-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Calculate Net Income

To understand whether your business is profitable or not, it is essential to be able to calculate its net income. While revenue gives you a general idea of how much money you get, you can know the exact sum you earned only once you subtract all the expenses. Here you can learn how to compute net income easily.

What Is Net Income?

To begin, let’s answer the main question – what is net income? When it comes to net income definition, it is a simple concept. Net income refers to the total profit earned by your company once all the necessary business expenses are deducted. There are other terms used for this type of income, including net profit and earnings. The expenses that you would need to subtract can be different depending on your business type. They might include the salary of employees, operating expenses, utilities, rent, interest, taxes, and more.

If you find out that your revenue is greater than your expenses during your net calculation, it means that you have a positive net income. On the contrary, when you realize that your expenses have been more significant, you have the so-called net loss or negative net income.

Net Income Formula

Now that you know what net income is, it is important to understand how to calculate net income correctly so that you consider all the factors.

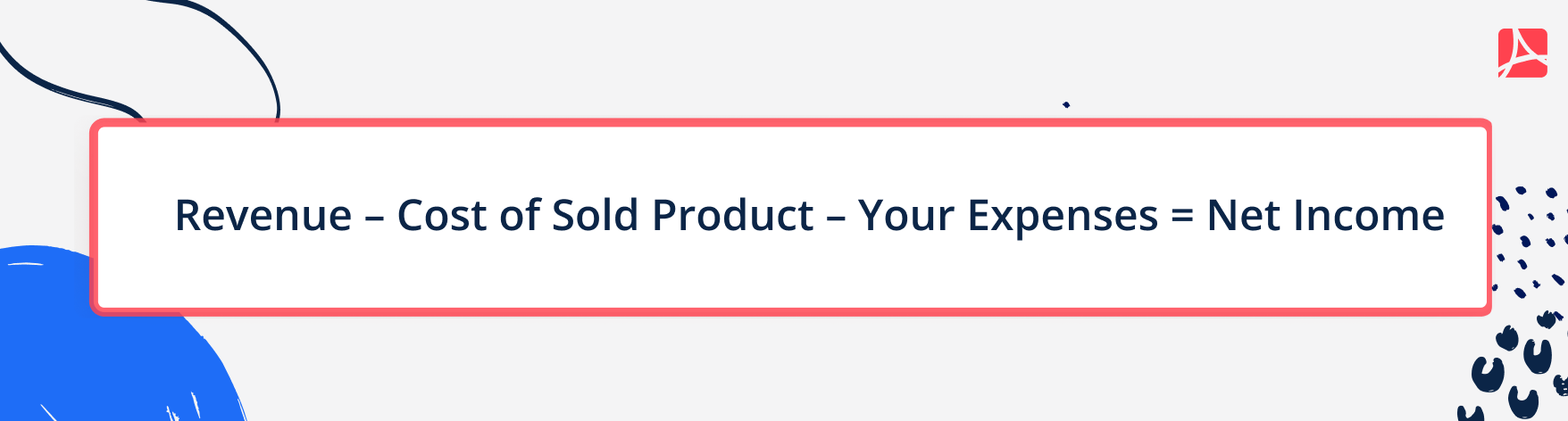

The net income formula that you can use for your business to calculate your profit properly:

Another term to remember is gross income. The definition refers to the subtraction of the cost of sold products from the revenue. In this way, you can look at the formula differently – you have to subtract expenses from the gross income, and you will get the right revenue sum.

Regardless of the period for which you calculate, the formula remains the same. You can use it to get an idea of your monthly, quarterly, or annual revenue so that you know exactly how your business is doing.

Example of Net Income Calculation

It is easier to understand how to find net income by using an example. For instance, you want to see the net income of your clothing business for January. Firstly, you should have the exact numbers when it comes to your gross income. They include:

- Cost of sold products: $10,000

- Total revenue: $35,000

Next, you should add up all the expenses that you had in January. This might include the following:

- Utilities: $300

- Store rent: $1.800

- Employee’s salary: $3,500

- Taxes: $750

- Any additional purchases: $900

By subtracting the cost of sold products from the total revenue, we get the gross income of $15,000. The expenses for the month come to $7250, which means that the net income of this clothing store for January is $15,000 - $7,250 = $7,750. By using this example on how to get net income, you can now quickly calculate yours.

