-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Sending W-9 Over Email: Pros and Cons

Liza Zdrazhevska

Last Update: Nov 11, 2024

As the saying goes, “Every coin has two sides,” and that's true for emailing W-9 forms, too. It's quick and easy but not without drawbacks. In this article, we'll unpack how to send a W-9 form via email, exploring its advantages and potential pitfalls. Stay tuned.

Fillable W9 Form

Key Takeaways

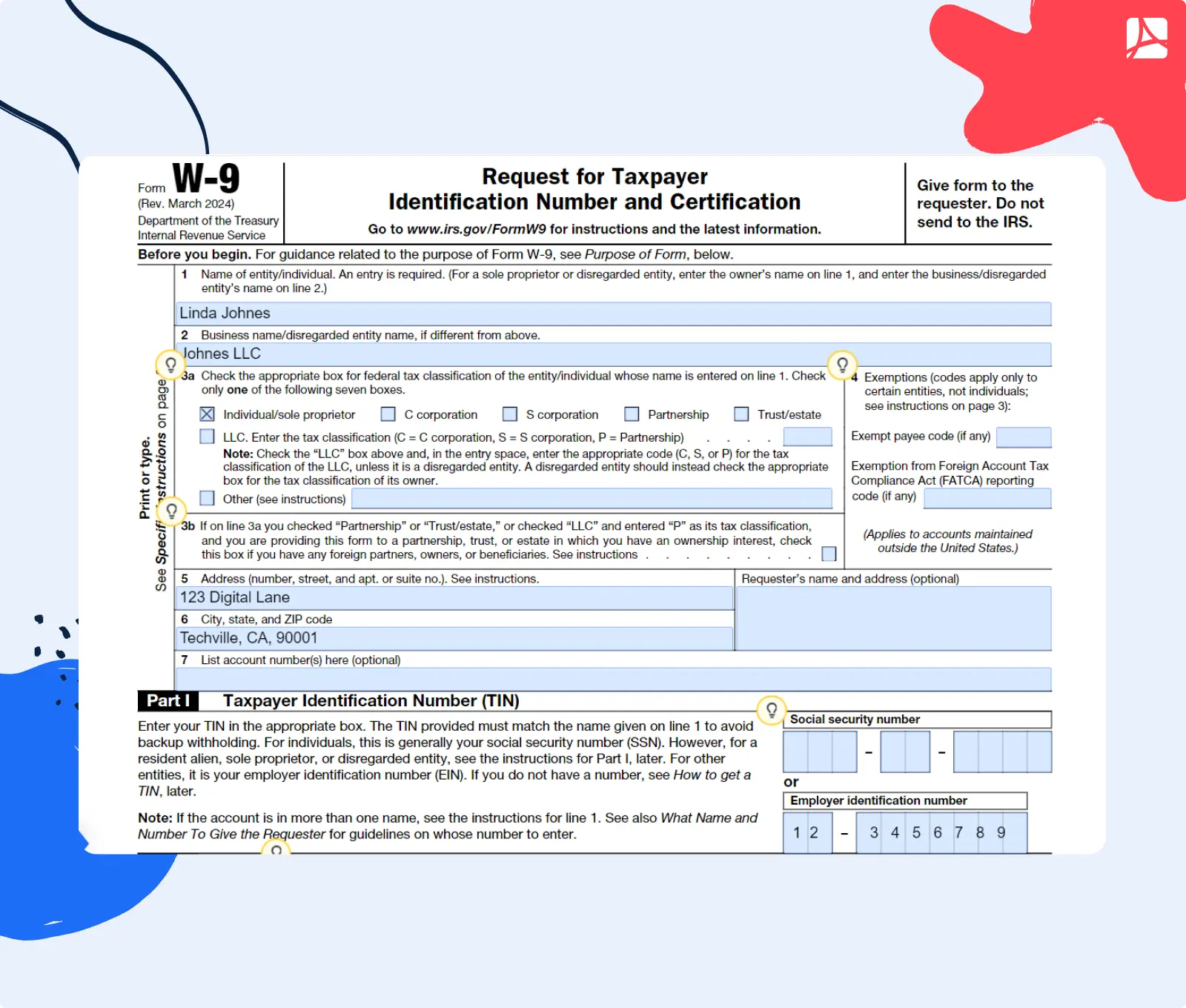

- The W-9 form is crucial for independent contractors and freelancers to ensure businesses report their payments to the IRS accurately.

