-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

What Is a 1099-R Form and How to File It

.png)

Dmytro Serhiiev

To clarify the question “what is a 1099-R form?” you need to find out details on pensions and distributions from them. The form is usually sent to the person who received a designated distribution from you. The document may be used by a person even before retirement. You have to file a tax Form 1099-R for every distribution from different sources.

Fillable Form 1099-R 65cf0e3305ada3c6c50c56fd

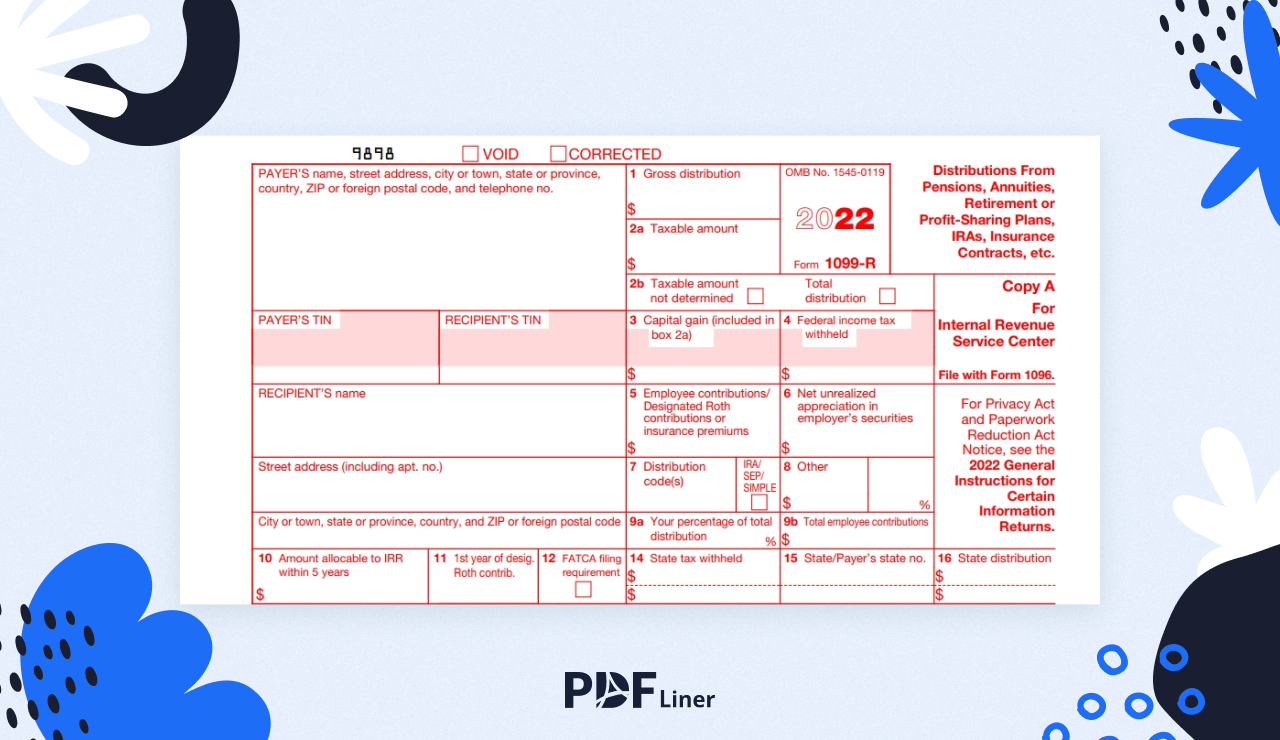

What Is a 1099-R Form?

The IRS Form 1099-R is also known as distributions from pensions, annuities, retirement, or profit-sharing plans, IRAs, insurance contacts, etc. This form must be provided any time you take the money from the retirement account, no matter the reason. You don’t have to wait for your retirement to get the form. The most popular reasons are:

- rollovers of retirement accounts;

- annuity and pension payments;

- early retirement account distributions;

- loans that go against the pension plans.

Ordinary income may be reported in the 4b and 5b lines of Form 1040. You have to use the form to notify the IRS of the federal tax return. If you have the withheld federal income tax revealed in the 4th box, you need to attach Copy B of the form to the tax return you send to the IRS.

The form must be filled in 3 copies by the account or plan custodian:

- The first copy or Copy A which is made in red color is sent to the IRS.

- The second copy or Copy B is for the distribution recipient.

- The third copy or Copy C is sent to the local tax department.

