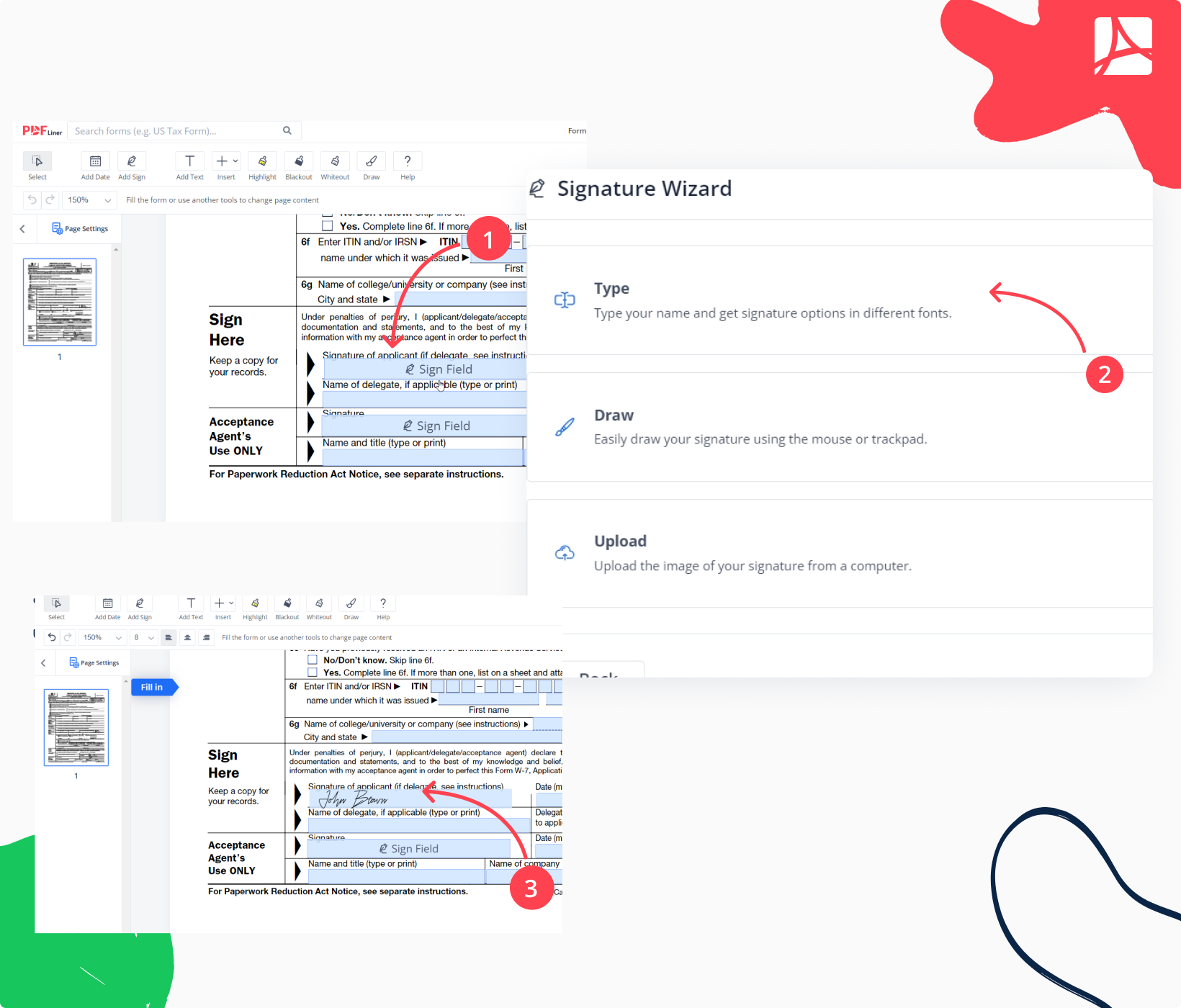

Here’s a quick guide on e-signing your W-7 form via PDFLiner:

1. Press the ‘Sign Field' button.

2. Choose how you want your signature generated: Type, Draw, or Upload.

3. Save the changes you’ve just made, and that’s about it.

Frequently Asked Questions

Do you still want to clarify the "what is the W-7 form" question? The explanation below might help you with that. There are also additional recommendations on how to fill out this blank.

What is the latest update of Form W-7?

The last time Form W-7 was changed was in August 2019. This version of the document is legal, and you can fill it with confidence.

What is the difference between Form W-7 and Form W-9?

The IRS Form W-7 is used by non-citizens to get ITIN for the tax return. Form W-9 is a request for ITIN that is used mostly by employers. These two forms differ in their purpose and individuals who fill them out.

How long does it take to get the W-7 Form?

This form is available for free on the official IRS website or PDFLiner. You can start filling it out right now. If you wonder how long it takes to get an ITIN number, the term is usually 6−10 weeks.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Form W-7 5e591bab920a7d66fc49b7a1