-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Form 4868 with Simple Steps

.png)

Dmytro Serhiiev

The IRS Form 4868 is used to request the IRS, namely the Internal Revenue Service, to extend the filing process for any of your tax returns. You can download, edit, and submit Form 4868 online by using the convenient PDFLiner service. This service has a wide catalog of forms, among which you can find the one you need.

Form 4868 in PDF 657c60a12646cae8a10f40fc

What Is Form 4868?

This form may be used by all US citizens who pay taxes to the state. With this document, you can extend the deadline for filing your tax return. The grace period can be up to 6 months to complete the required tax form.

This form requires you to enter the approximate sum you owe, as well as the total amount of taxes. It's also worth noting that it doesn't give you more time to pay any taxes. The form only extends the filing and submission deadlines.

Where to Get Form 4868?

You can send Form 4868 electronically in case you have not received all the information you need to fill in yet and send the declarations before the deadline. To do this, you may use Form 4868, which you can get in several ways:

- The fastest way is to use the printable blank Form 4868 provided by PDFLiner. Our convenient editor allows you to quickly find, save, and send any form along with detailed instructions for filling it out.

- The second way is to get the form via the IRS website, where you can fill in the Tax Extension Form online and then print and mail it. You can also download the completed form and keep a copy to yourself.

Fillable 4868 657c60a12646cae8a10f40fc

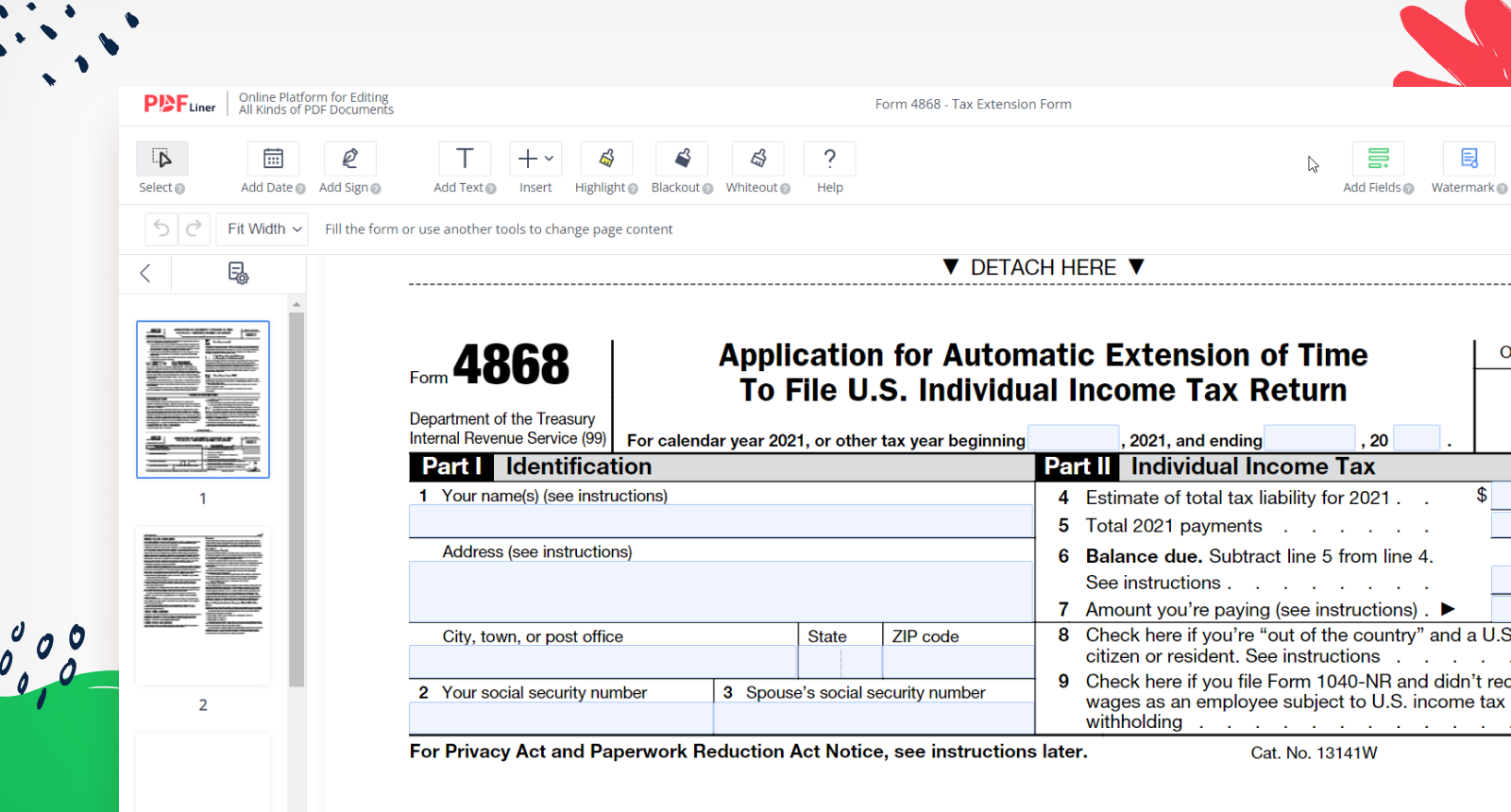

How to Fill Out Form 4868?

The IRS Form 4868 has nine fields and comes with instructions, making it relatively easy to fill out. Let's take a look at steps you need to make to complete Form 4868:

Step 1: The form consists of 2 parts, with fields to fill out. The first part presents fields 1, 2, and 3, where you must specify personal information, including your full name, address, and Social Security Number. There is a field where you need to add the data of your spouse for those who are married.

Step 2: Next, in Part 2, you need to fill in field 4, which asks for an estimate of the total number of taxes you still need to pay. To specify the correct total tax liability, you need to use your W-2 forms.

