-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Form 4506-T Online: Brief Guide

.png)

Dmytro Serhiiev

If you had to fill out Form 4506-T but didn’t know how to do it, the guide below will help you with this procedure. You can complete this document on PDFLiner’s website. Also, you can sign the form online and then print it or share it with other users. Here you will find SBA Form 4506-T instructions and a step-by-step guide.

Fillable 4506-T 653660fbc74e78c81d004861

What Is IRS Form 4506-T?

The SBA 4506-T form is a request to get a copy of your tax return transcript. You may also ask for the tax account information and forms W-2 and 1099 data. When you fill out the SBA 4506-T form, you send it to the IRS and wait while they process your application. You may only ask for the data of one form. If you want to get a copy of several forms and tax returns, you should fill out different 4506-T forms.

The IRS can provide you with information about your tax returns for the last ten years or less. However, you can’t request the current year's data. It becomes available only after one year of filing the form. The IRS tax Form 4506-T is usually required when you file for the loan, and your lender wants you to confirm your income match. It’s not obligatory in all cases when you apply for a loan. If you want to know how to get Form 4506-T, there is a guide on our website.

Blank 4506-T 653660fbc74e78c81d004861

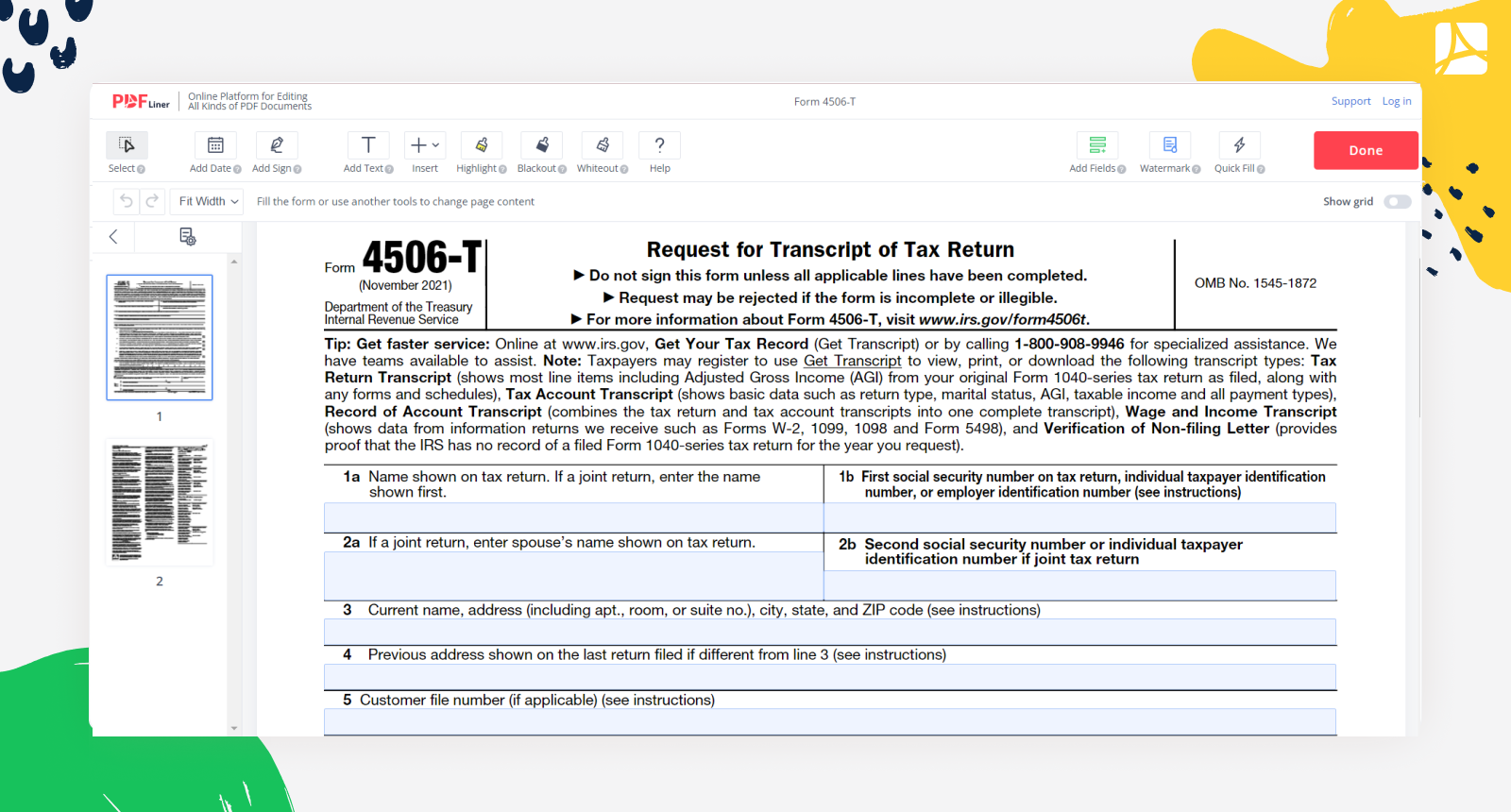

How to Fill Out Form 4506-T?

Form 4506-T doesn’t require you to fill out a lot of information. You just need to indicate the main data that will help the IRS to make a copy of your tax return. Let’s look at Form 4506-T filling instructions.

Step 1: in line 1a, you have to write the name that is shown on the tax return. If you’re requesting the joint tax return, you need the one that is indicated first. Line 1b should contain your Employer Identification Number if you file the form for the business tax return. In another case, you can fill out your Individual Taxpayer Identification Number or Social Security Number.

Step 2: the second line is for the case of the joint tax return. Here you should indicate your spouse’s name and their Social Security Number or Individual Taxpayer Identification Number.

Step 3: line 3 should contain your current address. Indicate the details like room, suite no., and P.O. box.

Step 4: if you moved to the new address, and the previous tax return has the old address, you should write it in line 4. If you didn’t change your address, just proceed to line 5.

Step 5: line 5 requires your customer file number if you have one.