- Emailing offers swift delivery, instant confirmation, easy tracking, and convenience over traditional mail.

- While emailing is convenient, it poses risks such as data breaches and phishing scams. It’s essential to employ safety measures like checking email addresses, securing Wi-Fi, and using passwords.

- PDFLiner provides a secure solution for emailing W-9 forms with encryption, password protection, and secure storage, ensuring the safety of sensitive information.

What Are W-9 Specifics?

As the saying goes, “The devil is in the details,” and the W-9 form is all about those details. It’s a tax document you have to fill out for businesses that pay you. It's not for the IRS but for companies that give you money.

- Who Usually Fills It Out? Independent contractors, freelancers, and anyone getting income without taxes withheld.

- Why They Do It: Businesses need to report what they pay you to the IRS. It's their way of saying, “Yes, we paid them!”

So, if you're freelancing or doing contract work, you'll likely need to complete a W-9. It's the paperwork prelude to getting that hard-earned cash in your pocket.

How To Send a W-9 via Email

Step 1: Fill out form

Follow one of the guides on our website or our YouTube video to fill out the form:

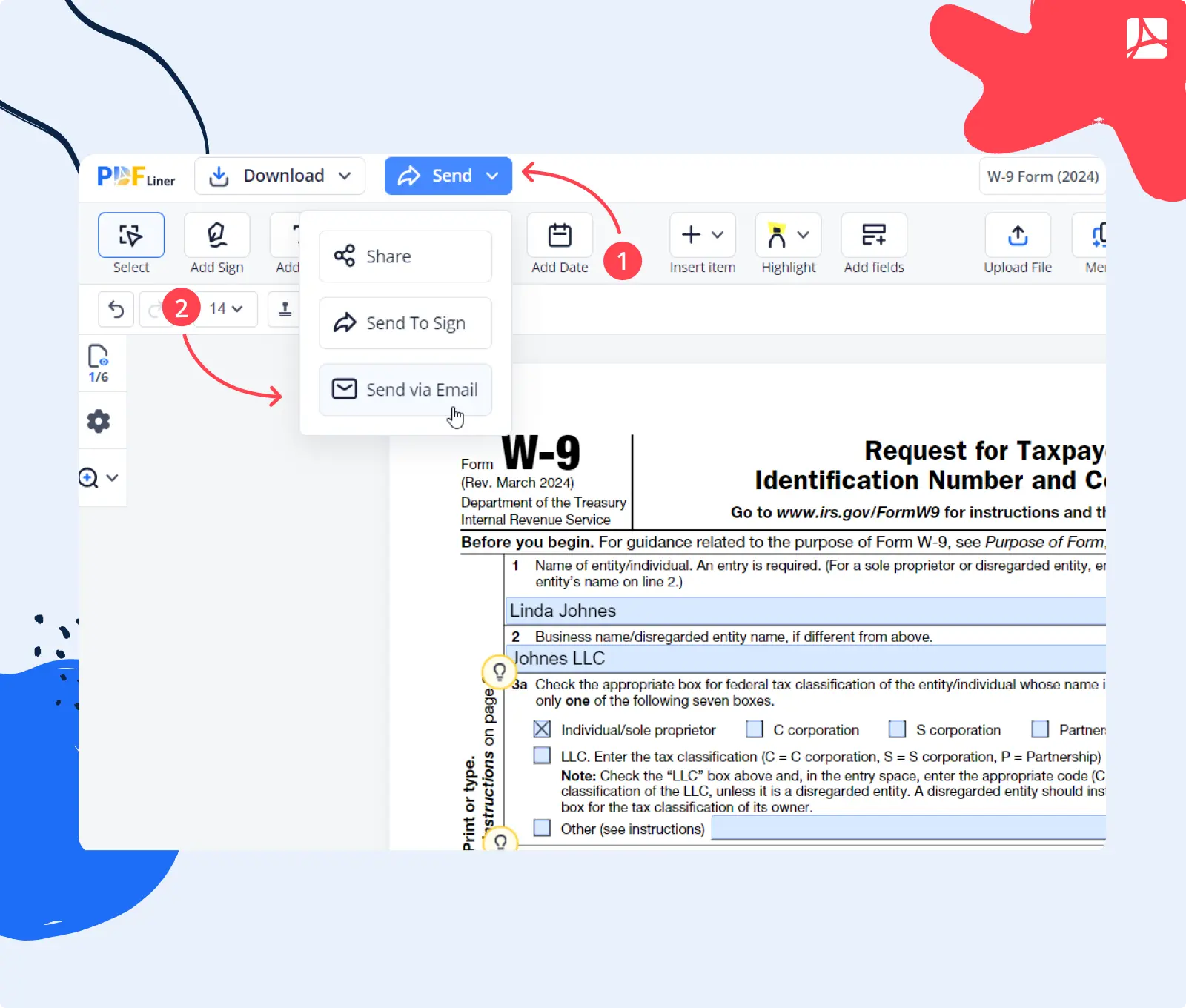

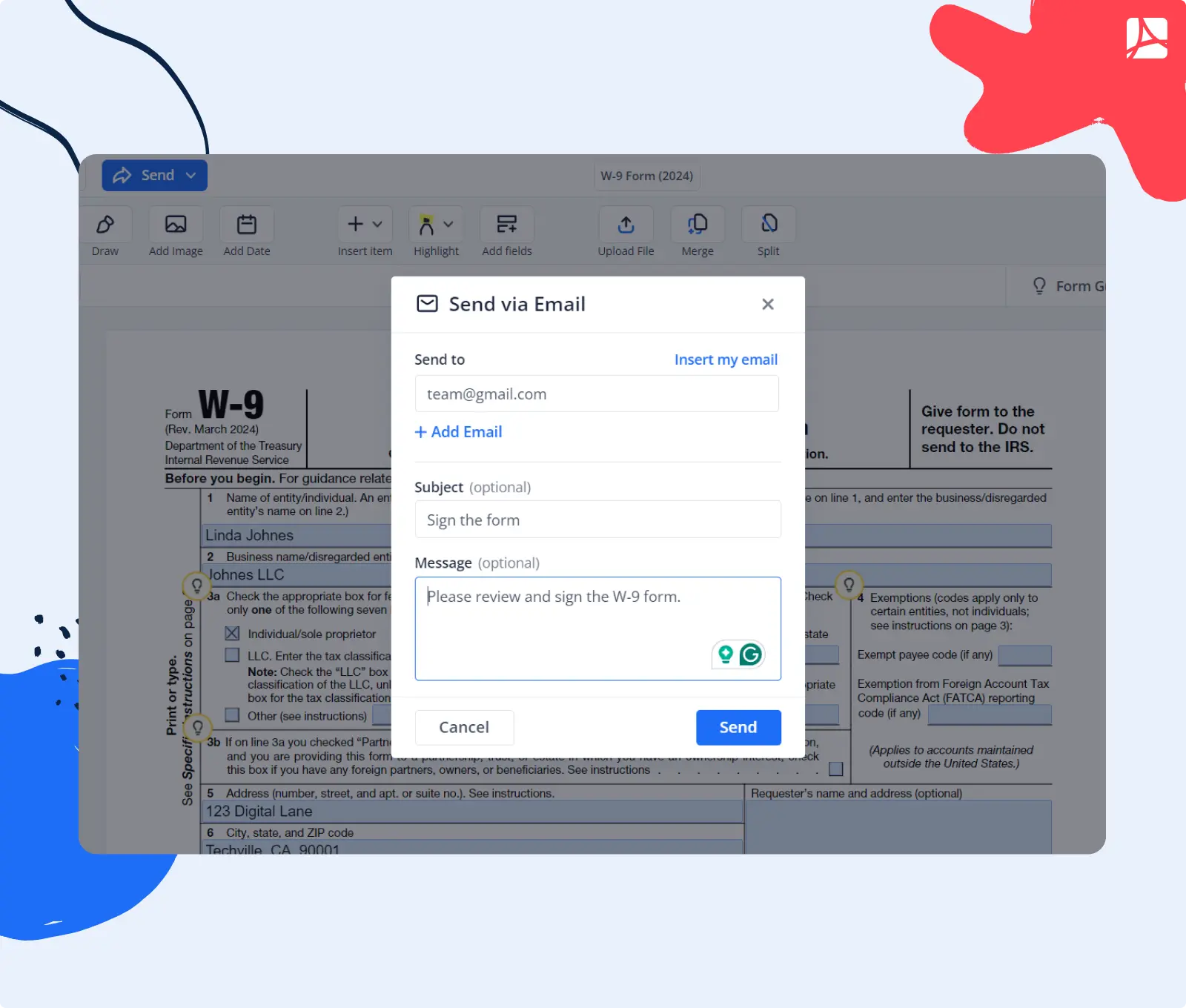

Step 2: Click “Export”

Click the “Export” button and choose the “Send via Email” option.

