-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Form 1095-A: Your Simplest Guide

.png)

Dmytro Serhiiev

Health Insurance Marketplace Statement or simply Form 1095-A is a highly important document for all Americans who enrolled in Obamacare. In this article, we cover all the most important aspects of the form, explain its actual purpose in detail, and provide Form 1095-A instructions to make things easier for you.

Fillable 1095-A 65269f86c62046236c062b1d

Form 1095-A

What Is a 1095-A

ObamaCare 1095-A form (Health Insurance Marketplace Statement) is an essential document that must be provided to every US citizen who enrolled in a particular health insurance program through the federal insurance marketplace established by the Affordable Care Act (known as Obamacare). It’s highly important that all the insurance owners receive the marketplace form 1095-A in time to be able to include the information from it on their annual tax returns. The information from the form shows the amount of money you paid for your insurance premiums from your own pocket.

In case you receive health treatment under insurance purchased outside the federal marketplace or your employer provides you with one, your coverage details must be reported to the Internal Revenue Service via Form 1095-B or Form 1095-C.

If you need more detail on how to get form 1095-A, take a while and check our quick guide on the topic. We describe only the most reliable ways to get this form. You can also dig into the form on the official IRS website.

Form 1095-A 65269f86c62046236c062b1d

Who Should Use Form 1095-A

Form 1095-A is used by government-established Health Insurance marketplaces in order to provide citizens who enrolled in Obamacare health plans with the information for their tax returns. If you are not an elected member of a government health insurance marketplace, you don’t have the right and necessity to use the form until it's properly filled by your healthcare provider and provided to you on legal matters.

How to Fill Out Form 1095-A

Attention! If you are not an elected representative of a Health Insurance Marketplace, you don’t have the right or reasons to fill out this form even though you can download it as an example. If you are an eligible person or entity, use the instruction below to learn how to complete the form.

