-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

W-9 vs. W-2: Comparison Guide

.png)

Dmytro Serhiiev

“Strength lies in differences, not in similarities,” as American educator, author, businessman, and speaker Stephen Covey pointed out. It's a sentiment that rings true even in the world of tax forms. Confused between the W-2 and W-9? You're not alone! They might seem like two peas in a pod, but their jobs differ. In this article, we'll untangle the web and compare these two forms, so you can tell them apart like a pro. Enjoy.

What Is the Difference Between W-2 and W-9?

Understanding tax forms can be as challenging as deciphering a secret message. They might look similar, but they come with slightly different purposes. So, what is a W-9 vs. W-2? Let's clarify what sets them apart.

Quick W-2 Overview

- Employee Form. Issued by employers to employees.

- Income Reporting. Reports how much you earned and how much was withheld.

- Tax Filing. Used when filing your annual return to report income and taxes paid.

Quick W-9 Overview

- Requester Form. Provided by businesses to request taxpayer identification information.

- No Income Reporting. Doesn’t report income or tax withheld.

- Taxpayer Information. Used to collect taxpayer's name, address, and TIN for potential future payments.

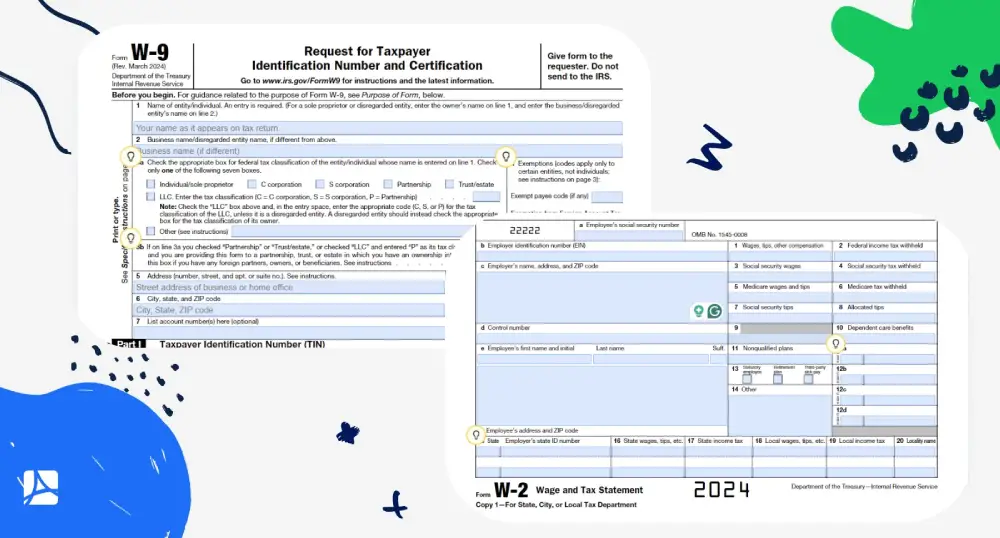

The W-2 vs. W-9 combination is the most common in the U.S. tax system. The former helps keep employees' tax information in order, while the latter helps you get a nonemployee’s tax info and avoid backup withholding. So the next time you come across these forms, remember that they may look similar, but in the world of the IRS, they're completely different.

What Is a W-2 Form?

The W-2 form is a key document that provides a comprehensive overview of your annual earnings and withheld taxes. It serves as a financial record for the year and provides transparency between you, your employer, and the IRS. Let's examine this document based on the following criteria:

Specificity and purpose W2

- Income Reporting. Details your annual earnings from your job.

- Tax Withholding. Shows the taxes your employer took out of your paycheck.

- Filing Assistance. Helps you fill out your return accurately.

Role in employee-employer relationships

- Transparency Tool. It makes sure employees know how much they've earned and how much tax has been withheld.

- Documentation. Provides employers with a record of wages paid and taxes withheld for each employee.

- Compliance. Aids both employees and employers in meeting their tax obligations.