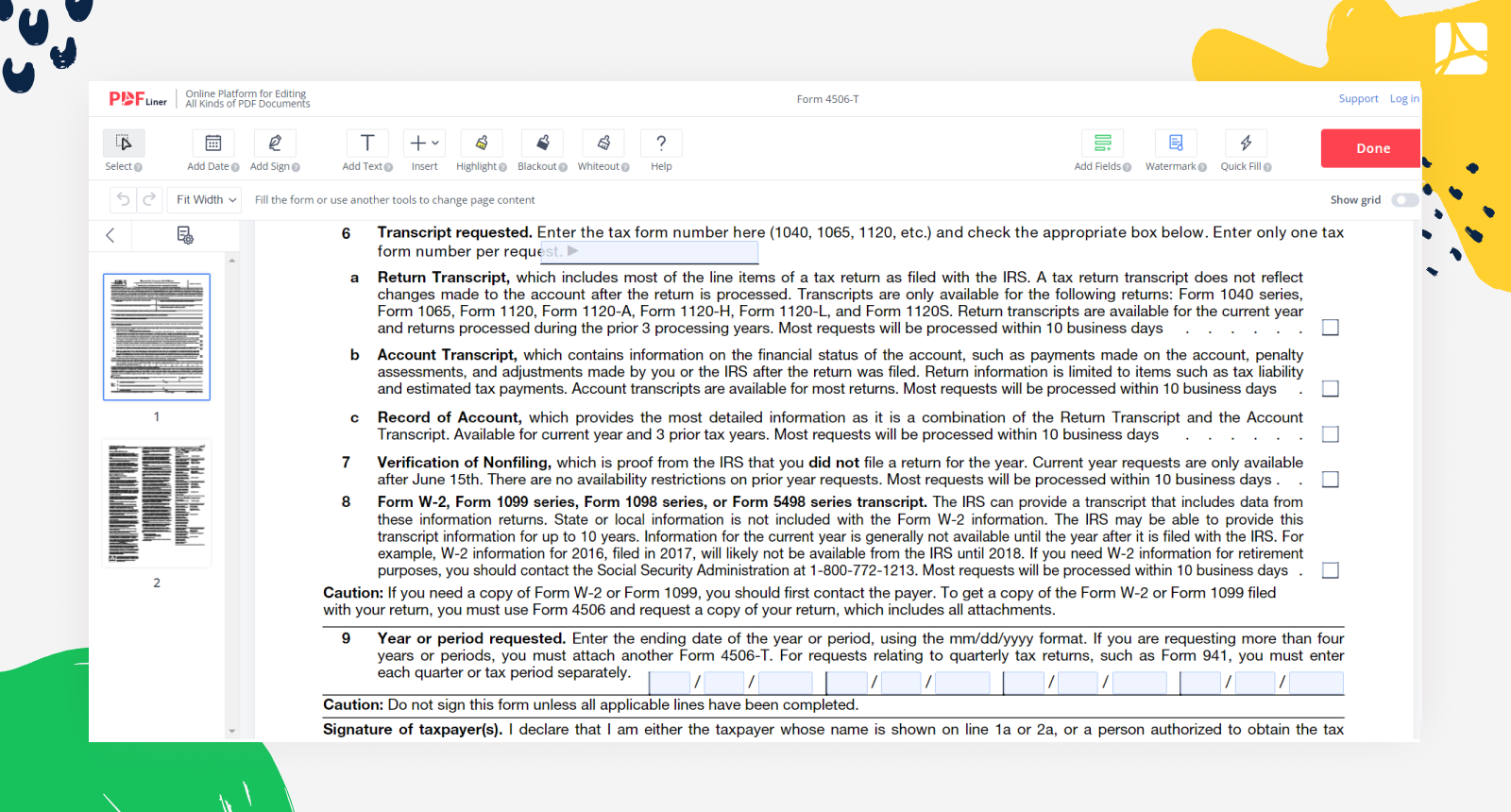

Step 6: in line 6, you should choose the form you want to get. Also, you should decide whether you need a Return Transcript, Account Transcript, or Record of the Account. The difference between them is described in the form.

Step 7: line 7 is verification of non-filing. It means that you confirm you didn’t file the tax return for the current year.

Step 8: if you want to get a W-2, 1099, or 5498 transcripts, you should put a tick in line 8. However, you have to contact the payer first. Also, you should fill out the 4506 form to get a copy of your return with all the attachments if you want to get a W-2 or 1099 copy.

Step 9: in line 9, you should indicate the tax return periods. You have to fill out each year or period separately. Only four periods can be filed with one 4506-T form. If you want to file for more, you should fill out another 4506-T form.

Step 10: the last thing to do is to sign the form. If you’re requesting a joint tax return, at least one spouse should sign it. In case you fill out a 4506-T form for your business, you should write a title too. Don’t forget to indicate a phone number to allow the IRS to contact you if there are any issues.

How to Sign Form 4506-T?

There is a signature field at the end of the first page. You can sign this form directly on PDFLiner and then print it out or send it online. When you click on the signature field, you may choose one of four options for how to sign the form. You can type your full number, and our editor will provide you with a handwritten signature variant.