Step 3: Send

Enter the requester's email address and compose a subject and a letter. And then click the “Send” button to email the form.

The Advantages of Sending W-9 via Email

Sending this important file via email is like upgrading from a horse-drawn carriage to a sleek sports car — it's faster. Time is money, and email triumphs over traditional mail in more ways than one. Below, we'll delve into why emailing your W-9 is the way to go, with time-saving taking center stage.

- Speedy Delivery. With email, your file reaches its destination at the speed of light — or at least the speed of your internet connection. Say “goodbye” to the days of waiting for snail mail to crawl its way to the recipient. Email guarantees that your form arrives promptly, cutting down unnecessary waiting time.

- Instant Confirmation. When you hit “send” on that email, you're not left in the dark wondering if your W-9 made it to the right hands. Most email services provide read receipts or delivery confirmations. It gives you peace of mind that your document has been received and opened. No more second-guessing!

- Easy Tracking. Email serves as a GPS for your messages. You can monitor the moment your W-9 is dispatched, opened, or downloaded. Consider it a digital receipt that keeps you informed and helps you avoid the “Did you get my form?” drama.

- Convenience at Your Fingertips. How do you like filling out your W-9, clicking “send” on an email, and doing it all while lounging in your favorite chair? Pretty sweet, right? When you email your tax docs, you cut out the old-school steps of printing, signing, and mailing. You are skipping the line and going straight to the good part. This, in turn, saves you time and spares you from paper cuts and postage mishaps.

Emailing your W-9 form is a no-brainer in our fast-paced digital era. It's quicker, more effective, and offers such perks as tracking and instant confirmation. So, the next time you're faced with the task of submitting a W-9, embrace the time-saving benefit of email. After all, in the race against the clock, who wouldn't want a head start?

Risks Associated With Emailing W-9 Form

Is it safe to send a W-9 via email? In the majority of cases, the answer to this question is a definite “yes.” But any rule comes with a few exceptions, and now it’s time to cover them, too.

In the wise words of Thomas Jefferson, “With great risk comes great responsibility.” When you send a W-9 electronically, you're diving into the digital deep end where convenience swims alongside caution. While it's a speedy way to share tax info, there are some digital drags to watch out for:

- Data Breaches. Emails can get hacked, making your personal details fair game.

- Phishing Scams. Bogus emails might try to trick you into handing over your W-9 to the wrong crowd.

- Unauthorized Access. Once that W-9 is out there, it's hard to control who gets a peek.

- Technical Glitches. A slip of the keyboard could send a W-9 to an unintended inbox or, worse, nowhere at all.

So, before you hit 'send' on that precious file, take a second to double-check the email address, make sure your Wi-Fi isn't on the fritz, and keep those scam-spotting glasses handy. After all, safeguarding your tax info is no laughing matter.

Safety Measures When Sending a W-9 via Email

Sending a W-9 electronically can be as safe as sending a letter, but only if you lock down some key safety measures. After all, your tax info deserves VIP protection in the digital age.

So, before you hit “Send,” here's a checklist to keep your W-9 on the straight and narrow:

- Check, Then Double-Check. Make sure you've got the right email address. Sending your W-9 to the wrong inbox is like mailing a love letter to your neighbor.

- Secure Your Wi-Fi. A flimsy Wi-Fi connection is an open door for data thieves. Lock it up tight before you hit “Send.”

- Password Protect. Consider zipping your precious file and adding a password.

- Avoid Public Computers. Sending sensitive info from a café computer is like shouting your secrets in a crowd. Stick to your own device.

- Beware of Phishing. Watch out for sneaky emails pretending to be from legitimate sources. If they smell fishy, they're probably scams.

Remember, an ounce of prevention is worth a pound of cure, especially regarding your tax info. So, take a moment to secure your digital envelope before sending off that W-9.