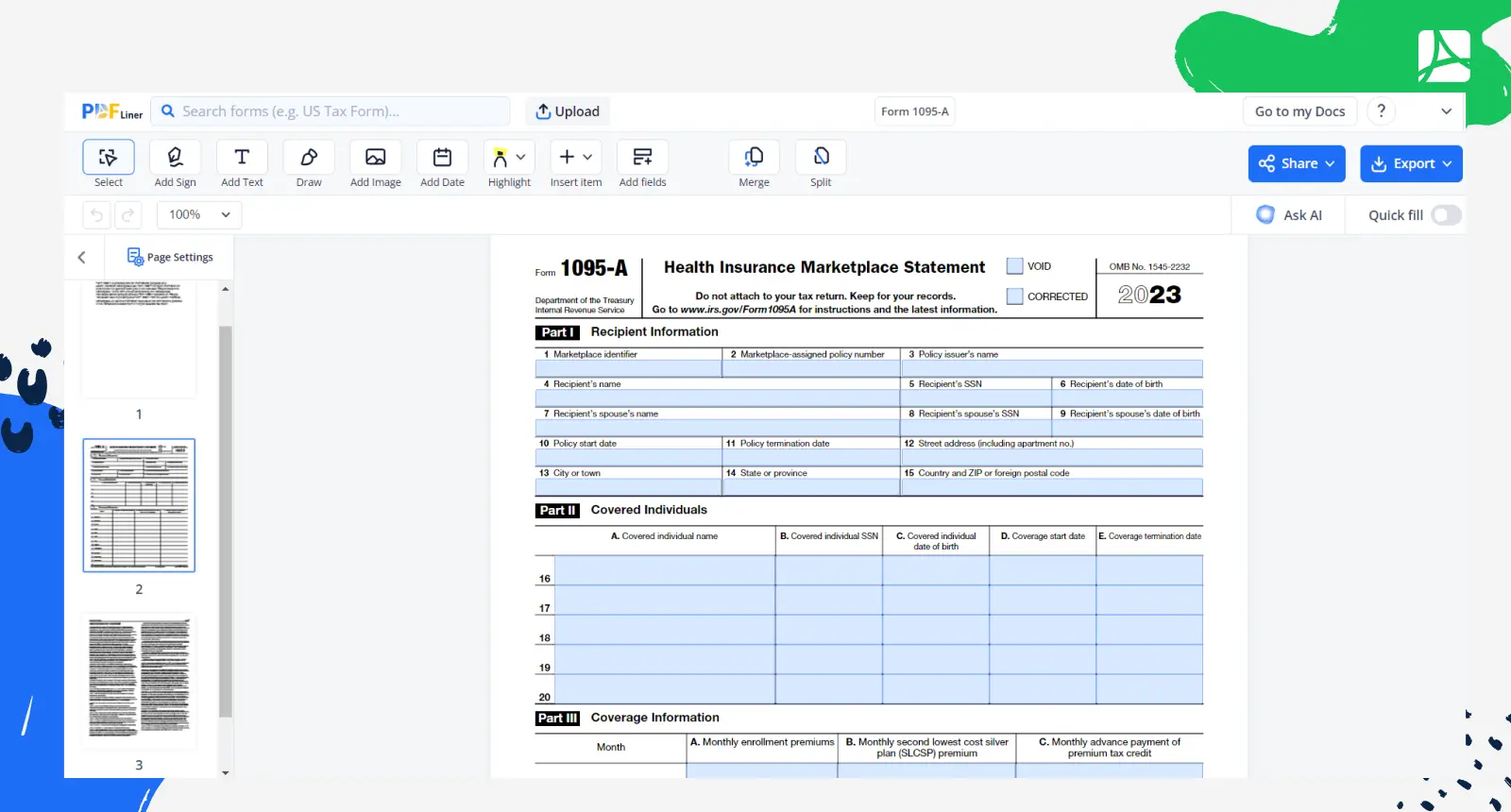

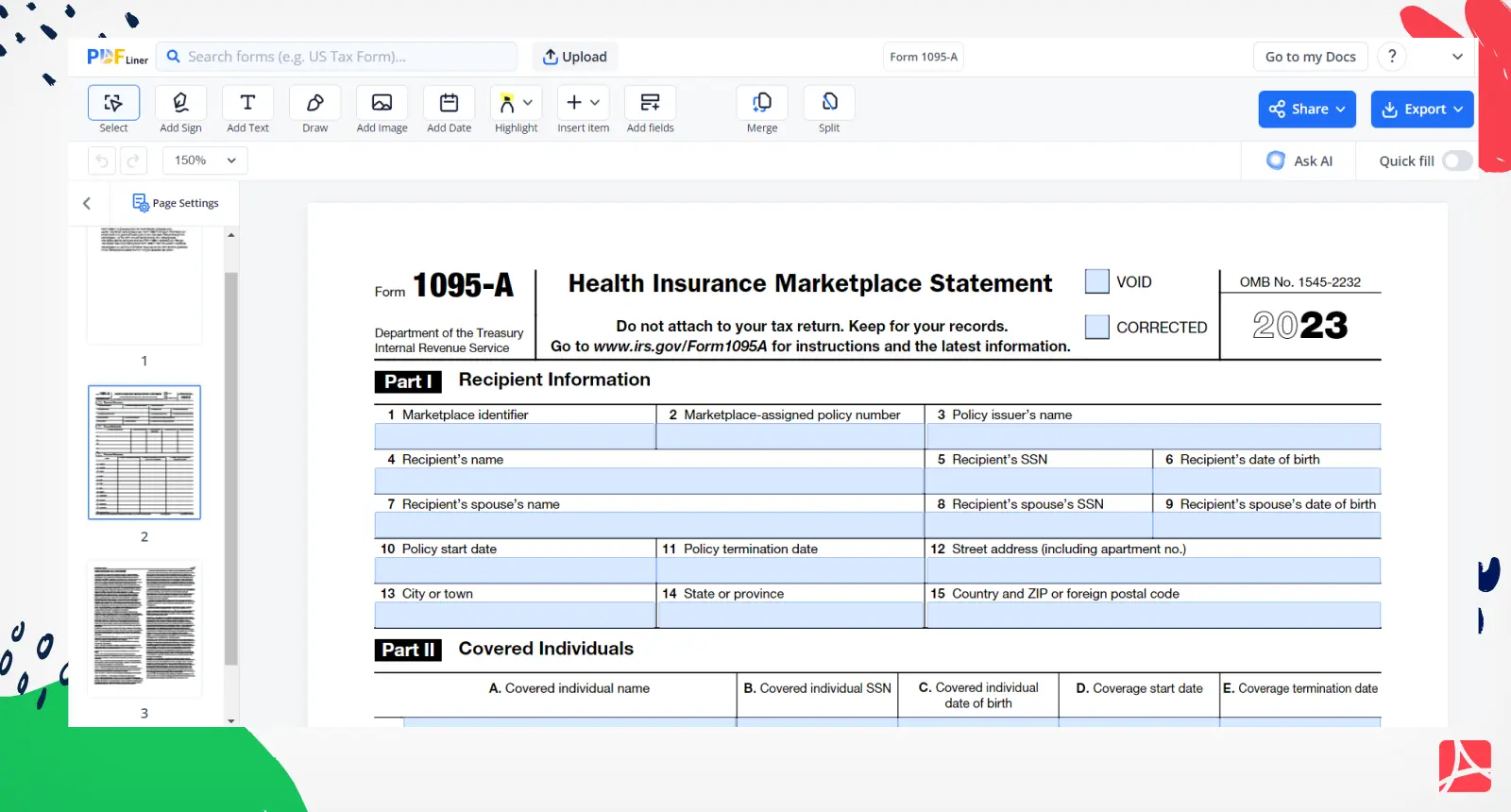

The form includes 2 pages. The first is filled out by the marketplace, while the second must be attached to guide the recipient on the form’s purposes and uses. To fill out Page 1 properly, you need to:

- Check whether the form is Void or Corrected;

- Part I – Recipient Information – Lines 1-15 must be carefully filled with valid recipient information;