Step 3: In field 5, you need to specify the amount of taxes you have already paid. You need to enter a number from another form. Line 18 of your Form 1040 indicates the total number of taxes you had already paid.

Step 4: Next, you need some mathematics to fill in field number 6. You need to subtract line 5 from line 4 to get the amount you need to enter in field 6.

Step 5: In field 7, you need to enter the amount you can pay. It is better to pay the maximum amount you can so that you don't get a late fee.

Step 6: In field 8, you should check the box if you are not in the country.

Step 7: In the last field, place a checkmark if you want to submit forms 1040NR or 1040NR-EZ.

With PDFLiner, this process won't take you much time. The instructions, available along with convenient online editing tools, are designed to work with any PDF files and forms that you can also find in the catalog.

How to Sign Form 4868?

The PDFLiner online service provides you with many different electronic tools that are indispensable for working with PDF files. With the online signature tool, you can sign and save any document. This is one of the most popular features on the site, and here's how to use it:

- To get started, press on the “Add Signature” button that is located at the top of the panel with the ink pen icon.

- Next, click on "Add New Signature" to create the required signature.

- Sign the document and save it.

Where to File Form 4868?

To file the form with the IRS, you simply need to fill it out and submit it no later than April 18th. You do not have to state the reason for the IRS to extend the filing period for your forms. The IRS will contact you if the request is denied, but this is only possible if you are late in sending documents.

It is important to keep in mind that the form delay does not apply to the tax deferral. Anything you don’t pay before the due date is subject to a fine or late payment penalties. Take a closer look at the amount you have to pay before the deadline.

FAQ

When to file Form 4868?

You should complete this form if you can’t manage to file your federal income tax return by the end of the deadline. If you have unpaid taxes by their income tax deadline, you will have to pay interest or penalties that will start accruing at the original deadline, even if you applied for an extension. It is important to note that this does not delay the payment of your taxes.

When is Form 4868 due?

For most states, the deadline to submit Form 4868 is April 18th. Once you file for a tax deferral, you have 6 months to submit the required forms.