PDFLiner: Secure Way to Email W-9 Form

PDFLiner offers a secure way to email your W-9 form, which takes the stress out of digital document sharing. With its top-notch security features, you can trust that your sensitive tax information remains confidential and protected. Here's why PDFLiner stands out as a safe choice:

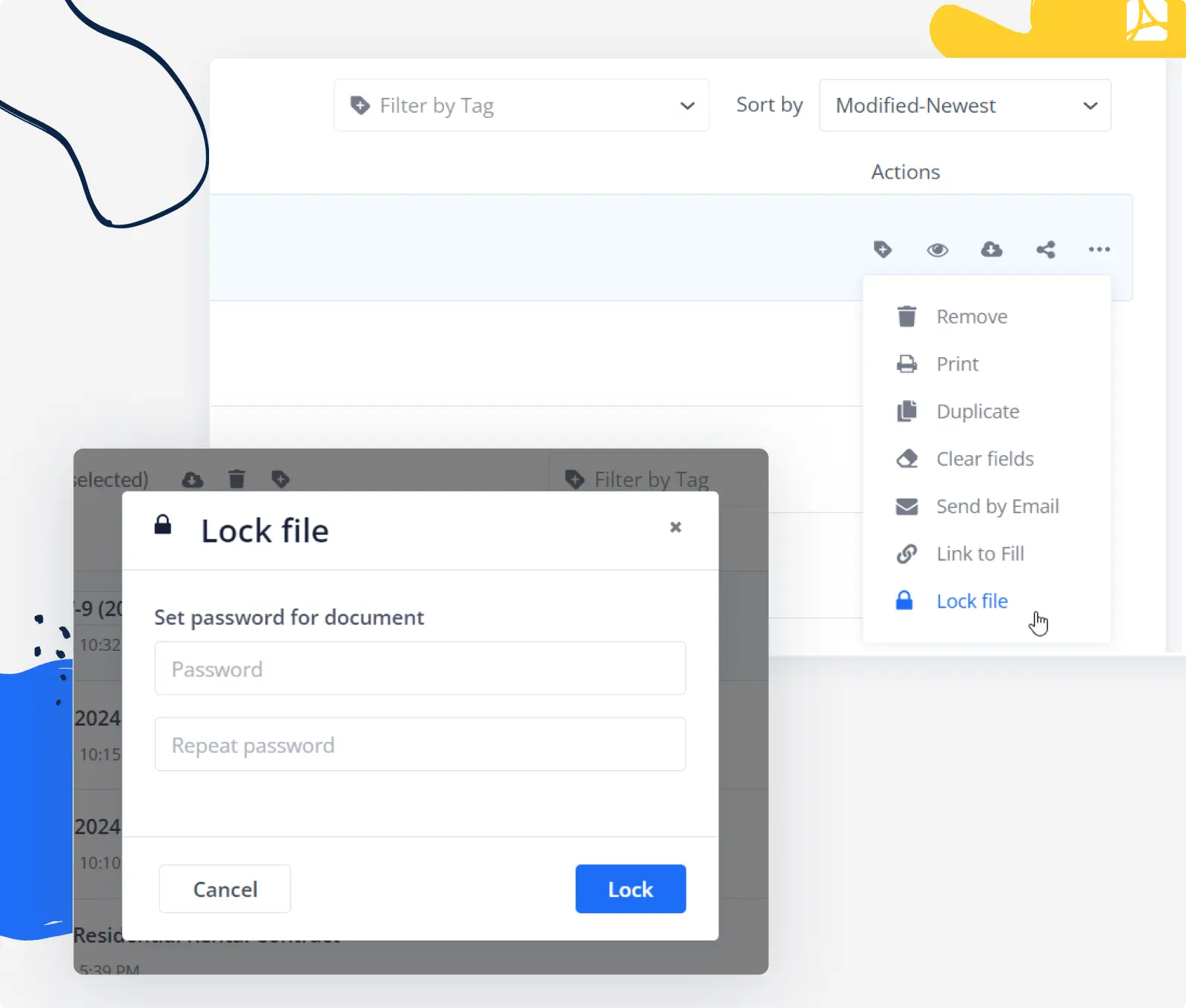

- Lock-Tight Encryption. PDFLiner uses strong encryption protocols to keep your information under a digital lock and key.

- Password Peace of Mind. Protect your W-9 PDF with a password for that extra "stay-out" message.

- Fort Knox Storage. Your docs are stored in a virtual vault, safe from nosy neighbors (or hackers).

With all that said, PDFLiner is a fortress for your important documents. The platform makes sure they reach the recipient without falling into the wrong hands. As the saying goes, "Trust, but verify." With PDFLiner's security features, you can finally trust the process — and verify the safety of your information.