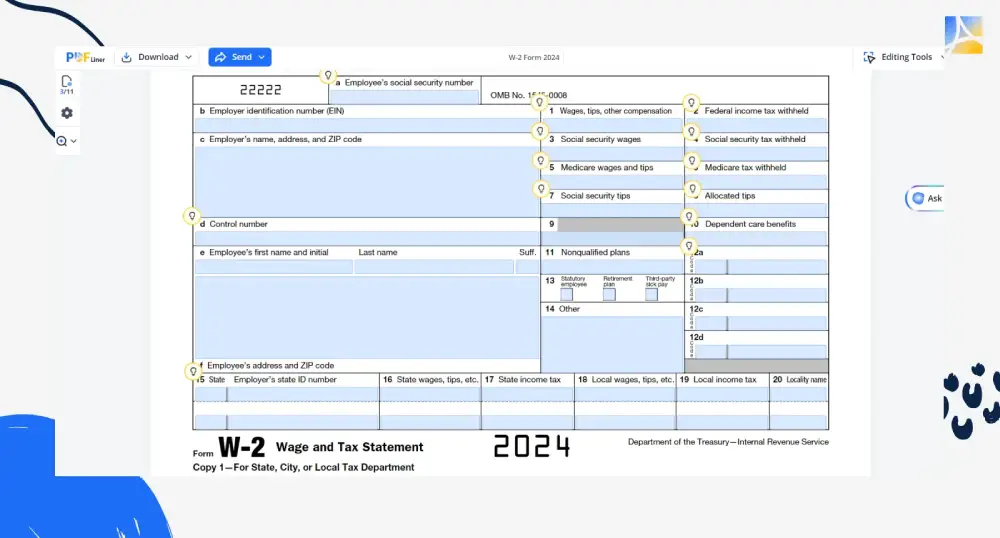

Main fields on the form

- Employee Information. Name, address, and Social Security number.

- Earnings. Total wages, tips, and other compensation.

- Tax Withholding. Federal and state income tax withheld.

- Benefits. Retirement plan contributions, health insurance, and other benefits.

In summary, the W-2 serves as an impartial arbiter of the tax obligations of both employees and employers, helping to maintain proper compliance and prevent any discrepancies in tax reporting.

Fillable W-2 6596e0950573f9514908ee3a

What Is a W-9 Form?

The W-9 is your go-to document when you're working as a freelancer or contractor. It helps the authorities track your earnings accurately. Now, let's dwell upon this doc based on the following criteria:

Specificity and purpose W9

- Taxpayer Identification. Provides your Social Security number or Employer Identification Number to the client.

- Income Reporting. Confirms your earnings for the client's records.

- Tax Classification. Specifies your tax classification, e.g. sole proprietor or corporation.

Role in contractor-client relationships

- Conformity Checker. Makes sure clients have the necessary information to report payments to the IRS.

- Documentation. Helps clients keep track of payments made to contractors for potential deductions.

- Mutual Understanding. Establishes clear responsibilities and classifications for both parties.

