-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Tips on How to Get 1099-INT Form

.png)

Dmytro Serhiiev

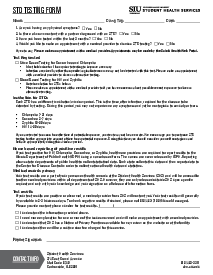

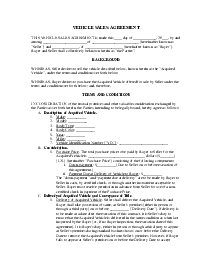

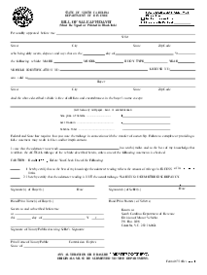

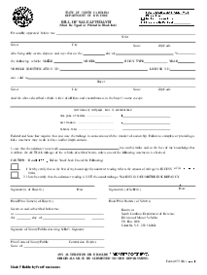

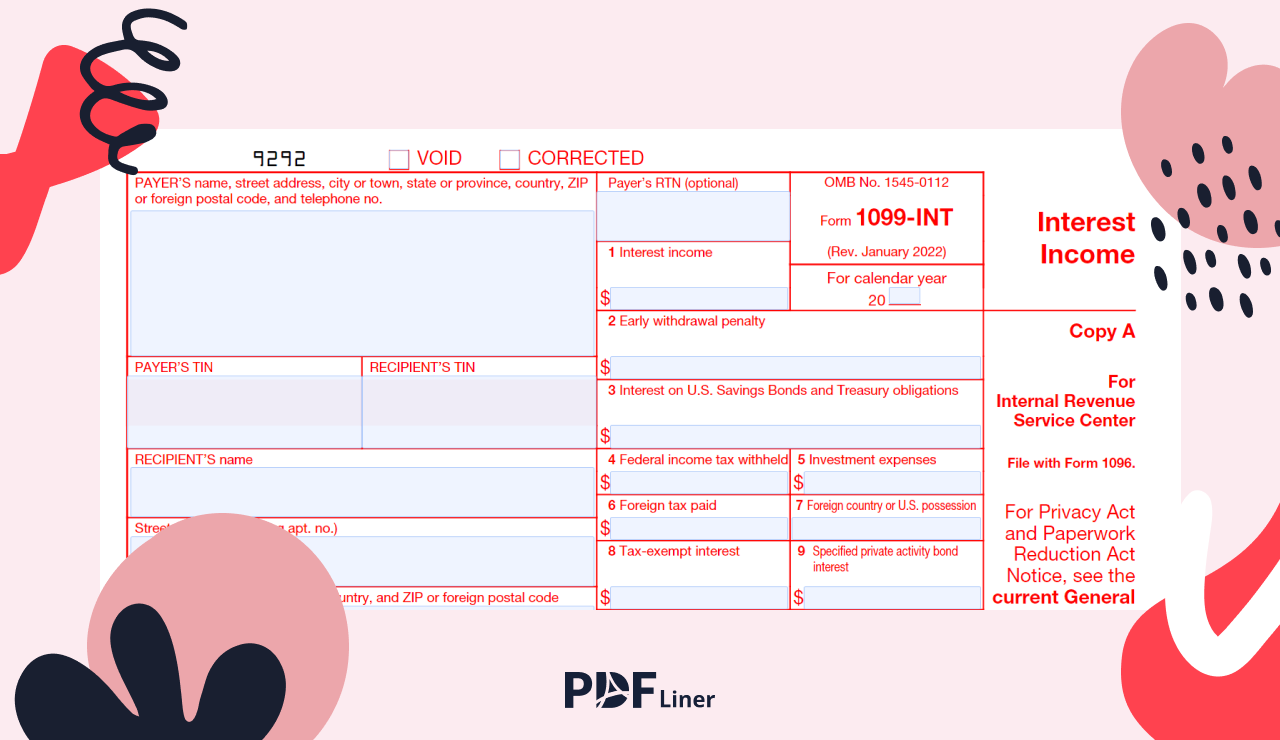

Do you want to know how to get a 1099-INT form? Read this detailed guide, and you will find the easiest way to do it. You might need the form to report interest income or to receive the information from your bank or broker agency. If you don’t know the answer to the question “what is a 1099-INT form,” it is likely you have never paid or received interest of $10 or more.

Fillable 1099-INT 65bb66ba44aa4904c305d679

How to Get a 1099-INT Form?

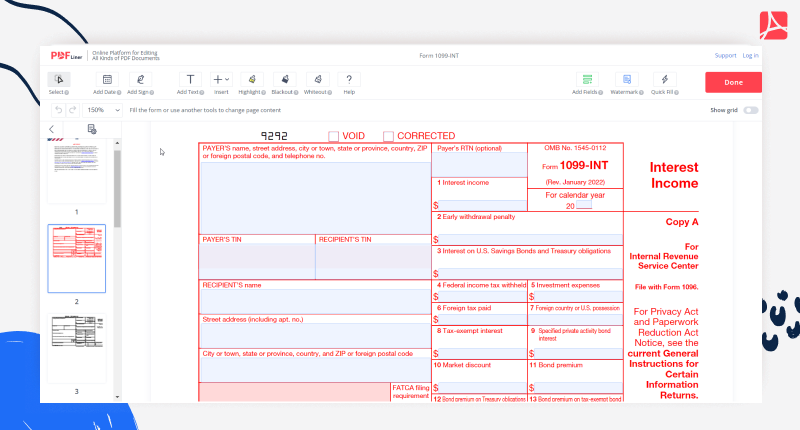

There are three possible ways to receive the IRS Form 1099-INT. You can either find it on the official IRS website or here, on PDFLiner. There is a detailed guide on how to fill out a 1099-INT form in a separate article. While you need to spend some time searching for this form online and on the IRS website, PDFLiner does not require a lot of effort. You can simply tap the button and start filling out the document.

PDFLiner is more convenient since you can easily find Form 1099-INT instructions and edit documents there. Once every section is filled with the required data, you can check it again and send it to the IRS online. You don’t have to download anything if you use PDFLiner. This editor keeps the form saved in the storage, so you can always come back to it later.

If you need to put your signature on the document, you can do it in our editor. When using the Internet, you have to search for the relevant form. There are lots of old versions or changed copies. We recommend you to use only the IRS or PDFLiner’s services if you are looking for the form.

Printable 1099-INT 65bb66ba44aa4904c305d679

Frequently Asked Questions

Read these popular questions about the 1099-INT form. The answers might be helpful for you as well.

Who must file Form 1099-INT?

This form must be filed by a person or entity that paid interest of $10 and more. Usually, the document is used by brokers, banks, and mutual funds. The form has to be sent to the IRS, as well as to the receiver of the interest for the future tax report.

What form do you use to submit a 1099-INT?

You can submit the form online via the IRS website or app. Make sure you complete it before sending it anywhere. You may also send the form via email to the recipient.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

1099-INT Form 65bb66ba44aa4904c305d679