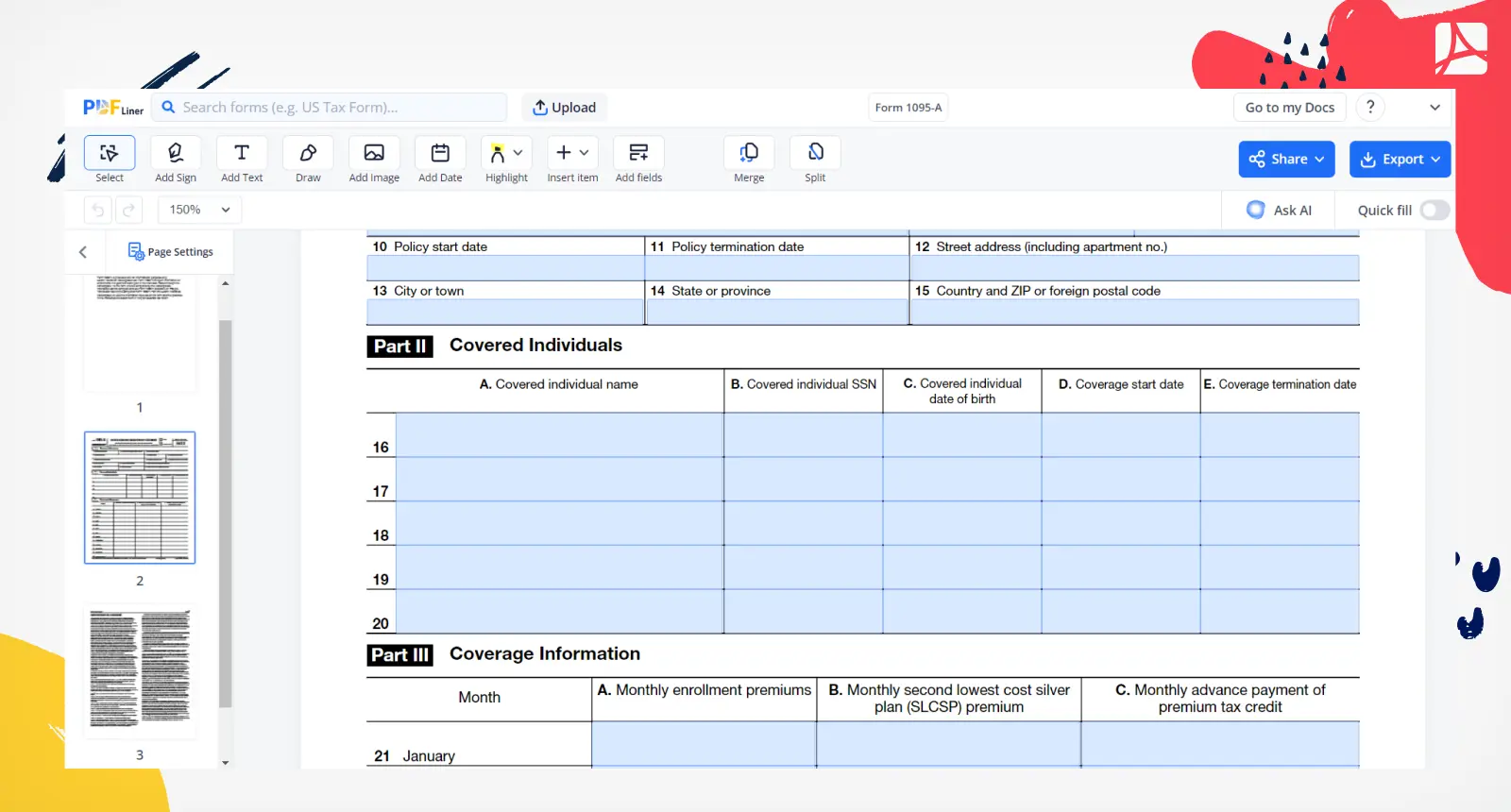

- Part II – Covered Individuals – list all the covered individuals and provide their personal information in columns A-E;