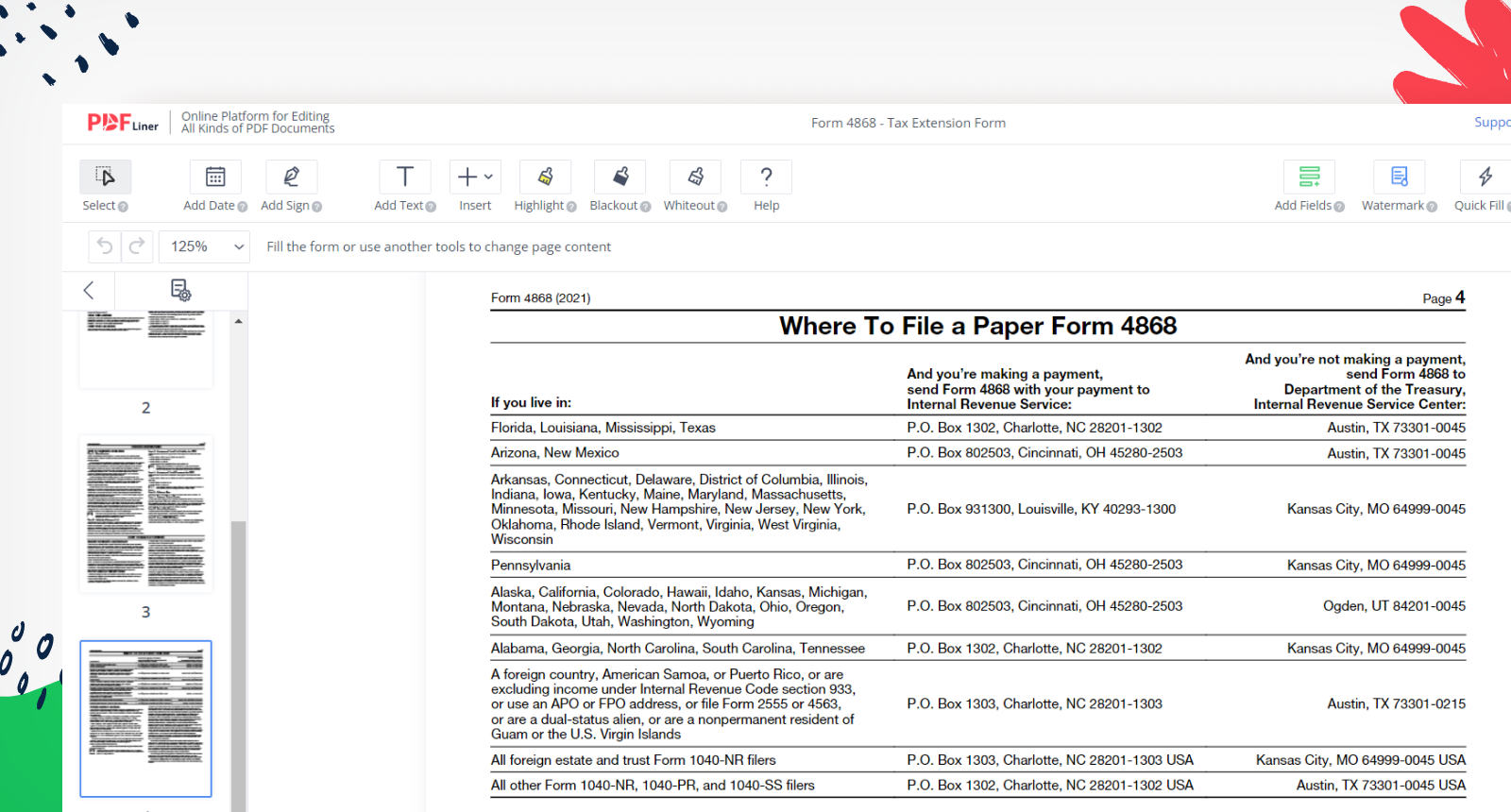

Where to mail Form 4868?

You can submit and file Form 4868 electronically or print the form after completing it online. Submit the paper form along with the payment and refer to the 4868 instructions for the most up-to-date addresses to send your mail.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Form 4868 Online 657c60a12646cae8a10f40fc