Another method is to draw a signature using your mouse or touchpad. You may also upload the image of your signature or take a photo with your webcam. Your signature will be automatically saved in the account, so you can use it for signing other forms too.

Printable 4506-T Form 653660fbc74e78c81d004861

How to File Form 4506-T?

On page 2 of the form, there are instructions that contain the main address where you should send Form 4506-T. It depends on the state you lived in during the period indicated in the document. You can print this form after you fill it out, and file it to the IRS service center. Form 4506-T doesn’t have a date of filing, so you can make a request at any time. However, at least one year should pass from the time a tax return is filed.

FAQ

You might have some other questions regarding the form, so here is a FAQ section to give you the additional information.

What is the difference between 4506-T and 4506-C forms?

Form 4506-C is used to allow the lender to request the borrower’s tax return information. Earlier, Form 4506-T was filed for this purpose. However, starting from the previous year, Form 4506-T can only be filed by the taxpayer to get a transcript.

Why does SBA need Form 4506-T?

SBA requests filling out Form 4506-T to get a copy of tax return information. They need it to ensure that you or your business is capable of repaying the loan.

Where to mail Form 4506-T?

You should mail this form to the address indicated on the second page of the form. It is different for each state.

How to request Form 4506-T?

First, you should fill out this document and sign it. Then you can mail it to the IRS service center, and you will get your transcript in 10 days.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fill Out 4506-T Online 653660fbc74e78c81d004861