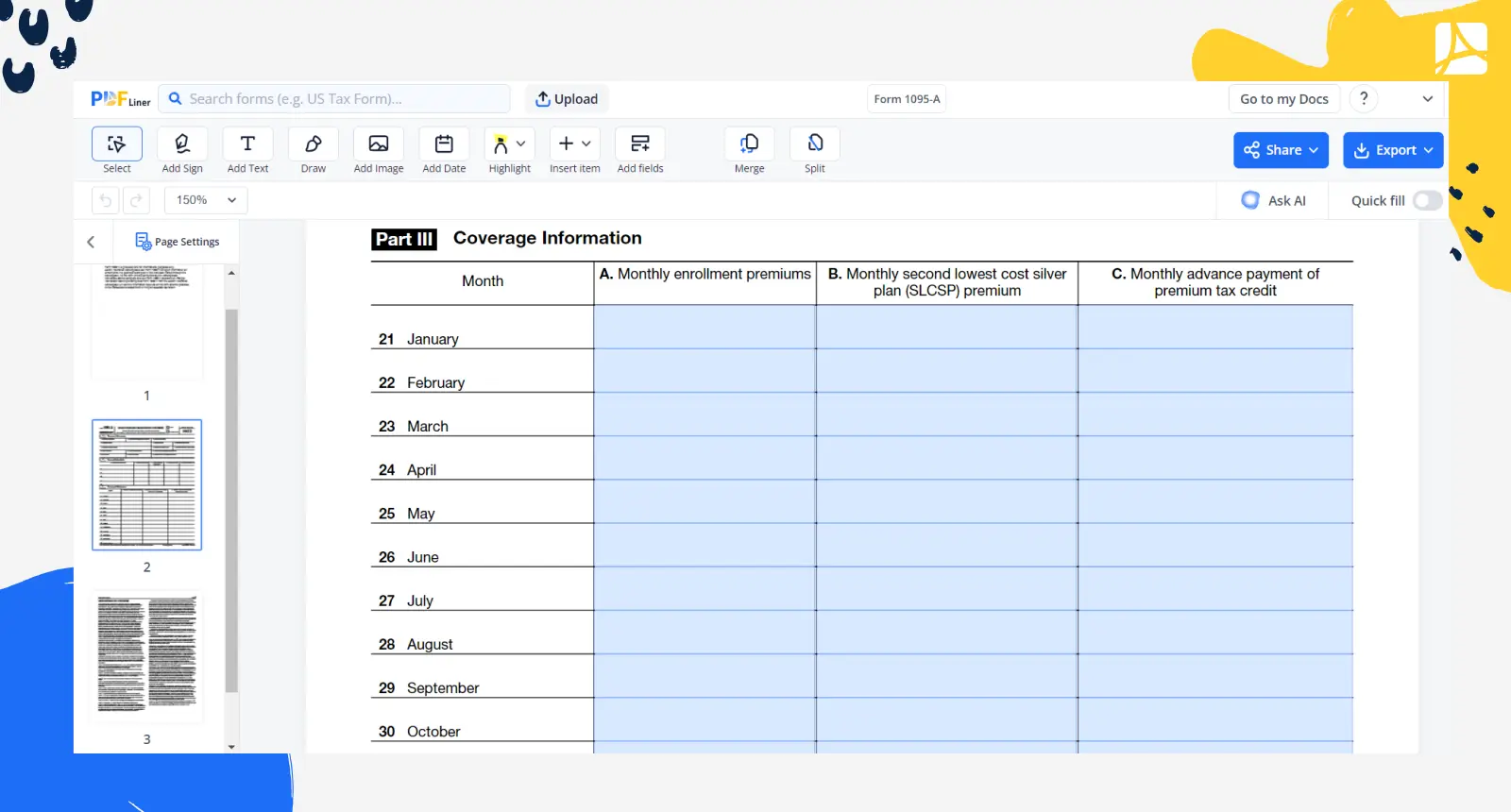

- Part III – Coverage Information – here you have to enter all the monthly enrollment premiums, SLCSP premiums, and advance payment of premium tax credit. Calculate annual totals on line 33.

Filling out Form 1095-A online on PDFLiner, you can accomplish the form quickly and even collaborate on it with up to 4 more people, which is highly convenient for organizations. It also supports secure e-signature so that you can save a lot of time on signing each form by hand.

Fill Out 1095-A Form 65269f86c62046236c062b1d

How to File the 1095-A Form

You have to report the information from your copy of Form 1095-A in your annual tax return. There’s no need to file the 1095-A Form to the IRS along with your tax return. Submission schedules for the annual tax return remain standard if you have 1095-A. The same rule applies to forms 1095-B and 1095-C.

FAQ

Do you have more questions? Make sure to skim the following section even if you don’t as there are many important quick facts on the topic.

When will I receive my 1095-A?

Marketplaces are obliged to mail you a copy of your Health Insurance Marketplace Statement by mid-February and not later than that. In most cases, you can access an electronic copy of the form on your HealthCare.gov user account around 30 days earlier (mid-January). As a taxpayer, you must remember that 1095-A must come to you before you file it. It means that if any delay occurs, you must contact the marketplace, figure out the reasons, and try to speed up the process.

What is the difference between 1095-A and 1095-B?

The main difference is that Form 1095-A is filled out by federal health insurance marketplaces, while Form 1095-B is a similar document designed for non-governmental insurers. You may also receive Form 1095-C if you have employer-sponsored coverage.

How do you know if you have a 1095-A?

Be sure to have a 1095-A if you purchased health insurance from a government Health Care Exchange (Marketplace).

Do I need 1095 to file my taxes?

Yes, you must have your 1095-A to file your taxes. Read the next answer to see what happens if you don’t include it in your tax return.

What happens if I don't file my 1095-A?

If you fail to report it for some reason, you will trigger a serious refund delay and affect the upcoming advance credit payments. The IRS recommends taxpayers to wait until 1095-A comes by mail or electronically. We recommend the second option as it’s always faster.

What form goes with 1095-A?

If you already have your 1095-A and at least the second low-cost silver plan insurance premium, you have to take a while and fill out a copy of Form 8962 (Premium Tax Credit). If you need step-by-step instruction, click here.

How much is a 1095-A tax?

First, you need to have your 1095-A form in order to calculate the actual amount of your premium tax credit. Second, it’s necessary to reconcile advance payments of the premium tax credit that were made for you with the use of the tax credit claimed on your tax return.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fill Out 1095-A 65269f86c62046236c062b1d