Printable 1099-R 65cf0e3305ada3c6c50c56fd

How to File a 1099-R

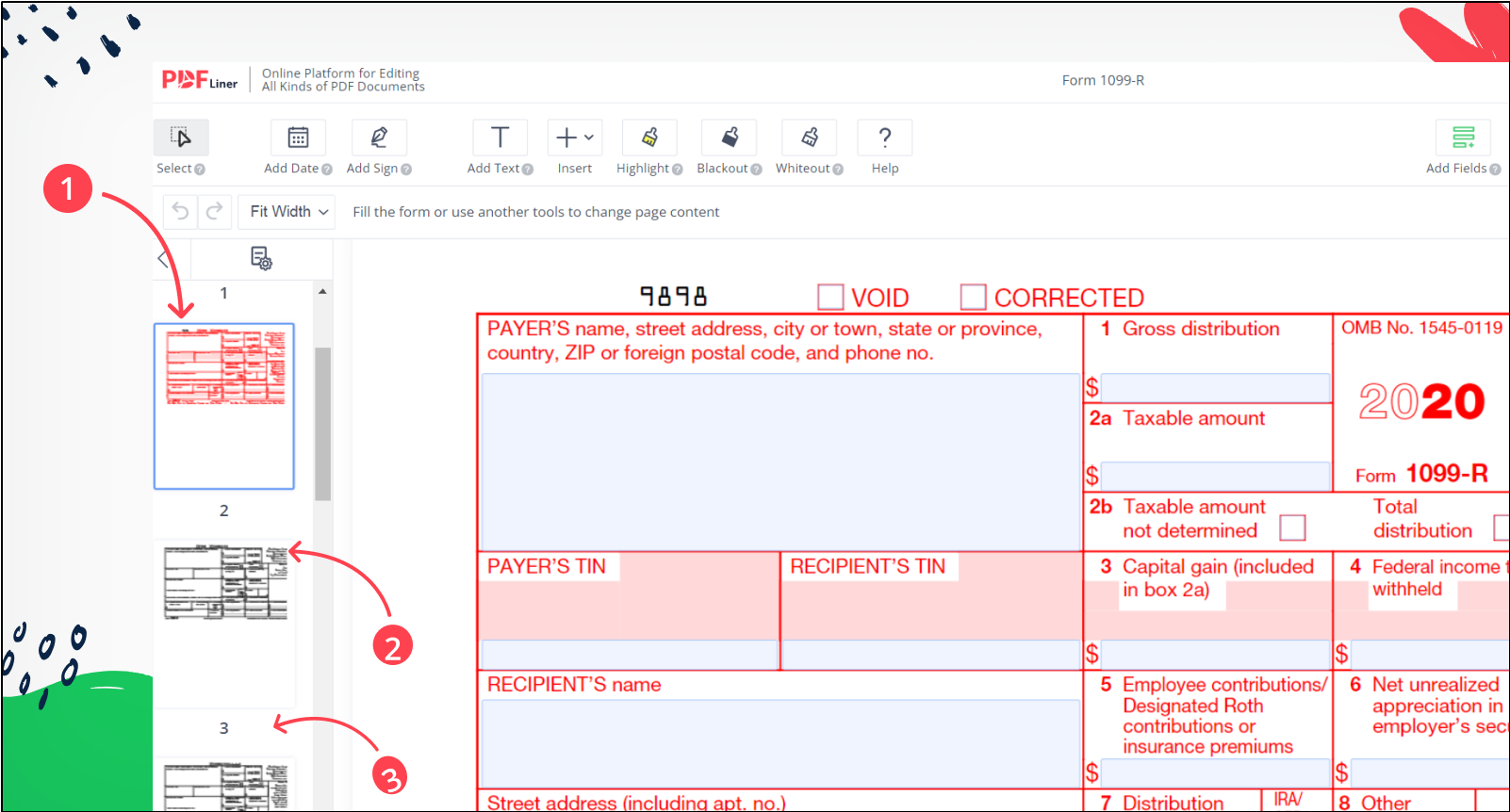

If you want to learn how to file a 1099-R form, follow these detailed recommendations. Although the form is really simple, you have to pay attention to the numbers you provide. Each form contains the information on the recipient. Read the Form 1099-R instructions:

- Provide details on the payer, including the name and address.

- Include the TIN of the payer and the TIN of the recipient.

- Provide information on the recipient, including name and address.

- Provide information on the amount of money that was spent, including gross distribution, taxable amount, capital gain, income tax withheld, employee contributions, and net unrealized appreciation in employer’s securities.

- Provide distribution codes, percentage of total distributions, and employee contribution in total.

- Write down the allocable amount of money to the IRS in 5 years, 1st year of designated Roth contribution, account number, date of payment, state tax that was withheld, number of payers, state distribution, local tax withheld, name of the locality, and local distribution.

Blank Form 1099-R 65cf0e3305ada3c6c50c56fd

FAQ

Check out these frequently asked questions about Form 1099-R. Read the answers attentively for any information you might still find unclear.

How do I get a copy of my 1099-R form?

You can receive a copy of 1099-R from the IRS. All you need to do is to download it or file it online. You need this form for your tax return. You may use PDFLiner to enter the form there.

What is a 1099-R form used for?

The form is used for the information on distributions from pensions that were made. It must be reported to the IRS to calculate your taxes properly.

How does a 1099-R affect my taxes?

This form is used to report your income. The IRS needs this information to check whether you pay your taxes properly. They calculate your chances to pay taxes on reported distributions.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Blank Form 1099-R 65cf0e3305ada3c6c50c56fd