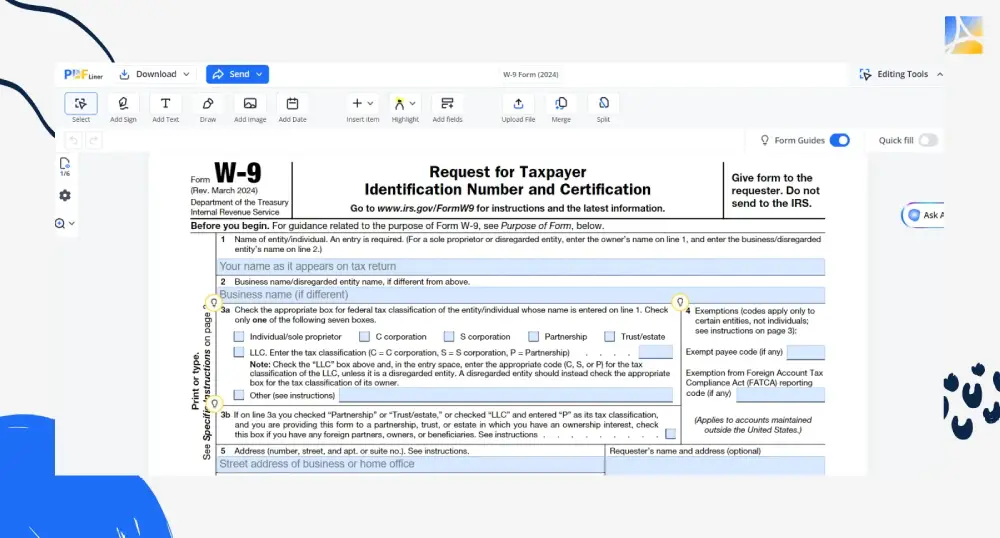

Main fields on the W-9 form

- Name. Your legal name or business name.

- Tax Classification. Your business entity type, e.g. sole proprietor or LLC.

- Address. Your current mailing address.

- Taxpayer Identification Number. Your SSN or EIN.

Long story short, the W-9 form helps you and your client stay harmonized on tax matters and prevent any potential shocks.

Fillable W-9 65f013686d1834a70e07c82d

Detailed Comparison: W-9 vs. W-2

Albert Einstein once said, “The important thing is to never stop questioning.” When it comes to tax forms, questioning the differences between them can lead to clearer financial insights. Below, we'll cover the difference between W-9 and W-2, based on the following vital parameters:

Main purpose and use-case distinctions

W-9

- Purpose. Gathers taxpayer information from freelancers or contractors.

- Use-case. Guarantees transparency and correct reporting of income for tax purposes.

W-2

- Purpose. Reports annual earnings and tax withholdings for employees.

- Use-case. Documents wages, tips, and other compensation for accurate filing.

Who submits each form to whom

W-9

- Submitted by. Freelancers or contractors.

- Submitted to. Clients or companies that hire them.

W-2

- Submitted by. Employers.

- Submitted to. Employees.

Differences in legal and tax implications

W-9

Legal implications

- Requires accurate and honest taxpayer information.

- Non-compliance may result in legal penalties.

Tax implications

- Does not withhold taxes.

- Contractors are responsible for self-reporting and paying taxes.

W-2

Legal implications

- Must accurately report employee earnings and tax withholdings.

- Non-adherence can lead to penalties and audits.

Tax implications

- Withholds federal, state, and other taxes based on employee earnings.

- Provides clear documentation for employees to file their returns.

W-9 is the freelancer's go-to. It collects all your taxpayer info and makes sure you're ready to report your earnings when tax season approaches. It's a trust exercise between you and your client. They trust you'll give accurate info, and you trust they won't use it for anything fishy.

W-2, in its turn, is the employee's yearly summary. It records exactly what you've earned and what's been withheld in taxes. It's your employer's way of saying, “Here's what you've made this year, and here's how much we've already paid in taxes on your behalf.” It's straightforward and leaves little room for error. In the long run, it makes sure that Uncle Sam gets his fair share without any fuss.

To wrap up, the W-9 vs W-2 comparison is definitely worth getting to grips with. Bear in mind that when you choose a W-9 or W-2 for a business, you don’t just pick a document. That way, you approach the nature of your workforce and your reporting obligations with deep understanding. You realize perfectly well that the W-9 is geared toward freelancers and contractors, which means it promotes transparency and accurate reporting. And you know perfectly well that the W-2, in its turn, is paramount for employees, because it details earnings and withholdings.

Deep knowledge of the W-9 or W-2 filing specificities, as well as the vital roles of these forms in practice, is guaranteed to keep you in the taxman's good books, irrespective of whether you're freelancing from your favorite coffee shop or clocking in at the office. Remember that knowledge is power — and fewer surprises when you're faced with that very season!

Keep Your Taxes In Order with PDFLiner

Fill out your tax forms and send them online at no time.