Net Operating Income Formula

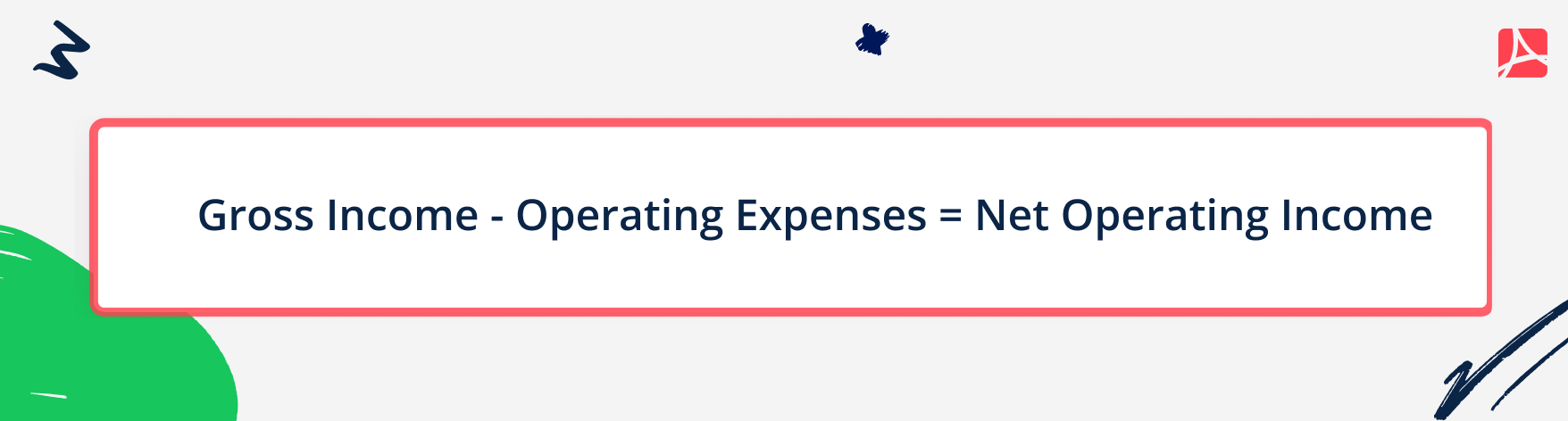

There exist different types of net income formulas, and another one that should be mentioned is the net operating income formula. In the case of lenders or investors, the net operating income can often be more informative and allows us to see how much revenue certain business activities bring. To calculate net operating income, you should do the following:

It is important to note that net operating income is calculated before tax, so it’s not taken into account when using the formula. When you calculate net operating income, you subtract only operating expenses while the net income formula subtracts all types of expenses, both operating and non-operating ones.

For instance, an office building can bring $150,000 of income on rent, but the operating expenses might include maintenance, property taxes, insurance, and vacant weeks. If all these expenses add up to $50,000, the final net operating income will be $150,000 - $50,000 = $100,000.

Net Income and Taxes

The Form 1040 used for reporting annual earnings requires you to provide your taxable income and gross income. But, when filing income taxes, you may also see the net income section. If this happens, all you have to do is take the taxable income and subtract the total tax.

The easiest way to fill out tax forms is online, as you don’t have to deal with a post office and worry that your tax forms might get lost or stolen. Also, using a digital signature and sending your tax form via email saves your time. There are many online platforms where you can sign a document out there, including a tax form, and one of the convenient options is PDFLiner. This tool streamlines the process of creating and managing legal documents and helps to fill out tax forms, ensuring that everything is perfectly filled out and no mistakes are made.

Calculating Your Net Income Is Essential

It’s easy to get confused with all the expenses and revenues, but it’s important to start calculating your net income as soon as possible. Now that you know how to calculate net income from the balance sheet, you can see exactly the money you earn each month. If your net income happens to be negative, you will be able to make correct adjustments.

File Taxes Online at No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

.png)